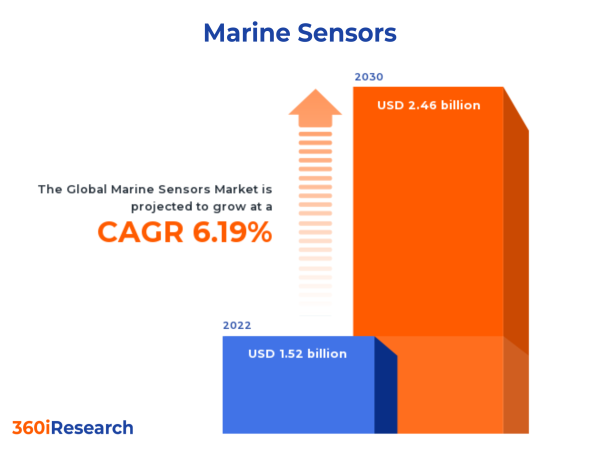

The Global Marine Sensors Market to grow from USD 1.52 billion in 2022 to USD 2.46 billion by 2030, at a CAGR of 6.19%.

PUNE, MAHARASHTRA, INDIA , November 20, 2023 /EINPresswire.com/ -- The "Marine Sensors Market by Sensor Type (Acoustic Sensors, Force & Torque Sensors, Level & Flow Sensors), Connectivity (Wired Sensors, Wireless Sensors), Application, Deployment, Sales Channel, End-Use - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Marine Sensors Market to grow from USD 1.52 billion in 2022 to USD 2.46 billion by 2030, at a CAGR of 6.19%.

Request a Free Sample Report @The "Marine Sensors Market by Sensor Type (Acoustic Sensors, Force & Torque Sensors, Level & Flow Sensors), Connectivity (Wired Sensors, Wireless Sensors), Application, Deployment, Sales Channel, End-Use - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.

The Global Marine Sensors Market to grow from USD 1.52 billion in 2022 to USD 2.46 billion by 2030, at a CAGR of 6.19%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/marine-sensors?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Marine sensors, also

Marine sensors, also referred to as water quality sensors, are devices and equipment used in oceanography and environmental monitoring to measure the properties of seawater and freshwater. Marine sensors serve various purposes in fields such as offshore oil extraction, climate science, fisheries, and marine conservation and provide crucial information to scientists, explorers, and ecologists, among others. The rising concerns regarding marine ecosystems and the need to monitor water quality and pollution have contributed to the demand for marine sensors. In addition, the advent of IoT and AI technologies presents considerable potential opportunities for the sector by integrating these systems for real-time data analysis, advanced automation, and predictive maintenance in marine operations. However, the high cost of advanced marine sensors and complexities in data management and interpretation present difficulties for the adoption of marine sensors. Furthermore, complex installations of marine sensors and limitations due to inaccurate readings generated by marine sensors and the impact on marine environments on the durability of marine sensors impede customer preference for the devices. Efforts by major players to invest in advancements in the design and models of marine sensors have significantly improved the accuracy and reliability of marine sensors. Furthermore, the integration of next-gen technologies such as AI, ML, and robotics in sensor design and applications is expected to serve as a promising avenue for the growth of marine sensors.

Deployment: Equipping ongoing marine and climate research initiatives through the surface deployment of marine sensors

Subsea marine deployment of sensors is used for various applications such as seismic exploration, resource identification, and deep-sea exploration. These sensors offer precise data during challenging conditions such as intense pressure and low light. Surface deployment of sensors is ideally used in applications such as navigation, weather monitoring, and surface-level exploration. Surface sensors play a crucial role in the shipping industry for voyage planning and for the safety of seafaring vessels. They are essential in climate research, providing invaluable data regarding global weather patterns and oceanic conditions.

Application: Necessitating deployment of marine sensors for in-marine environment monitoring and controlling

Maritime vessels require a robust ballast and bilge system for stability and proper underwater operation that keeps the vessel buoyant. Sensor technology optimizes this system by monitoring water levels, detecting any leaks, and controlling pumps. Firefighting systems are essential for safety on board. The marine sensors used in these systems identify smoke, heat abnormalities, and button alarms predicting emergencies. Fuel & propulsion systems are central to a vessel's overall performance, and sensors can be used for fuel monitoring, detecting leaks, and controlling propulsion systems. On board, the Heating, Ventilation, and Air Conditioning (HVAC) system requires sensors to maintain a habitable climate. The sensors provide vital data for the operation of HVAC systems by measuring parameters such as humidity, temperature, and air pressure, ensuring comfort and safety for those onboard. Navigation & positioning systems form the backbone of maritime travel, relying massively on sensor technology for accurate positioning, direction, and speed. Position sensors and motion sensors are widely deployed for this segment. Refrigeration systems are essential for cargo and fishing vessels as they maintain accurate temperatures. Sensor systems, especially temperature sensors, are used to monitor and control refrigeration units.

Sales Channel: Continuous technological advancements and quality assurance in OEM marine sensors

Aftermarket refers to the parts made and provided by third-party manufacturers once the original equipment has been sold. This sales channel represents a substantial segment of the marine sensors market. Consumers often favor aftermarket sensors for their competitive pricing and wider range of options. The original equipment manufacturer (OEM) refers to the companies creating the initial equipment, including marine sensors. These products, accompanied by trusted brand names, cater specifically to the need for reliability and long-term associations. OEMs generally command premium pricing in the market and are known for their high-quality production standards. Aftermarket products provide a cost-effective solution with an array of customization options. However, their versatile nature may signify a compromise on product consistency. OEMs assure consistency and top-notch quality due to rigorous in-house testing and adherence to stringent safety standards.

End-Use: Introduction of sensors that emphasize real-time data and autonomous capabilities for the commercial sector

Commercial marine sensors are primarily utilized in the shipping industry, oil & gas exploration, and research ventures. The blend of real-time data, long-range sub-surface measurements, and high-precision data collection make these instruments indispensable assets for commercial operations. Commercial marine sensors aid in maritime navigation, fish detection, oceanographic studies, and mapping of seabed resources in container vessels, cruise ships, dry cargo vessels, and passenger ferries. Marine sensors play a crucial role in naval operations in defense, including reconnaissance, submarine tracking, and mine detection. Defense marine sensors are designed to ensure national security by providing military personnel with vital locational and environmental data and are equipped in aircraft carriers, amphibious ships, offshore support vessels, or submarines. They offer extensive capabilities, from real-time enemy tracking to underwater communication and strategic warfare operations. Unmanned underwater vehicles (UUVs), mainly autonomous unmanned vehicles and remotely operated vehicles are fundamentally guided by marine sensors and are used extensively for a range of applications, including scientific research, resource exploration, data collection, and surveillance. While commercial and UUV sectors majorly seek efficiency and accurate data collection, defense prioritizes stealth and innovative functionality.

Sensor Type: Adoption of acoustic sensors in oceanographic and environmental studies

Acoustic sensors are devices designed to detect and measure sound waves or acoustic signals in the surrounding environment. Acoustic sensors, traditionally used for submarine navigation and fish tracking, are becoming increasingly popular for naval, oil & gas, and environmental applications. A force & torque (FT) sensor is an electronic device designed to monitor, detect, and regulate linear and rotational forces exerted upon it. They are used by research vessels, tankers, ferries, offshore platforms, fishing vessels, and pleasure craft. A level and flow sensor refers to an electronic device that measures or regulates the flow rate of liquids and gasses. The level & flow sensors use has expanded due to the increased use in water and wastewater, oil & gas, and chemical industries. Motion, proximity, and position and displacement sensors are electronic devices designed to detect and measure positional movement. An optical sensor measures the quantity of light rays physically present and turns that information into an electrical signal that can be interpreted. The pressure sensor is a device that can determine pressure by measuring the electric charge. Radar sensors detect, track, locate, and identify various types of objects at significant distances using electromagnetic waves. A smoke detector is a device that detects smoke and can typically indicate the presence of a fire. A speed sensor is a type of position sensor that is used to measure rotational speed. A temperature sensor refers to a device used to measure temperature, including air temperature, liquid temperature, or the temperature of solid matter.

Connectivity: Expanding usage of wireless connectivity to facilitate ease of operation

Wired marine sensors maintain a physical connection to the main system for continuous measurement collection and ease of maintenance. These sensors, largely preferred in stationary operations and controlled marine environments, supply consistent reliability. Wireless marine sensors offer increased flexibility and adaptability and are emerging with technological advancements. They are devoid of cables and wires and can be easily deployed in inaccessible regions, thereby earning preference for dynamic operations and complex explorations. A wireless sensor network (WSN) consists of a number of dedicated sensor nodes with advanced sensing and computing capabilities, which can sense and monitor the physical parameters and transmit the collected data to a central location. Generally, a WSN deploys more sensors than the optimal placement to improve the system's reliability and accuracy.

Regional Insights:

The advanced monitoring solutions in the Americas, backed by significant research and development spending, enable continual improvements in oceanic resource management and environmental compliance. This region supports tech innovation with new initiatives in aquaculture and offshore industries. The EMEA region, rich in offshore oil & gas reserves, relies on marine sensors for its resource extraction operations. A significant share of the demand originates from this region, as these sensors are majorly used in the drilling process for operational convenience and risk alleviation. The escalating need for marine sensors in the APAC region correlates closely with increasing trade activities. The rising maritime activities in the APAC demand sophisticated marine sensor capabilities, specifically in port security, offshore platform monitoring, and disaster management. Furthermore, governmental support in these nations for upgrading marine infrastructure to accommodate evolving trade requirements has augmented this demand.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Marine Sensors Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Marine Sensors Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Marine Sensors Market, highlighting leading vendors and their innovative profiles. These include ABB Ltd., Airmar Technology Corporation, Amphenol Corporation, BAE Systems PLC, Baumer Ltd., CODAR Ocean Sensors, Ltd., Cyclops Marine Limited, Danfoss A/S, Dartmouth Ocean Technologies Inc., Garmin Ltd., Gems Sensors, Inc, Gill Sensors & Controls Limited, Hansford Sensors, Honeywell International Inc., IST AG, Kongsberg Gruppen, Lockheed Martin Corporation, Micro-Air, LLC, Nantong Saiyang Electronics Co.,Ltd, nke Group, NORIS Group GmbH, Northrop Grumman Corporation, Norwegian Subsea AS, RTX Corporation, SBG Systems, Seapoint Sensors, Inc., Senmatic A/S, Signet Marine Inc., Silicon Sensing Systems Ltd, Siren Marine, LLC, TE Connectivity Ltd., Teledyne Technologies Incorporated, Thales Group, Trensor, LLC, and Wärtsilä Corporation.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/marine-sensors?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Marine Sensors Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Sensor Type, market is studied across Acoustic Sensors, Force & Torque Sensors, Level & Flow Sensors, Motion Sensors, Optical Sensors, Position & Displacement Sensors, Pressure Sensors, Proximity Sensors, Radar Sensors, Smoke Detection Sensors, Speed Sensors, and Temperature Sensors. The Temperature Sensors commanded largest market share of 12.24% in 2022, followed by Speed Sensors.

Based on Connectivity, market is studied across Wired Sensors and Wireless Sensors. The Wired Sensors commanded largest market share of 60.76% in 2022, followed by Wireless Sensors.

Based on Application, market is studied across Ballast & Bilge System, Firefighting System, Fuel & Propulsion System, HVAC System, Navigation & Positioning System, and Refrigeration System. The Ballast & Bilge System commanded largest market share of 27.89% in 2022, followed by Navigation & Positioning System.

Based on Deployment, market is studied across Subsea and Surface. The Subsea commanded largest market share of 57.25% in 2022, followed by Surface.

Based on Sales Channel, market is studied across Aftermarket and Original Equipment Manufacturer. The Aftermarket commanded largest market share of 56.12% in 2022, followed by Original Equipment Manufacturer.

Based on End-Use, market is studied across Commercial, Defense, and Unmanned Underwater Vehicle. The Commercial is further studied across Bulk Carriers, Container Vessels, Cruise Ships, Dry Cargo Vessels, Passenger Ferries & Yachts, and Tankers. The Defense is further studied across Aircraft Carriers, Amphibious Ships, Offshore Support Vessels, and Submarines. The Unmanned Underwater Vehicle is further studied across Autonomous Unmanned Vehicle and Remotely Operated Vehicle. The Commercial commanded largest market share of 74.59% in 2022, followed by Defense.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 39.10% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Marine Sensors Market, by Sensor Type

7. Marine Sensors Market, by Connectivity

8. Marine Sensors Market, by Application

9. Marine Sensors Market, by Deployment

10. Marine Sensors Market, by Sales Channel

11. Marine Sensors Market, by End-Use

12. Americas Marine Sensors Market

13. Asia-Pacific Marine Sensors Market

14. Europe, Middle East & Africa Marine Sensors Market

15. Competitive Landscape

16. Competitive Portfolio

17. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Marine Sensors Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Marine Sensors Market?

3. What is the competitive strategic window for opportunities in the Marine Sensors Market?

4. What are the technology trends and regulatory frameworks in the Marine Sensors Market?

5. What is the market share of the leading vendors in the Marine Sensors Market?

6. What modes and strategic moves are considered suitable for entering the Marine Sensors Market?

Read More @ https://www.360iresearch.com/library/intelligence/marine-sensors?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ 1 530-264-8485

[email protected]