Highlights

- Gold prices reached to 18-month highs on Monday.

- The tension between Russia and Ukraine escalates.

- The rising uncertainties lifted the demand for gold as a safe haven asset.

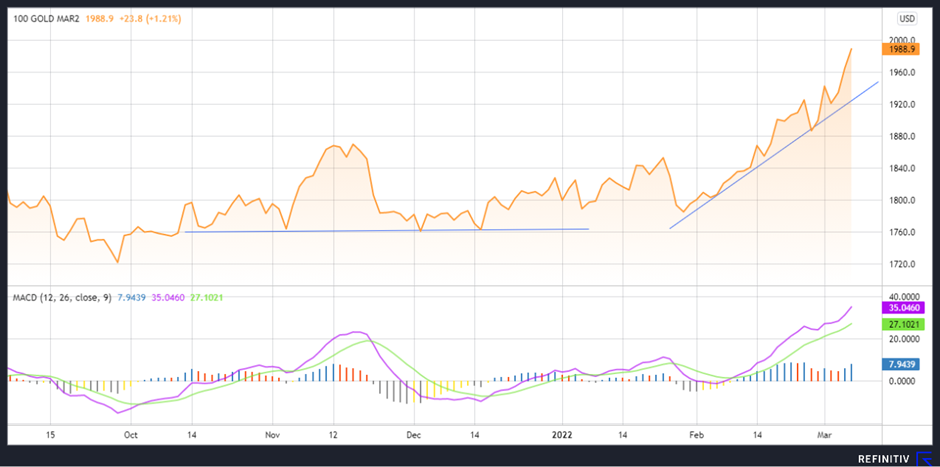

Gold prices surpassed the mark of US$2,000 per ounce on Monday, extending their rally to an 18-month high level on the back of escalating tension between Russia and the Western allies on the Ukraine invasion. The rising uncertainties lifted the demand for gold as a safe-haven asset. Gold prices have gained more than 8.9% in the last one month.

Source: Eikon Refinitiv

On Monday, the prices of April delivery gold futures reached an intraday high of US$2,005 per ounce before trimming their gains till afternoon. COMEX Gold futures (April delivery) last traded at US$1,994 per ounce, up 1.42% on the last close.

Must Read: Gold, Crude oil, and Aluminium: 3 Commodities to keep an eye on as Russia invades Ukraine

Also watch: Shining In Times Of Crisis: How Gold Prices Reacted During Wars?

The bullion has commenced its upward trajectory from the start of February 2022 with the beginning of a tussle between Russia and Ukraine. The ongoing tension between both nations continued to weigh on sentiment, as fighting intensified over the weekend and Russian President Vladimir Putin promised to press ahead with his invasion unless Kyiv surrendered.

Investors across the globe positioned themselves out of equities and took positions into safe assets.

Good Read: Shining in times of crisis: How gold prices reacted during major wars