Highlights

- The prices of both crude oil benchmarks gained significantly in the last week.

- Uranium prices gained more than 5.5% in the last week as demand from China, a major nuclear energy producer, surged significantly.

- Base metals including copper and iron ore prices saw their prices gain significantly last week amid lower inventories and ease in COVID-19 restrictions.

Commodities witnessed mixed sentiments during the last week. At the same time, the US dollar's gloomy situation lent considerable support to commodities.

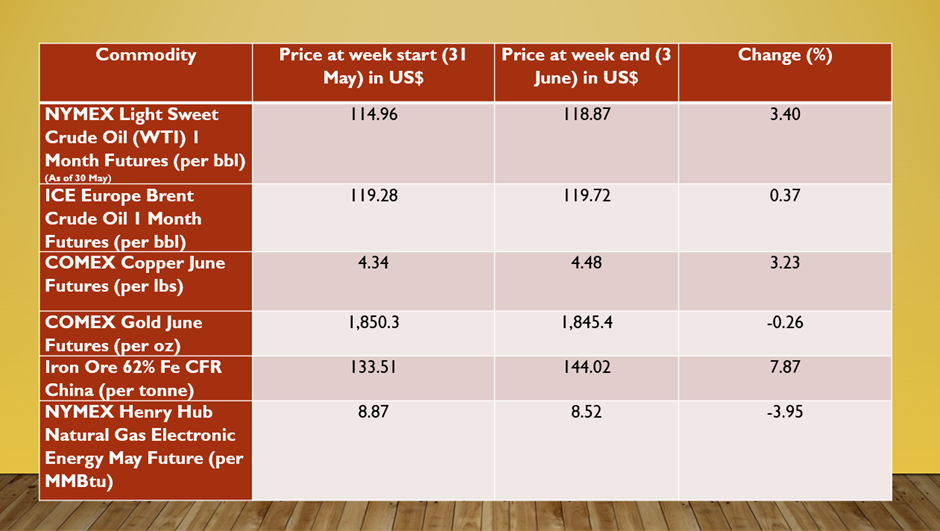

In the energy domain, the prices of Brent crude oil futures recorded marginal weekly gains of 0.37%. Both crude oil benchmarks exchanged hands over US$118/bbl on Friday. On the contrary, natural gas prices slumped by 3.95% in the last week due to higher-than-expected stockpiles in the storage facilities.

Also Read: Crude oil surges to 14-year highs on delays in Iranian talks

Image source: © 2022 Kalkine Media®

The benchmark Newcastle coal futures consolidated near US$412/tonne on Friday, supported by a strong demand against a tightening market backdrop. The prices gained more than 2.7% in the last week due to increased demand in the power generation sector.

Furthermore, uranium prices gained more than 5.5% in the last week as demand from major nuclear energy producer, China, surged significantly with ease in COVID-19 restrictions. The prices were additionally fuelled by Beijing's previous signals to build 150 new reactors by 2035 amid commitments to lower carbon emissions.

Must Watch: As Russia-Ukraine War Intensifies, Commodities Also Soars

Within precious metals, the prices of both gold and silver logged marginal dips following two straight weekly gains. Comex gold futures dropped 0.26% in the last week as the US Fed remained on track to continue its tightening plans. Traders believe that interest rates will be increased to curb rising inflation.

The prices of base metals including copper and iron ore prices gained significantly in the last week amid lower inventories and ease in COVID-19 restrictions in China. The country’s key commercial hub – Shanghai allowed all manufacturers to resume operations from June. Aluminium prices, on the other hand, dropped amid slowing demand and rising output.

Furthermore, the prices of battery metal lithium remained stable during the last week while nickel prices dropped more than 3.5%.

On this backdrop, let's look at a few commodities that were popular among traders in the past week.

Data Source: Refinitiv Eikon

Here are a few significant commodities that recorded substantial volatility during the last week.

Iron Ore

Iron ore prices surged more than 7% last week to close at US$144.02 per tonne, significantly up from last week’s closing price. The solid rise in iron ore prices was underpinned by the reopening of Shanghai and moves by the Chinese government to detail a series of stimulus measures.

Crude oil

Image source: © 2022 Kalkine Media®

WTI Crude oil prices gained as much as 3.40% in the last week, recording the third straight weekly gain. The prices reached multi-week highs amid solid demand due to the peak US driving season. Furthermore, in the last week, OPEC+ also decided to increase its output in July and August by 648,000bpd. Also, the ease in lockdown restriction in China's financial hub, Shanghai, fuelled demand and buoyed oil prices.