Highlights

- A glitch resulted in Bitcoin being shown as being valued at US$799 billion per coin on CoinMarketCap, while others reported Bitcoin’s price as high as US$877 billion per coin on Coinbase

- Report Shows More Australians To Be Employed in Crypto Industry in 2030

Crypto data providers CoinMarketCap and Coinbase experienced apparent glitches on Tuesday causing them to show hugely inflated prices.

According to some tweets on unverified accounts, Bitcoin was shown as being valued at US$799 billion per coin on CoinMarketCap while others reported Bitcoin’s price as high as US$877 billion per coin on Coinbase.

The glitch lasted for around one hour before engineers for the respective sites addressed the problem.

Bloomberg reported later that representatives from CoinMarketCap had said there’s no evidence suggesting the glitch was caused by an external party.

Coinbase also acknowledged the supposed inflationary prices via Twitter, saying that is was merely a display issue which wouldn’t impact trading.

In the aftermath of the incident, Crypto.com Chief Executive Kris Marszalek, blamed CoinMarketCap for the blunder as Coinbase and Crypto.com use the crypto data compilers’s price information on their respective platforms.

Marszalek added that his team was working to remove the “unreliable price feed” from its site.

Technical glitches are nothing new for the emerging crypto industry and many exchanges have had issues in the past processing transactions during periods of high trading activity.

Furthermore, the feature of anonymity, which is paramount to the crypto space has made it difficult to resolve hacks and thefts of crypto exchanges.

Report Shows More Australians To Be Employed in Crypto Industry in 2030

A major report has found a quarter of a million Australians could be employed in the cryptocurrency industry by 2030.

A report commissioned by Mawson Infrastructure Group found Australia was in a prime position to capitalise on the booming cryptocurrency market.

The report found by 2030, cryptocurrencies and related digital assets could generate AU$68.4 billion and employ over 200,00 people.

Currently, there are around 12,000 people working in the digital asset industry in Australia.

The list of careers in demand in the crypto space include software engineering, artificial intelligence engineering, data, ICT and information security.

Altcoin News

Swiss non-profit company, the Interchain Foundation, which works with the COSMOS crypto system, announced the launch of Gravity Bridge, on Wednesday.

Gravity Bridge will enable the transfer of ERC-20 tokens between the Ethereum and Cosmos blockchains.

During the opening phase, Gravity Bridge will operate as a standalone chain before joining forces with the Cosmos blockchain in early 2022.

The move will ultimately make the interchangeability of tokens across Ethereum and Cosmos much more fast and easy.

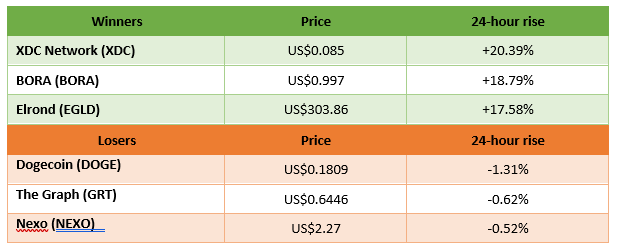

Winners and Losers

Note: this is the past 24 hours from 12:30pm AEST

Source: Coinmarketcap.com, based on top 100 cryptos.

Image Source @ 2021 Kalkine Media®