Highlights

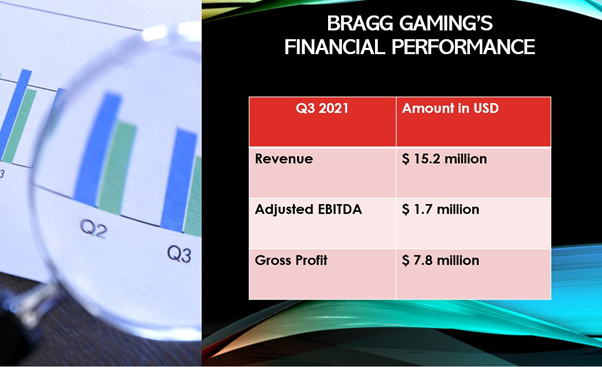

- In this third quarter of 2021, Bragg Gaming recorded a revenue of US$ 15.2 million, reflecting an increase of 9.9 per cent year-over-year (YoY).

- The BRAG stock declined about 23 per cent year-to-date (YTD) and has surged 10.3 per cent in the last three months.

- Bragg Gaming could see growth in future as the company has raised its outlook for 2021.

Bragg Gaming Group Inc. (TSX:BRAG) reported increased revenues as it announced the financial results for the third quarter of this year. The business-to-business content and gaming technology company also provided an update on its growth initiatives full-year outlook.

In this third quarter of 2021, Bragg Gaming recorded a revenue of US$ 15.2 million, reflecting an increase of 9.9 per cent year-over-year (YoY). Notably, the BRAG stock seems to be gaining momentum after witnessing a downward trajectory since the beginning of this year.

The BRAG stock declined about 23 per cent year-to-date (YTD) and has surged 10.3 per cent in the last three months. The gaming technology company has achieved improved quarterly results as it came up with new proprietary online content, expanded business operations and added new customers.

Should you consider exploring the Bragg Gaming Group Inc. (TSX:BRAG) stock?

The Toronto-based company has shown strategic development in the recent past. On August 27, Bragg Gaming went public in the US and its shares started trading on the Nasdaq Global Select Market.

© 2021 Kalkine Media Inc.

The gaming and content company is also expanding its market presence and continues to diversify European market penetration. Bragg Gaming has a presence in Spain, Greece, and Denmark. In addition, the company entered the newly regulated market in the Netherlands in October 2021.

The main portfolio asset of the company is ORYX Gaming as it delivers exclusive and proprietary casino content via a hub distribution platform and in-house remote game servers.

Bottom line

Bragg Gaming could see growth in future as the company has raised its outlook for 2021.

The company now expects to record increased revenue of US$ 65 to US$ 66 million for full-year 2021 and an adjusted EBITDA between US$ 7.8-8 million, in comparison to the earlier expected full-year revenue of US$ 57.8 million and adjusted EBITDA of US$ 6.4 million.

Also Read: Thunderbird, Shaw, & Bragg: 3 Rising TSXV Communication Stocks

The Company also raised its full-year 2022 revenue guidance to US$ 70 to US$ 72 million from US$ 63.7 million. Notably in Q3 2021, the number of unique players using the ORYX hub distribution platform increased by 14.4 per cent YoY to 2.1 million.