Highlights

- Crude oil prices have softened as OPEC+ has decided to continue to stick to its original plan of increasing the output gradually.

- Precious metals showed signs of life after the market concluded the long-awaited taper announcement from the US Federal Reserve to be dovish.

- Iron ore futures in China recorded a fourth straight weekly decline as industrial demand remained sluggish due to steel output curbs in China.

The global commodity sector continues to consolidate, resulting in a lower Bloomberg Commodity Index for a third straight week. Various data from several sources, notably from China, point to slow growth expectations and have forced investors to become more risk averse. A slowdown in the country's manufacturing industry, coupled with debt risk in the property sector and power crunch in China portray a slower economic activity.

Additionally, the recent collapse in Chinese coal prices due to the intervention of the government has helped some industrial metals like aluminium to support lower prices. The weakness was led by crude oil and industrial metal correction. Apart from this, dovish signals from the FOMC gave a boost to precious metals.

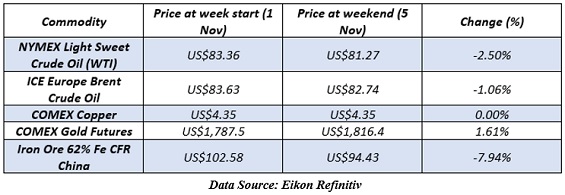

A snapshot of the price movement of various commodities is given below:

With this backdrop, let's have a look at a few commodities that were popular among traders in the past week.

Crude oil

Crude oil is indicating signs of entry into the stage of consolidation following a two-month ground-breaking rally, which has lifted the prices of both benchmarks by nearly 33%. However, the prices have softened with OPEC+ deciding to continue to stick to its original plan of increasing the output gradually by 400,000bpd.

Source: Copyright © 2021 Kalkine Media

Additionally, rising expectations for the stabilisation of gas prices amid expected supply from Russia has also cooled oil demand and, in turn, its prices. An expected seasonal rise in the US inventories coupled with the release of crude oil from its strategic reserves has also impacted oil prices.

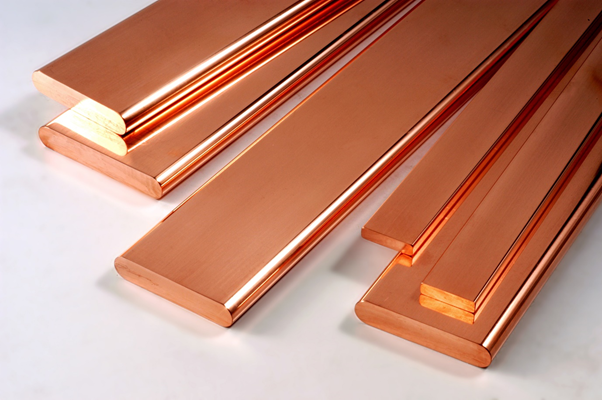

Copper

Industrial metals suffered the most during the last week after having witnessed record-high levels three weeks ago. Copper has lost majority of the gains gathered during October spike. Moreover, tight conditions can still be seen in data from exchange-monitored warehouses. Also, Chinese demand worries and long liquidation from recently established longs have been influencing the market.

Copper prices | Source: © Gana123 | Megapixl.com

Gold

Gold prices bounced back to surpass the US$1,800 per ounce mark on Friday last week on the back of ease in global bond yields, providing an opportunity for non-interest-yielding bullion to advance.

Source: Copyright © 2021 Kalkine Media

Precious metals recovered after the market concluded taper announcement from the US Federal Reserve to be dovish.

Iron Ore

Iron ore futures in China recorded a fourth straight weekly decline as industrial demand remained sluggish due to steel output curbs in China.

Falling iron ore | Source: © Argus456 | Megapixl.com

The most-traded iron ore futures on the Dalian Commodity Exchange ended the week at CNY561 per tonne, down 3.2%. The contract tumbled 12.1% in the last week.

Coal

Coal futures bounced back over US$150 per metric tonne after recording a massive selloff that wiped off almost 50% of its value from the record-high levels of US$269.5 per metric tonne. The bounceback in coal futures came on the back of colder than usual weather forecasts bolstering Chinese demand prospects.

Coal Ore Price Going Up | Source: © Bakhtiarzein | Megapixl.com

The prices of coal remained close to three-month lows as traders in the country continue to weigh China’s intervention to lift output and crack down on speculations in coal prices.