Summary

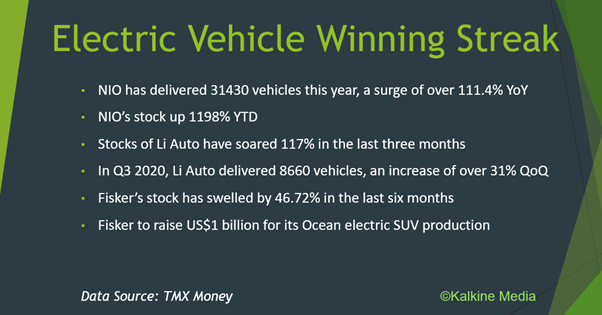

- NIO’s stock has soared by over 1887 per cent since the pandemic-caused market crash in March.

- NIO has delivered 31430 vehicles this year, a surge of over 111.4 per cent year-over-year.

- Stocks of Li Auto have soared by over 117 per cent in the last three months.

- In the third quarter of 2020, Li Auto delivered 8660 vehicles, an increase of over 31 per cent quarter-over-quarter.

- Fisker’s stock has swelled by 46.72 per cent in the last six months.

- Fisker is expecting US$1 billion in funding for its Ocean electric SUV production.

Electric vehicle (EV) stocks have been on the growth spree this year while most automobile giants were stuck in pandemic morass. The market value of Electric Vehicles (EVs) is gradually surging across North America. The fossil fuel-reliant Canadian economy too has taken headways towards its net zero-emission target by 2050, pressing for adaptation of clean-energy and EVs.

In this article we take a closer look at three trending electric vehicle stocks that has been gaining traction: NIO Inc. (NYSE: NIO or NIO: US), Li Auto Inc (NASDAQ: LI or LI: US), and Fisker Inc (NYSE: FSR or FSR: US).

NIO Inc. (NYSE: NIO or NIO: US)

The Chinese electric vehicle manufacturer, NIO maintained its lead by doing what it has done so well throughout 2020 – gathering stock gains. The EV stock has accrued an overwhelming 1198 per cent growth year-to-date at the time of filing this story. In the last six months, stocks of NIO have skyrocketed by 1333 per cent.

It rebounded by over 1887 per cent since the COVID-19 pandemic-caused market crash on March 19.

The stock delivers a positive return on equity (ROE) of 247.28 per cent. NIO’s 10-day average trading volume is 252.13 million units. Its market capitalization stands at US$65.79 billion.

NIO set a record high monthly EV deliveries in October. The EV maker delivered 5055 vehicles in October 2020, a 100 per cent increase year-over-year. NIO distributed 31430 vehicles this year, a surge of over 111.4 per cent year-over-year.

NIO registered vehicle sales of US$493.4 million in the second quarter of 2020, an increase of 146.5 per cent from the second quarter of 2019, and a 177.6 per cent surge from the first quarter of 2020.

The automaker will announce its third quarter 2020 financial results on November 17.

Nio is also pursuing European expansion and believes to enter the market by the second half of 2021. JP Morgan expects that NIO will try to match the success of Huawei and Xiaomi. The two telecom giants hold nearly a quarter of the European market share.

Li Auto Inc (NASDAQ: LI or LI: US)

Another Chinese EV player, Li Auto started its trading journey on the NASDAQ in July this year. The stock has soared by 105 per cent in less than four months. The Chinese auto stock has increased by over 117 per cent in the last three months.

Its market capitalization stands at US$26.57 billion. The EV stock’s debt-to-equity (D/E) ratio is 0.27, and its price-to-book (P/B) ratio is 29.42. Li’s 10-day average trading volume is 26.74 million units.

The e-mobility manufacturer delivered 3,692 Li ONEs in October 2020. In the third quarter of 2020, Li Auto distributed 8660 vehicles, an increase of over 31 per cent quarter-over-quarter.

Li Auto had 41 retail stores in 36 cities as of October 31, 2020. Looking forward, the e-auto company is planning to continue bolstering its direct sales and servicing network to expand its footprint in the Chinese market.

Fisker Inc (NYSE: FSR or FSR: US)

US-based Fisker Inc provides e-mobility services and manufactures the eco-friendly electric vehicle. The e-mobility stock has surged by a notable 48 per cent year-to-date at the time of filing this story. In the last six months, the stock has swelled by 46.72 per cent. Stocks of Fisker Inc. have increased by 51.61 per cent since the COVID-19 pandemic-caused market crash on March 19.

Its market capitalization stands at US$4.16 billion. Fisker’s 10-day average trading volume is 17.28 million units.

Fisker is expecting US$1 billion in funding for its Ocean electric SUV production from Spartan Energy Acquisition Corp. (NYSE:SPAQ). Fisker’s Ocean program which is planned to start manufacturing in Q4 2022.