Highlights

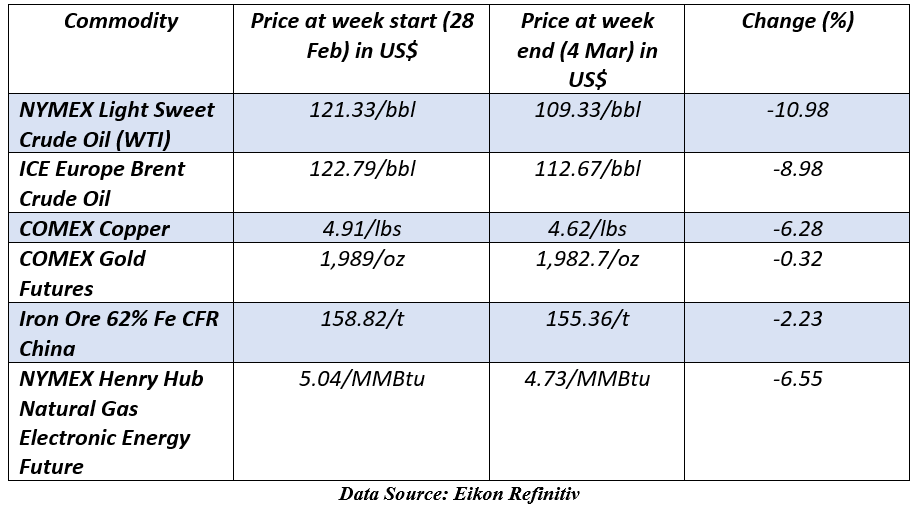

- The prices of commodities are hovering near multi-year highs despite recording a significant drop during the last week.

- Crude oil futures tumbled more than 8.98% last week while coal prices dropped more than 40% last Friday.

- Uranium prices soared more than 11% last Friday to record weekly gains of more than 17%.

The prices of commodities ranging from energy products to metals have shot up in the past one month following Russia’s invasion of Ukraine, raising concerns of supply shortage. Though the momentum has partially stalled on hopes of reconciliation between both nations, many experts believe that the prices will remain volatile in the near term as market players assess demand-supply implications.

Source: Refinitiv Eikon

Brent crude oil ended last week at US$112.67/bbl while WTI crude oil closed at US$109.33/bbl on Friday, recording the biggest weekly drop since November 2021. Natural gas prices also dipped to near US$4.73/MMBtu, nearly 10% lower than three-month highs of US$5.18/MMBtu reached on 7 March.

Also, coal prices slid more than 40% last Friday (11 March 2022) after hitting record highs of US$425/t. The prices skyrocketed to record levels on fears of supply-chain disruptions and low inventories.

Source: Copyright © 2022 Kalkine Media®

Last Friday, uranium prices soared more than 11% to record weekly gains of more than 17%. The prices reached near US$60.40 on Friday amid mounting supply concerns and stronger global demand prospects. Russia signed a decree including a ban on raw material exports, raising alarms about US uranium imports.

Among precious metals, both gold and silver recorded marginal declines in the last week as investors braced for an upcoming rate hike from the Federal Reserve which pushed 10-year US Treasury yields significantly. Industrial metals including copper, aluminium, platinum, tin, zinc, and lead retreated during the last week after hitting multi-year highs.

A significant battery metal, nickel surged by a whopping 65% last Tuesday to hover near US$80,025/t after hitting US$101,365/t in the previous session on the same day. The prices gained more than 74% in the last week. At the same time, lithium prices remained stable during the period.

Against this backdrop, let's skim through a few commodities that recorded substantial volatility during the last week.

Crude Oil

Both crude oil benchmarks recorded substantial drops last week after hitting 14-year highs. The significant rise in crude oil prices was underpinned by the Russian oil embargoes. The prices dropped significantly later in the week after Europe stepped back from its allies in banning Russian oil. Furthermore, few OPEC members coupled with Iran and Venezuela also pledged to boost production, further easing supply concerns.

Uranium

Uranium futures extended their gains above US$54/lb last Friday to reach the highest level since September 2011. The energy sector in the US produces nearly one-fifth of its total energy through nuclear sources. and imports around 16% of uranium from Russia. After the US embargoed Russian oil, Kremlin also banned its raw material exports, creating chaos in the nuclear energy market. At the same time, rising crude oil and gas prices also prompted utilities to search for cheaper alternatives.