Summary

- Base metals market has been on a rollercoaster ride for both investors and producers with prices rallying due to the COVID-19 outbreak over Indonesian export ban and later tumbling over the weak global demand.

- The estimated plunge in the global economic conditions has taken a deep toll on base metals price with many such as copper, nickel witnessing a considerable downturn, posting strong headwinds for base metals miners such as Metals X Limited (ASX:MLX).

- The Company reported an EBITDA of -$8.7 million for the period ended 30 June 2020 while taking a considerable hit on revenue over low market prices for base metals.

- However, now the tables are turning for base metals, leading to the market traction in ASX-listed base metals stocks.

- MLX on charts.

Base metals prices have witnessed a see-saw ride with the market rallying before the COVID-19 outbreak over the ore export ban from Indonesia, prompting base metals such as copper and nickel to test multi-period high.

However, with the COVID-19 outbreak, base metals were among the hardest hit commodity along with oil over weak global demand.

Base metals are typically linked with economic growth, as a robust economy needs base metals like copper to meet the infrastructure needs.

And, with the COVID-19 outbreak, the economic growth on the global scale has taken a U-turn with many independent economist groups such as the Internal Monetary Fund (or IMF) forecasting a contraction in the global economy.

The estimated plunge in the global economic conditions has taken a deep toll on base metals price with many such as copper, nickel witnessing a considerable downturn, posting strong headwinds for many base metals miners such as Metals X Limited (ASX:MLX).

MLX Reports FY2020 Results

The Company reported an EBITDA of -$8.7 million for the period ended 30 June 2020 and an EBITDA of $16.6 million for the Renison Tin Operation, which remained ~ 22.79 per cent down against the previous corresponding period (or pcp).

MLX suggested that revenue took a hit over lower prices against pcp while the cost of sales increased against pcp due to the drawdown of the large low-grade ore stockpile developed prior to the construction of the ore sorter in 2019.

Likewise, EBITDA for the Nifty Copper Operations stood at -$19.0 million, due to the suspension of operations.

MLX Suggested that, during the period (or FY2020), the Company recognised impairment and other losses of $49.5 million along with a further write down at Nifty of $15.6 million.

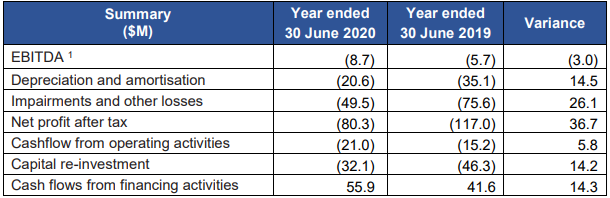

MLX FY2020 Performance Snippet (Source: Company’s Report)

The care and maintenance costs at Nifty for the period were $24.7 million, and there were write-offs on exploration and evaluation expenditure of $0.1 million and a surge in the rehabilitation provision at Mt Bischoff of $8.4 million.

Copper Assets Strategic Review

The Company suspended the Nifty Copper Operations in November 2019 to place it on care and maintenance. In January 2020, MLX commenced a strategic review of its copper assets, including Nifty, the Maroochydore Copper Project, and the surrounding copper tenements.

In June 2020, MLX announced a $32 million Farm-in and Joint Venture agreement with IGO Limited in relation to the Company’s Paterson Exploration Project comprising the exploration tenure surrounding Nifty, excluding Nifty and Maroochydore.

To Know More, Do Read: Nickel Rush- IGO Rejuvenates West Kimberley JV, MLX Inks Farm-in and Unveils Long-Life Open Pit

The Tables are Turning!!

Since the onset of the second quarter, base metals have demonstrated a strong recovery with both copper and nickel surging over 40 per cent from their March 2020 lows.

In the wake of a strong recovery in base metals prices, many ASX-listed miners such as IGO Group Limited (ASX:IGO), Sandfire Resources Limited (ASX:SFR), Nickel Mines Limited (ASX:NIC) are gaining limelight with their recent developments across multiple prospects to take advantage of a swift recovery in base metals prices.

Furthermore, in the recent past, MLX had identified a long-life open-pit at Nifty, which the Company now intends to develop.

Apart from MLX, other base metals miners are also currently focusing on the development of various base metals assets to lock-in the rally in prices.

To Know More, Do Read: Copper Rush Awaking Australian Titans; Australia To Climb The Supply Ladder?

Market Reaction and Price Behaviour

The stock seems to be gaining some traction with MLX surging from $0.043 (intraday low on 23 March 2020) to the level of $0.105 (intraday high on 11 June 2020) on ASX. However, post showing a decent recovery, the stock has entered consolidation with prices moving in a range of $0.077 to $0.092.

MLX Daily Chart (Source: Refinitiv Eikon Thomson Reuters)

On following the daily chart, it could be seen that the stock is trading in a narrow range and at present is below the 200-day and 50-day exponential moving average, suggesting that the primary trend is a downtrend.

- However, recently, the stock saw an uptick in price and traded and near its 50-day EMA along with a squeezing Bollinger band, reflecting that the stock is poised to gain momentum ahead, direction of which would depend upon certain signals.

- The primary resistance for the stock is at 50-day EMA, which is overlapping with the mean value of the 20-day simple Bollinger band; thus, could act as a decisive resistance.

- A break and sustain above the same could seed short-term bullish sentiments ahead.

- The 200-day EMA could act as a major resistance for the stock; above which, the intermediate downtrend could change direction.

- The On Balance Volume is relatively flat and is in tandem with the price action, suggesting that currently there is less participation in the stock from both bulls and bears.

.jpg)