Highlights

- Bitcoin has dipped to its lowest point in over a year with the flagship token dropping 4.4 per cent since yesterday to add to its overall decline this week

- Coinbase shares plunged around 25 per cent to its current price of US$53.72 – a massive drop from its opening price of US$328.28 in April 2021

Bitcoin has dipped to its lowest point in over a year with the flagship token dropping 4.4 per cent since yesterday to add to its overall decline this week.

Bitcoin is now valued at US$29,531, marking its lowest level since December 2020.

Crypto investors have been experiencing a world of pain in the past seven days as Bitcoin and other cryptos plummet in value.

Bitcoin has lost over 60 per cent of its value since it reached its all time high of US$68,500 in November 2021.

Meanwhile, shares in publicly traded crypto exchange, Coinbase, plummeted, signalling investor skepticism about the value of the crypto exchange in a bear-market.

Coinbase plunged around 25 per cent to its current price of US$53.72 – a massive drop from its opening price of US$328.28 in April 2021.

Despite the devastating performance of the crypto market, Australia’s first three cryptocurrency exchange-traded funds (ETF) launched on the Cboe exchange today. The ETFs mean that Bitcoin and Ethereum products are now available to traders and investors on the stock market.

Also Read: What is yield farming? Is it the best way to invest in cryptocurrencies?

One of the funds, the Cosmos Purpose Bitcoin Access ETF from Cosmos Asset Management, tracks the Purpose Bitcoin ETF on the Toronto stock exchange.

The remaining two funds were launched by Australian ETFS Management Ltd. and Swiss 21Shares AG spot-trade Bitcoin and Ether by tracking the crypto asset directly.

While the ETFs were originally slated for release in April, brokerage concerns resulted in last minute delays.

However, the launch of the ETFs come at a turbulent time for the cryptocurrency market, with Bitcoin and Ethereum both hitting their lowest points in 2022.

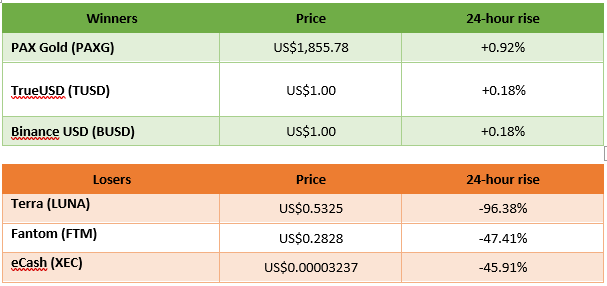

Winners and Losers

Image Source @ 2022 Kalkine Media®

Data Source: CoinMarketCap.com, based on top 100 cryptos.

Note: Growth from the 24 hours prior to 12:30pm AEDT

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.