The shares of Infinity Lithium Corporation Limited (ASX:INF) were voluntarily suspended from quotation today, i.e. 3th June 2019, at the request of INF pending an announcement regarding an update on the San Jose mining applications. It is anticipated that the announcement will be made on 7th June 2019.

Recently, during 2019 March quarter, the company increased its ownership of the San Jose Lithium Project from 50% to 75%, through a renegotiation of the Joint Venture (JV) agreement, which is a major step in progressing Infinityâs position in relation to dialogue with potential strategic partners.

The new JV arrangement is beneficial as it is accelerating the project by providing clarity of ownership with less expense for Infinity. This increases the projectâs potential to enter into development and attract strategic investments sooner for the benefit of both joint venture partners. The company believes that now that the Joint venture Agreement has been successfully renegotiated and the project is currently on a pathway for lithium hydroxide, a Pre-Feasibility Study is the optimal next stage.

During the March quarter, the company progressed with the Pre-Feasibility Study work program and provided an update to the market after the successful confirmation of Stage 1 test work. The company continued to engage with stakeholders, including local, regional and national governments to complement industry and project technical advancements.

As part of an ongoing interaction within the battery metals space, the company recently attended key battery conferences in Europe, including the Ninth Advanced Automotive Battery Conference in Strasbourg and the European Battery Association EBA250 conference in Brussels.

During the quarter, the company further strengthened its Board composition with the appointment of an industry expert and highly experienced, Vincent Ledoux-Pedailles, reflecting the corporate requirements and core focus with regards to San Jose.

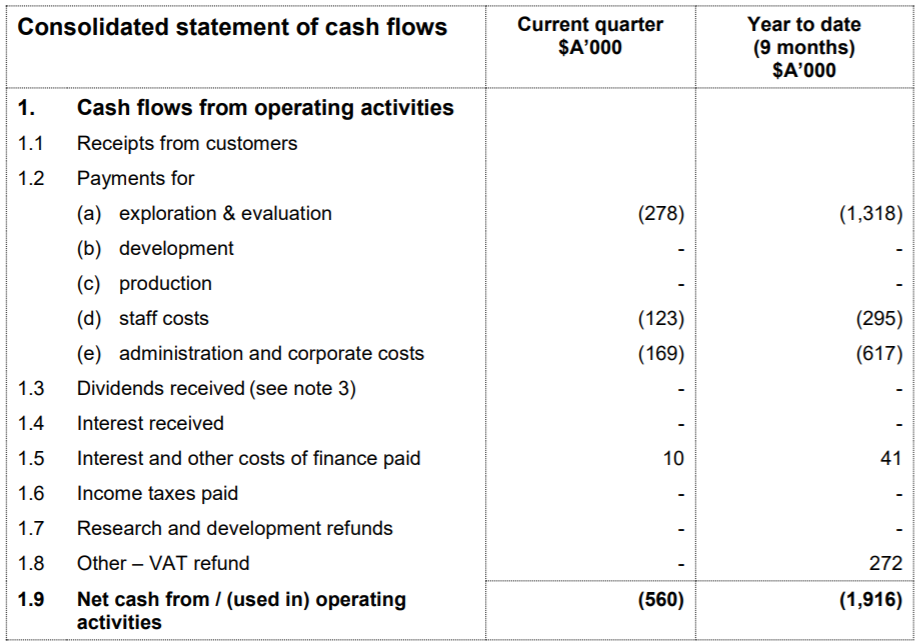

During the 2019 March quarter, the company spent $278k on exploration and evaluation activities. Further, the company reported administration and corporate costs of $169k. The net cash used in operating activities during the March quarter was $560k and the net cash used in investing activities was $399k. As at 31 March 2019, the company had a cash balance of $1.59 million.

Cash Flow Statement for Operating Activities for 2019 March Quarter (Source: Company Reports)

Cash Flow Statement for Operating Activities for 2019 March Quarter (Source: Company Reports)

The company recently executed a Memorandum of Understanding with the Spanish industrial group, Ercros SA to supply major input reagents for the production of lithium chemicals at San Jose Lithium Project.

Now, letâs have a glance at the companyâs stock performance and the returns it has posted over the past few months. INFâs stock last traded at $0.86, with a market capitalisation of circa $16.35 million as on 29th May 2019. The stock has provided a YTD return of 43.33%. In the last one year, the share price of the company has increased by 3.61% as on 29th May 2019. Its 52-week high price stands at $0.105, with an average volume of ~390,290.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.