Highlights

- Cryptocurrency’s market cap dropped from US$2 trillion to U$1.83 trillion – around eight per cent.

- Terra’s LUNA coin was the worst hit, plunging 13 per cent in the past 24 hours, and 28 per cent over the past week

- TON blockchain, has chosen as its official ecosystem, the TONcoin fund, which on Monday, announced the launch of an ecosystem fund focussing on supporting TON-based projects

After a solid three weeks, US$250 billion was wiped off the crypto market overnight in a major crash.

Market capitalisation of cryptocurrencies dropped from US$2 trillion to U$1.84 trillion – around eight per cent.

Bitcoin, the largest cryptocurrency by market value, fell eight per cent, below the US$40,000 mark. At the time of drafting this article, Bitcoin was trading at US$39,471 per token.

Meanwhile, Ethereum fell 9.7 per cent, worth just below US$3,000.

Out of the top ten tokens, Terra’s LUNA coin was the worst hit. It was down 13 per cent in the past 24 hours, and 28 per cent over the past week.

Meanwhile, Avalanche fell by 12.6 per cent, Solana by 13 per cent and Cardano by 12 per cent.

Why is crypto market crashing today?

After touching a high of US$48,200 for this year so far on 28 March, Bitcoin and the overall crypto market could not manage to hold on to the gains as expectations of faster interest rate hike and tightening of money supply by the U.S Federal Reserve spooked investors.

Crypto assets typically mirror the performance of highly valued tech stocks, which crashed overnight as bond yields rose amid expectations of rate hike. Overnight, the tech-heavy Nasdaq fell over 4% led by Tesla Inc (down 4.83%), Apple Inc (down 2.55%), and Alphabet Inc (down 3.35%).

Worth mentioning here is that lower interest rates bode well for risky assets such as cryptos and high value tech stocks. But as interest rates rise investors can earn better returns from debt instruments at lower risks, hence attractiveness of risky assets reduces. So, the present selloff that we are witnessing in the crypto market could be because of risk aversion as investors used to park their excess liquidity in these risky assets as capital was cheaper. But now, as interest rates globally have started moving higher, investors are exiting risky assets.

However, given the growing popularity of Bitcoin and some altcoins, investors are unlikely to lose money if they hold on to their crypto assets for a longer term. Trading in crypto assets will most likely result in losses.

Altcoin News

The open network, TON blockchain, has chosen the TONcoin fund as its official ecosystem. TONcoin fund on Monday, announced the launch of an ecosystem fund focussing on supporting TON-based projects.

Amongst the fund’s contributors are firms, including Huobi Incubator, KuCoin Ventures and 3Commas Capital.

This new fund will look to generate funds through incubation, investments, grants, hackathons as well as educational programs.

The announcement coincides with Cameroon, The Democratic Republic of The Congo and The Republic of the Congo announcing their plans to adopt TON to drive future economic progress.

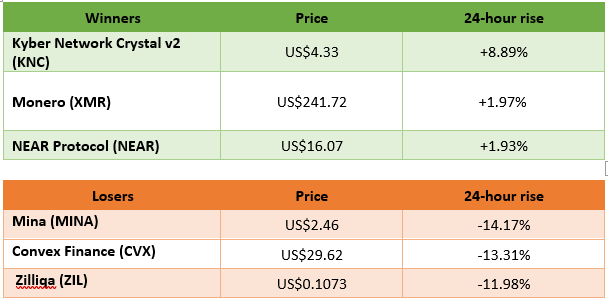

Winners and Losers

Image Source @ 2022 Kalkine Media®

Data Source: CoinMarketCap.com, based on top 100 cryptos.

Note: Growth from the 24 hours prior to 12:30pm AEDT

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.