Highlights

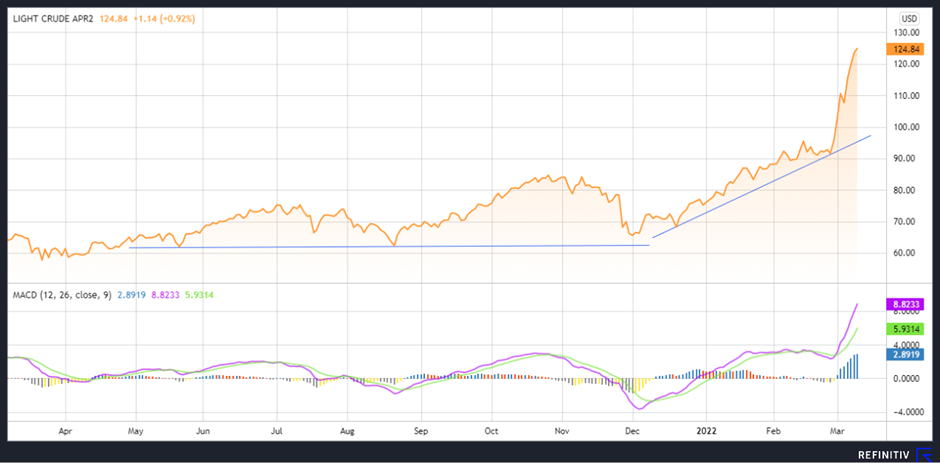

- Crude oil prices jumped as much as 4% on Tuesday.

- The prices have increased more than 30% since Russia invaded Ukraine.

- The Western sanctions on Russian oil exports are expected to create chaos in the energy market.

Crude oil prices jumped as much as 4% on Tuesday after the US banned Russian oil imports. At the same time, Britain also said to phase out the import of Russian oil and oil products by the end of 2022.

Crude oil prices surged more than 30% since Russia invaded Ukraine and the Western allies imposed firm sanctions on Russia.

Brent Crude Oil 1-month futures settled 3.9% higher at US$127.98/bbl on Tuesday. On Wednesday, May delivery Brent Crude oil futures extended their rally and traded at US$130.80 per barrel up 1.25%, while April delivery WTI crude oil futures exchanged hands at US$125.80 per barrel, up 1.70% at 1:25 PM AEDT.

Source: Refinitiv Eikon

Also Read: Crude oil surges to 14-year highs on delays in Iranian talks

Source: Refinitiv Eikon

Russia is one of the leading producers of crude oil in the world. The country ships nearly 7-8Mbpd of crude oil to the global markets. The Western sanctions on Russian oil exports are expected to create chaos in the energy market.

Also Read: Crude oil slides from multi-year highs as Iran talks rev up

Though European allies are not expected to join the US in the ban, major buyers across the globe are already snubbing Russian oil because of criticism. Shell Plc faced huge criticism for a purchase made on 4 March 2022.

The prices also got support from the dimmed expectation of returning Iranian crude oil into the market. Meanwhile, American Petroleum Institute showed a surprising increase of 2.8 million barrels in US crude stocks for the week ended 4 March 2022. The energy major has decided to stop buying Russian oil & gas products.

Here’s how commodities performed in the last week click here

Crude oil is not the only commodity, the impact of the Russia-Ukraine tussle is spilled over the entire commodity market. Gold and palladium have extended their blistering rally towards all-time high levels due to increased uncertainty and supply concerns respectively. The London Metal Exchange suspended nickel trading on Tuesday after the prices of the metal jumped by a whopping 400% from Friday’s close.

Must Watch: As Russia-Ukraine War Intensifies, Commodities Also Soars