Highlights

- In a positive turn of events for the cryptoverse, Tiger Global has led a crypto-focused company’s Series A funding

- Meow claims to provide up to 4% yield to corporate treasuries, which it says, is better than keeping funds in a deposit account

- Meow’s CEO might now focus largely on stablecoins by using the funds he has managed to raise in a dull crypto market

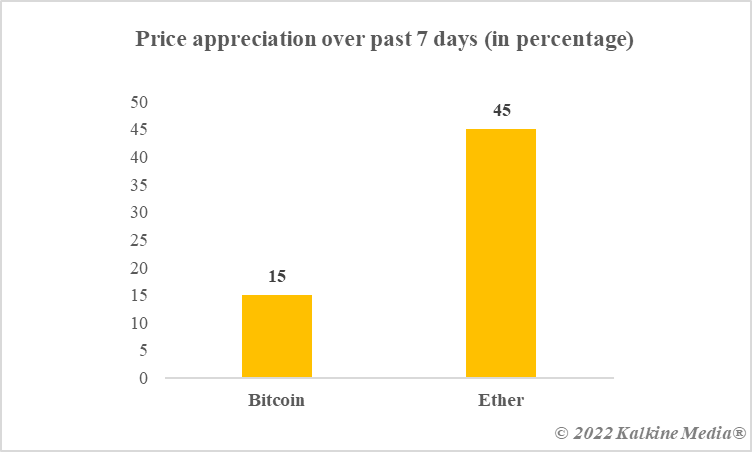

The crypto world is buzzing with new positive activities. On one hand, cryptos have been gaining of late with Ethereum (ETH) up almost 40% in one week, and on the other, new deals are underway.

The latest such deal has been struck between a crypto market participant, Meow, and a prominent investment firm, Tiger Global. This comes amid some negative movements, including crypto companies like Voyager and Celsius filing for bankruptcy, and the deal might instil some new confidence in enthusiasts.

Let us explore more.

What is Meow and Tiger Global’s deal?

Meow, a firm that focuses on yields for corporate treasuries, has released a statement about raising US$22 million in Series A. This funding round was led by Tiger Global, with others like the FTX exchange and QED investors in participation.

In the statement, Meow has stated its objective of using the funds for developing its stablecoin-focused product. The company’s CEO, Brandon Arvanaghi, has talked about the potential of stablecoins, crypto tokens pegged to assets like a fiat currency or gold, in “revolutionising” the world.

What is Meow?

Meow is a new company, founded only last year, with the primary focus on corporate treasuries. It claims to devise “high-yield” strategies, with up to 4% yield, for corporate treasuries. How Meow achieves the goal while also assuring the corporate treasurer about the financial prudence and sustainability of the strategy will become clearer with time.

Meow’s founder has talked about stablecoins on multiple occasions. Stablecoins have “stable” prices, which move with the price of the asset they are pegged to. For example, Tether has a price of US$1, thanks to its peg with the US dollar. However, even stablecoins can be risky, and this year’s TerraUSD crash was the biggest such blow to stablecoin enthusiasts.

Meow might focus on stablecoin in its new products, which is also indicated in the blog released after Series A funding.

Is Meow safe?

Meow is a very new market participant. It asserts a “100% track record” and “full compliance” with regulations in the US. Cryptocurrencies are not properly regulated in the US, which makes it a little complex to decipher Meow’s claim.

The company also states that all funds are stored with “industry-leading” lenders and custodians. But ever since crypto-focused companies like Celsius, which promised high yields, have experienced liquidity concerns, investors are more cautious.

After a steep fall in prices, cryptos have rebounded of late, which can, for now, keep negative sentiments like the “cryptos are based on greater fool theory” remark of Bill Gates at bay.

Data provided by CoinMarketCap.com

Bottom line

What is making news right now is the US$22-million funding round of Meow. By all measures, this is not a very high-ticket deal in the crypto world where new tokens can start their journeys easily with million-dollar market caps. Meow’s corporate treasury-focused services, however, make it a little different than other crypto companies.

Also read: What is AEX exchange and why has it suspended operations?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.