Stocks and investing are one of the fast-rising markets with many career opportunities. However, today's stock market is not what it used to be. Stock market trading has evolved in many ways.

Choosing the perfect degree has been made easier by experts who have mastered the art of stock trading. The selection depends on the interest of the individual and the jobs available. Additionally, investing in bonds has become very easy to earn huge profits from trading.

The degrees for stock trading & investing rely on many factors and are necessary to understand how bonds and holdings are bought and sold. It also involves selecting a college certification that provides an in-depth understanding of the market. It is important to note that stock market trading is not for the faint of heart. Choosing the right certification for stocks and investment helps to enhance risk management.

Buying and selling shares is not easy, especially in the present economy. However, with the right career choice and school courses, you can become a master in the field. The best degrees for stock market & investing include the following.

1. Finance

This course covers numerous factors that facilitate stock trading and investing. It is a technological study of funds. It gives marketers and traders, including investors, a broad awareness of the effect of money on people and places. A degree in finance massively contributes to bond trading. Additionally, it facilitates the understanding of investments. A finance degree helps stock traders to make proper conclusions in trades. For accurate calculations, computational finance is recommended.

2. International Business

This course concentrates on practical applications and trades. The financial analysis of this area of study is achieved after mathematics is taught. However, it also focuses on international securities and portfolio management. It is great coursework to acquire an understanding of bonds and shares.

3. Economics

This is another important course that stock traders or investors are encouraged to study. It helps them to make financially safe commitments in bond and share trading. It is surely one of the appropriate areas of study for investments. Furthermore, it helps to understand how interest rates work and how to take advantage of them. Additionally, it enables them to make economic predictions based on past trends.

4. Statistics

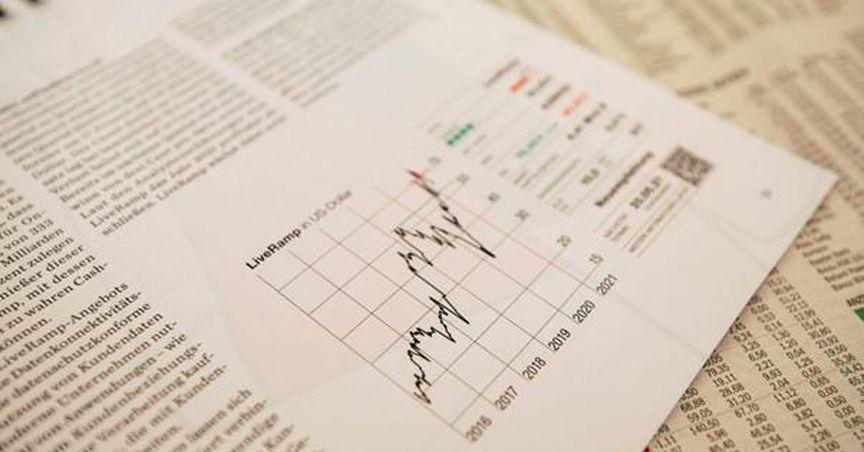

Source: Unsplash

This area of specialization encompasses analyzing data sets and turning the information into helpful rates or other mathematical calculations. In this certification, you get to understand the basics of using statistical computations for finance. However, a certification in this course provides a more in-depth understanding of complex calculations and derivatives.

For example, if a stock trader wants to research a company to see if it will be a good option to invest in, he may use ratios to measure profitability, liquidity, and more. These ratios can be harder to comprehend without an in-depth comprehension of this study area.

5. Business Administration and Management

These two go hand in hand. Students are encouraged to choose these areas of specialization because it provides many opportunities to choose their careers. Since these fields of specialization teach organization, research, and planning skills, you gain a better awareness of how to apply those skills. Bonds and shares traders must be able to plan, manage and retain numerous accounts. It educates on the knowledge to govern a vast number of aspects. It is also considered one of the finest certifications for bond trading and investments.

Bond and holdings trading is a technical industry, this area of specialization aids in comprehending the complexities of planning, and running cooperation, alongside event planning exit strategies. Students acquire the understanding of identifying threats, weaknesses, opportunities, and more.

You will also grasp trade strategies, investments, economics, and other financial topics. It also helps pick a cognate or specialty related to stockbroking, like international business or accounting.

6. Communications and Strategic Communications

Communication is vital in the stock market trading and investing. When it comes to strategic communications, you learn the same core precepts of communication via several aspects in this path. However, Cristine Jefferson, who is a senior trading specialist and also works as a writer for PapersOwl, claims: "The priority is more on effective communication than on communication strategies." She goes on by saying: "Communication, which is the best degree for stock trading and investments, assists in communication with customers. That is why it has more practical value.”

Experts have proved strategic communication principles in bonds trading as one of the top certifications. It can help understand how to communicate politely with individuals, potential clients, and the public. They acquire an understanding of this through verbal and electronic communication channels, such as social media. Your ability to communicate effectively with all stakeholders is important for increasing everything from consumer appointments to general confidence.

7. Accounting

This is one of the preeminent certifications for investments. It studies the proper record of financial business. Any student who would like to own companies or businesses that are concerned with purchasing and selling bonds is recommended for this course. It teaches you the right approach to apply when taking a record.

8. Physics, Engineering and Applied Mathematics

Although these areas of study differ from one another, they share the same implications when it comes to trading and investments. With a certification in any of the fields mentioned above of study, the bonds market is most likely to come running to you and not the other way around. However, your ability to excel in the fields mentioned above of study depends not only on your ability to understand high quantitative concepts but also on applying them creatively.

Conclusion

According to business experts, communication is the foremost degree to acquire. However, this list is not complete without computer science. The world is evolving into a digitalized era, and almost everything can be done on the computer. This makes it one of the top college degrees for stock trading.

Choice in college certification increases the student's experience on how to make proper decisions that will help them in the future. As an investor, your start determines your end. If you make mistakes in the selection of certifications for bonds trading and investments, you will find it difficult to cope with the organization of your portfolio.

About the Author

Catherine Jefferson is a senior trading specialist and investment expert who also writes for PapersOwl. Her rich experience in the financial sector has turned into a series of professional research papers that were positively acclaimed by her peers. Catherine has been a financial advisor to many government and business entities. She is an author of an extensive list of academic publications.