Highlights

- Bitcoin is up above US$50,000 adding to more than 80 percent on its year-to-date return

- A regional Queensland property has gone to sale to people offering Bitcoin or Ethereum as payment

- A crypto trading platform has lost almost US$80 million after hackers managed to access hot wallets connected to the platform

Bitcoin Passes US$50K

The worlds largest cryptocurrency, Bitcoin, has tiptoed above US$50,000 once again after spending much of December under the US$50,000 mark.

This comes just one month after bitcoin hit an all-time high on November 11. However, shortly after this, bitcoin dropped rapidly in a market-wide sell-off, which saw bitcoin lose around 20 percent of its value.

Despite this, Bitcoin is up more than 80 percent on its year-to-date return.

Meanwhile, the second-largest cryptocurrency by market cap, Ethereum, also experienced a positive 24 hours, clawing back some of last week’s losses to reach US$4,100 this morning.

Queensland Property On Sale for Crypto

In a first for regional Queensland property, a beautiful spot on the fringe of the coral sea has gone to sale to people offering Bitcoin or Ethereum as payment.

The owner of the 162-acre property, John de Costa, has been trying to sell the property, which lies about 100 kilometres south of Mackay, for AU$2.2 million.

However, with not much luck during the Covid pandemic, de Costa decided to put the property up for sale using cryptocurrency, believing he’ll have more luck selling it this way.

At the current market rate, the property is for sale at 30 bitcoins, equivalent to about a little over AU$2 million.

Another Crypto Platform Hack

A crypto trading platform has lost almost US$80 million after hackers managed to access hot wallets connected to the platform.

scendEX lost a total of US$77.7 million in tokens hosted on the Ethereum, Binance and Polygon blockchains.

The trading platform managed to warn its users soon after it realised the breach of security, also telling its users that the hackers had not managed to compromise the cold wallets.

Hot wallets are those connected to the internet, while cold wallets are not connected to the internet.

According to the data security company, PeckShield, approximately US$60 million in tokens were transferred from the Ethereum blockchain, while US$9.2 million were taken from the Binance smart chain and US$8.5 million were transferred from the bbPolygon blockchain.

This latest hack comes just a week after the popular crypto exchange, BitMart, suffered its own security breach, in which hackers absconded with nearly US$200 million. Interestingly, the wallets targeted in that attack were also Ethereum and Binance hot wallets.

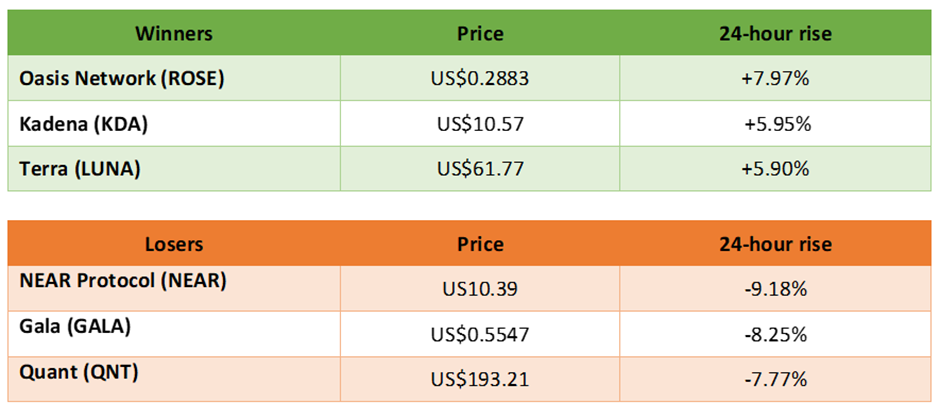

Winners and Losers

Note: this is the past 24 hours from 12:30pm AEST

Source: Coinmarketcap.com, based on top 100 cryptos.

Image Source @ 2021 Kalkine Media