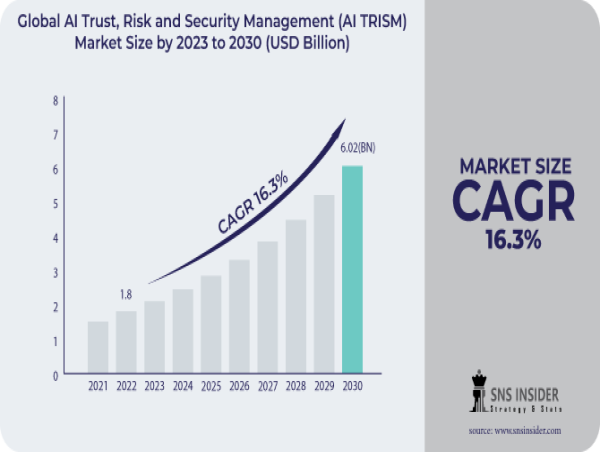

The SNS Insider report indicates that the AI Trust, Risk and Security Management (AI TRISM) Market size was valued at USD 1.8 billion in 2022 and is expected to grow to USD 6.02 billion by 2030, with a remarkable CAGR of 16.3 % over the forecast period of 2023-2030.

Prominent Players:

• Rapid7

• Moody's Analytics Inc.

• SAP SE

• AT&T Intellectual Property

• SAS Institute Inc.

• Oracle Corporation.

• ServiceNow

• International Business Machines Corporation

• LogicManager Inc.

• RSA Security LLC

Get Full PDF Sample Copy of Report (Including TOC, List of Tables & Figures, Chart):@ https://www.snsinsider.com/sample-request/4175

Market Report Scope:

The market report delves into the expansive landscape of the AI Trust, Risk and Security Management (AI TRISM) Market, examining its current state and future projections. AI trust, risk, and security management are analyzed comprehensively, covering the creation, introduction, and continuous utilization of AI applications. As artificial intelligence continues its swift growth, businesses seek to leverage its capabilities while mitigating risks such as data leakage and malicious attacks. The report explores the dynamic interplay of government initiatives, industry demands for trustworthy AI, and the drive for transparent AI decision-making. With a forecast period spanning 2023-2030, the scope encompasses the evolving landscape of AI technology, its adoption across diverse industries, and the ethical and technical challenges it presents. Through a meticulous examination of market drivers, challenges, and opportunities, the report provides a holistic understanding of the AI Trust, Risk, and Security Management (AI TRISM) Market, paving the way for informed decision-making in this dynamic industry.

Market Analysis:

The market analysis reveals a burgeoning demand for trustworthy AI systems and transparent decision-making, propelling the AI Trust, Risk and Security Management (AI TRISM) Market towards exponential growth. Governments globally recognize the potential of AI, fostering its integration across sectors and driving market expansion. The BFSI sector leads in AI adoption, leveraging technology to minimize fraud and enhance customer service. Additionally, advancements in ML, NLP, and DL algorithms, coupled with stringent regulations, contribute to robust revenue growth. North America dominates due to widespread technology adoption, while Asia-Pacific experiences the fastest growth, driven by increased AI adoption, data sensitivity concerns, and the evolving cybersecurity threat landscape.

Key Market Segmentation

By Component

• Solution

• Services

By Enterprise Size

• Large Enterprise

• Small and Medium-sized Enterprise

By Deployment Mode

• On-premise

• Cloud

By Industry Vertical

• IT and Telecom

• BFSI

• Manufacturing

• Retail and E-commerce

• Healthcare

• Government

• Others

By Component:

The on-premise segment dominates, addressing data privacy, compliance, and protection against insider threats. Cloud, with its integrity and availability, is expected to experience the fastest growth.

By Deployment:

Cloud-based solutions register moderately fast revenue growth due to industry initiatives like CSPM, and the flexibility offered by the OpEx model.

By Industry Vertical:

BFSI leads with cutting-edge technology adoption, utilizing AI for fraud minimization and improved customer service. Retail and e-commerce show steady growth, integrating AI into various business processes.

Key Regional Development:

North America dominates the AI trust, risk, and security management market, owing to the widespread adoption of advanced technologies such as AI, ML, and cloud computing. The region's push for efficient and secure AI solutions has revolutionized the IT industry. In contrast, Asia-Pacific experiences rapid growth driven by escalating AI adoption, concerns regarding data sensitivity and privacy, and the ever-evolving cybersecurity threat landscape. The region's recognition of AI's potential benefits has led to increased investments in trust, risk, and security management solutions, positioning Asia-Pacific as a major hub for technological advancements in the AI industry.

Key Takeaways for AI Trust, Risk and Security Management (AI TRISM) Market:

• AI trust, risk, and security management are crucial in ensuring secure and ethical AI application.

• The BFSI sector leads in AI adoption, focusing on fraud detection and customer service improvement.

• North America and Asia-Pacific dominated the market, driven by technology adoption and evolving cybersecurity threats.

Recent Developments:

• In April 2023, Google introduced the Google Cloud Security AI Workbench, utilizing Large Language Models (LLMs) to enhance cybersecurity.

• In March 2021, the U.S.-India Artificial Intelligence Initiative was launched to foster AI innovation through knowledge exchange and bilateral cooperation.

Buy This Exclusive Report: @ https://www.snsinsider.com/checkout/4175

Challenges in AI TRISM Market:

• Data Privacy and Security Concerns: Managing and safeguarding sensitive data processed by AI systems is a major challenge. Ensuring compliance with data protection regulations and preventing unauthorized access or breaches are critical components of AI TRISM.

• Explainability and Transparency: The inherent complexity of some AI algorithms makes it challenging to understand and explain their decision-making processes. Lack of transparency can lead to trust issues among users and stakeholders, requiring solutions for better explainability.

• Adversarial Attacks and Threats: AI models are vulnerable to adversarial attacks, where malicious actors intentionally manipulate input data to deceive the system. Protecting against these attacks and enhancing the resilience of AI systems is a key challenge in the AI TRISM market.

• Regulatory Compliance Complexity: The dynamic nature of AI regulations globally creates complexity for companies operating in the AI TRISM space. Navigating and adhering to diverse and evolving regulatory frameworks demands continuous efforts and resources.

Opportunities in AI TRISM Market:

• Innovations in Security Solutions: The rising challenges in AI security create opportunities for the development of innovative solutions. Investing in advanced security technologies and practices can position AI TRISM providers as leaders in addressing emerging threats.

• Enhanced Explainability Tools: Developing tools and methods to enhance the explainability of AI models presents an opportunity for market growth. Solutions that make AI decision-making more interpretable and understandable can improve trust and adoption.

• Collaboration for Standards: Opportunities exist for industry collaboration to establish standards and best practices in AI TRISM. Working together to define common guidelines can simplify compliance efforts and foster a more secure AI ecosystem.

• Ethical AI Frameworks: Building and promoting ethical AI frameworks can differentiate AI TRISM providers. Proactively addressing ethical considerations, bias, and fairness in AI systems can attract businesses and consumers seeking responsible AI solutions.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Ukraine- Russia war

4.2 Impact of ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

…..

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Company Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company 's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

![]()