Highlights

- Seasoned and amateur investors, from time to time, express their interest in international stocks.

- At the moment, stocks from mainland China are said to be drawing some attention from international investors, even as Chinese investors are reportedly being cautious about the local market volatility .

- In the latest quarter, Alibaba posted a net income of US$ 524 million, which was up by a significant 87 per cent YoY.

Seasoned and amateur investors, from time to time, express their interest in international stocks. At the moment, stocks from mainland China are said to be drawing some attention from international investors, even as Chinese investors are reportedly being cautious about the local market volatility.

Which Chinese stocks can global investors explore at the moment? Let’s find out.

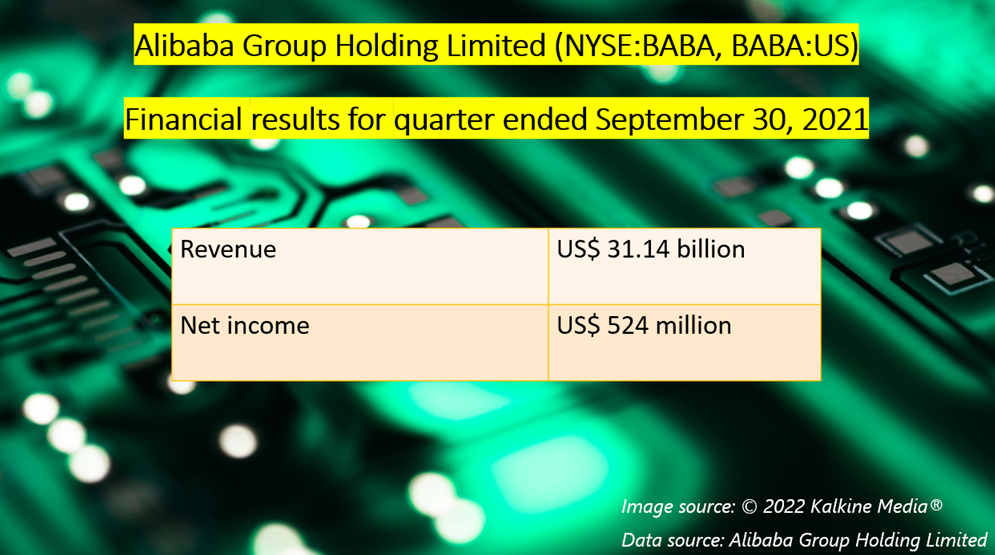

Alibaba Group Holding Limited (NYSE: BABA, BABA: US)

Alibaba Group, a well-known e-commerce company in China, saw its top line climb by about 29 per cent year-over-year (YoY) to US$ 31.14 billion in the quarter ended September 30, 2021.

In the latest quarter, Alibaba also posted a net income of US$ 524 million, which was up by a significant 87 per cent YoY.

Alibaba Group’s American Depositary Shares (ADS) closed at a price of US$ 125.56 per share on Wednesday, February 16, with 18 million shares exchanging hands. The ADS has spiked by almost six per cent year-to-date (YTD).

Also read: Shopify (SHOP) stock is plummeting despite 41% Q4 revenue growth. Why?

Pinduoduo Inc (NASDAQ: PDD, PDD: US)

Pinduoduo Inc is a China-based mobile platform with a market capitalization of over US$ 75 billion. The e-commerce firm saw its revenue amount to US$ 3.33 billion in the third quarter of fiscal 2021, which was a 51 per cent YoY increase from the previous-year quarter.

Its net income, on the other hand, amounted to US$ 254.5 million in the latest quarter.

Pinduoduo ADS jumped by over 26 per cent from its 52-week low of US$ 47.67 (January 6) and closed at US$ 60.2 apiece on Wednesday, with a trading volume of 5.98 million.

Are Alibaba (BABA) & Pinduoduo (PDD) 2 Chinese stocks to bag in 2022 ?

Bottomline

The growing tensions between Ukraine and Russia have triggered uncertainty on stock markets across the worldwide. However, some international stocks can offer notable growth in returns in the long run, keeping in mind the growth prospects in their respective sectors and industries.

Also read: Is Virgin Galactic (SPCE) a cheap space stock to buy?

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.