Summary

- The white metal Silver crossed the 13-year high price level and is currently hovering around US$27 per ounces.

- There is a theory going around that the spike in prices is a result of the “Reddit” traders who are investing heavily in ETFs and stocks related to silver.

- The “Robinhood” traders have successfully pushed the prices up to 20% in the last week.

The silver price rise has been a sensational story so far. The white metal is trading above US$26 per ounce after 13 years. The price rose to nearly 20% in the last one week.

The price movement of silver in 10 years (Image Source: Refinitiv Eikon)

Will silver be the next gold?

The year 2020 saw the unprecedented movement in the price of gold. The precious yellow metal became the safe haven for investment during troubled times of the lockdown. People shifted their money from equity market to gold commodity and ETFs. As a result, gold soared to an all-time high price of US$2060 in August 2020.

Also Read: Silver Contours A New Seven-Year High, How Sustainable is the Short Squeeze Rally?

The current price movement of silver attracts investors, and people are excited that silver may cross its all-time high price this time. The white metal reached up to US$30 per ounces for a short interval and then retreated.

The price movement of silver in one year (Image Source: Refinitiv Eikon)

Are Reddit traders trying another Game Stop on Silver?

The stocks of the Company GameStop (NYSE:GME) were in the limelight very recently. The Company’s shares soared more than 1600% during January. The reason behind the astonishing share price movement was a group of investors collectively known as “Reddit” traders.

The name is given because they use the online chat platform Reddit to discuss stocks. The group started buying the stocks and created such massive demand that hedge funds and fund managers, who had taken short position on these stocks, began losing money.

More on the News: A tale of two GMEs: How GME Resources (ASX:GME) is cashing in on GameStop’s juggernaut

The market speculation is that the same phenomenon is acting behind the price rise of silver. There has been discussion on various forums that banks hold a short position on silver. So, banks have put their money on the probability that prices will go down.

The Reddit traders are now trying to repeat their success story of Game Stop.

Only this time, the opponents are big banks with deep pockets. They may have beaten the hedge funds last time, but it will be extremely difficult to compete with the banks. Banks hold the physical form of gold and silver and also invest in the futures and options market. So, if price rises, the value of silver in their vault will increase, or if the prices slide down, they will earn through short positions.

History of Silver

Silver mining dates back to 3,000 BC. We do not have exact data from the period, but the silver’s significant production started during the end of the 19th century. By 1870, the global production of silver reached 80Moz.

The extraction of silver increased subsequently after the introduction of modern equipment in the field of mining. At the same time, new vast reserves were discovered in the US, South America, and parts of Europe. The production increased to 190 Moz by the end of 1920.

From the first-ever mined silver during early civilisation to modern days, silver has come through a long way and has still retained its value in the global commodity market. Silver has found many industrial applications apart from the jewellery and silverware.

Silver is an excellent conductor of electricity. It is widely used in high-end manufacturing of electrical items. Silver is used in most of our equipment ranging from laptops, cellular phones, automobiles, items that use circuit boards, solar panel, and many others.

What is happening in the silver market?

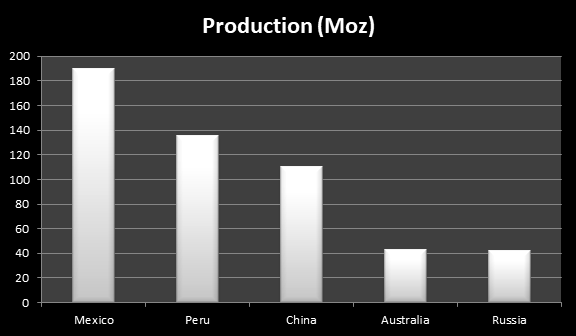

The global production of silver in 2019 stood at 836.5Moz, 1.3% down from the previous year. The production is declining since 2015. Mexico is the largest producer of silver, followed by Peru, China, Australia, and Russia.

Production Data 2019 (Source: The Silver Institute)

The demand for silver in 2019 was 991.8 Moz. The data include industrial as well as the jewellery market. Nearly 50% of all demand comes from the industrial sector. The growing use of renewable energy is estimated to increase demand further. Silver is used in the manufacturing of photovoltaic based solar panels. In 2019 alone, it saw impressive growth of 7%.

Silver – The ‘Devil’s metal’

Silver is also called the ‘Devil’s metal’. There can be high volatility in a very short span for silver, and traders may not get enough time to square off their position. Back in 1979-80, one such attempt was made when some oil billionaires purchased silver worth US$15 billion to raise the prices. While they did not gain much in monetary terms, they surely earned some court cases and lawsuits.

Interesting Read: Silver Surge Continues, Riding High on Reddit Mania