Highlights

- Bitcoin has recovered 2.5 percent in the past 24 hours to a touch below US$43,000

- Analyst’s opinions are divided over whether this week’s drop to below US$40,000 will, in fact, be the bottom

- The last time a death cross pattern appeared on Bitcoin’s price chart in June 2021

Bitcoin analysts are in the midst of a debate determining the future for the value of the world’s premier digital currency.

Bitcoin has made a slight recovery in the past 24 hours or so, after the token dropped to below US$40,000 for the first time since September last year.

Bitcoin has recovered 2.5 percent in the past 24 hours to a touch below US$43,000, where it currently lies.

Despite the overnight growth, traders’ opinions are divided over whether this week’s drop to below US$40,000 will, in fact, be the bottom.

Differing Bitcoin Forecasts

One argument for Bitcoin’s latest small surge lies in US Federal Reserve, Jerome Powell’s announcement regarding changes to the US’ fiscal policy and the market’s subsequent absorption of that information.

Powell announced on Tuesday that the central bank would continue to raise interest rates if inflation continues to rise at high levels.

However, what may have pleased investors was Powell’s comments later, which said it was time for the US economy to move away from the pandemic settings and return to a level of normalcy.

Bitcoin bulls have expressed their belief that Bitcoin is now entering a “buy zone”, which chart analysts determine by comparing price to spending behaviour. These technical developments, the bulls say, indicates that Bitcoin’s price has reached the bottom.

However, other analysts remain less optimistic regarding Bitcoin’s growth over the short term and warn investors that a pattern currently forming, known as the “death cross” has historically been an accurate indication of a future bear market.

In fact, the last time a death cross pattern appeared on Bitcoin’s price chart in June 2021, the coin’s value dropped by more than 20 percent over the following month.

For now, it seems crypto traders and investors will have to sit tight and see whether the market continues to dip or whether it reverses its course.

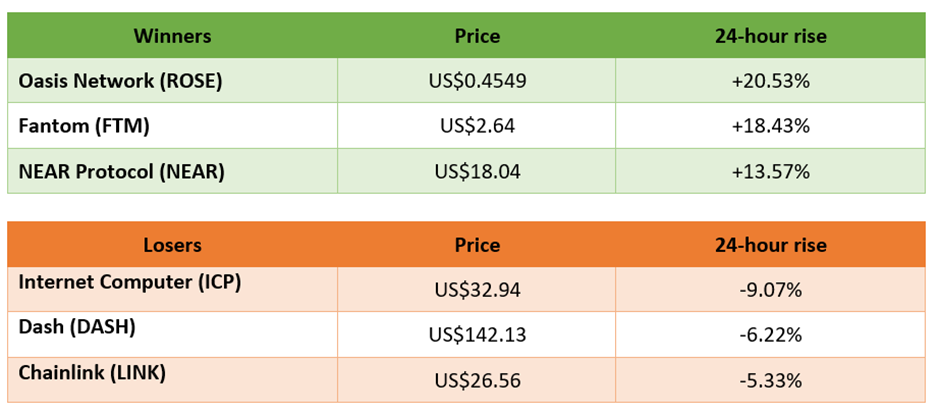

Winners and Losers

Note: Growth from the 24 hours prior to 12:30pm AEST

Source: Coinmarketcap.com, based on top 100 cryptos.

Image Source @ 2022 Kalkine Media®