Highlights

- Crude oil prices rose on Thursday.

- On Wednesday, the prices of crude oil reached their highest level since November.

- Crude oil prices made a significant rebound ranging from 50-60% in 2021.

Crude oil prices rose further on Thursday on expectations that the fuel demand will rise despite an upsurge in the Omicron variant of coronavirus. The prices were also boosted on expectations that OPEC+ would continue to increase imports only incrementally.

However, the gains were eased as the world's topmost importer – China cut the initial batch of crude import allocation for 2022.

On Wednesday, the prices of crude oil reached their highest level since November after the release of government data displaying a fall in US crude inventories in the last week.

March delivery Brent Crude oil futures last traded at US$78.89 per barrel down 0.15%, whereas February delivery WTI crude oil futures traded 0.84% down at US$76.84 per barrel as of 31 December 2021 at 12:50 PM AEDT.

Oil’s significant journey

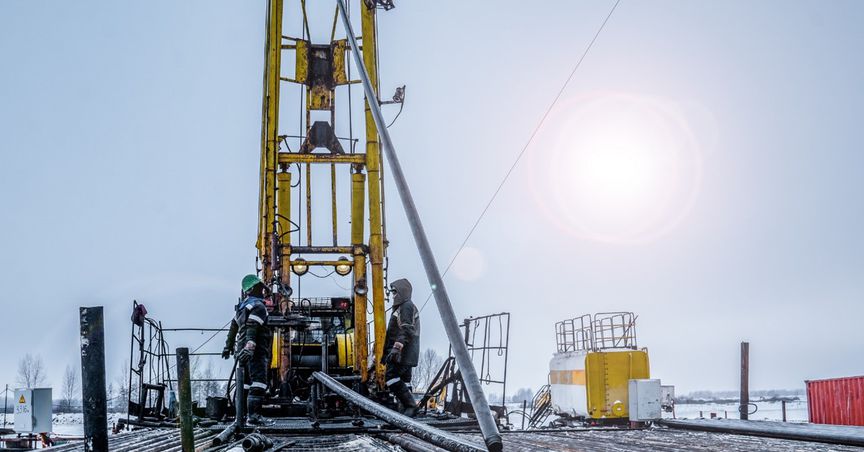

Crude oil prices made a significant rebound ranging from 50-60% in 2021 as fuel demand roared back to pre-pandemic levels and deep production cuts by OPEC and its allies.

Crude inventories in the US tumbled by 3.6 million barrels, US gasoline stocks dropped by 1.5 million barrels and distillate stockpiles fell by 1.7 million barrels in the last week.

Source: © Gumpapa | Megapixl.com

Oil market participants are waiting for the OPEC+ meeting scheduled on 4 January 2022, at which the cartel will decide whether to go ahead with the planned production increase of 400,000 barrels per day in February.

Bottom Line

Crude oil prices rose further ahead of the OPEC+ meeting scheduled on 4 January. Oil has witnessed a significant journey in 2021 with prices hovering between 50-60% in the subsequent year.