Highlights:

- Air Canada posted an operating income of C$ 644 million in Q3 2022.

- Cargojet Inc has a dividend yield of CJT 0.928 per cent.

- Cargojet paid a quarterly dividend of C$ 0.286 per share.

Airline stocks heavily depend on the travel situation at any given time. During the pandemic, these stocks saw a steep downturn and picked up whenever travel restrictions were lifted. However, over the past year, when the equity market was hit by volatility owing to a slew of economic headwinds, every sector felt the brunt of the slowdown.

So, how will the TSX airline stocks behave next year? Although there’s no answer to this question given the volatility factor, let’s discuss two TSX airline stocks and analyze their performances in the last quarter:

Air Canada (TSX:AC)

Air Canada is the largest airline in the country, transporting close to 50 million passengers each year along with its regional partners. In the third quarter of 2022, Air Canada’s operating capacity doubled from the third quarter of 2021. The airline posted passenger revenues of C$ 4.818 billion in Q3 2022, about three times higher than the same quarter of 2021.

The operating expenses in the reported quarter of 2022 were C$ 4.678 billion, an increase of C$ 2.211 billion from the year-ago quarter.

Air Canada reported an operating income of C$ 644 million compared to an operating loss of C$ 364 million in Q3 of 2021.

The Canadian airline’s net cash flow from operations in the third quarter of 2021 was C$ 290 million compared to C$305 million in the corresponding quarter of 2021.

The AC stock climbed a little over four per cent in the past week.

Cargojet Inc. (TSX:CJT)

Cargojet Inc runs its fleet of air cargo of co-load network across 16 major cities in Canada. The company has a dividend yield of 0.928 per cent. It paid a quarterly dividend of C$ 0.286.

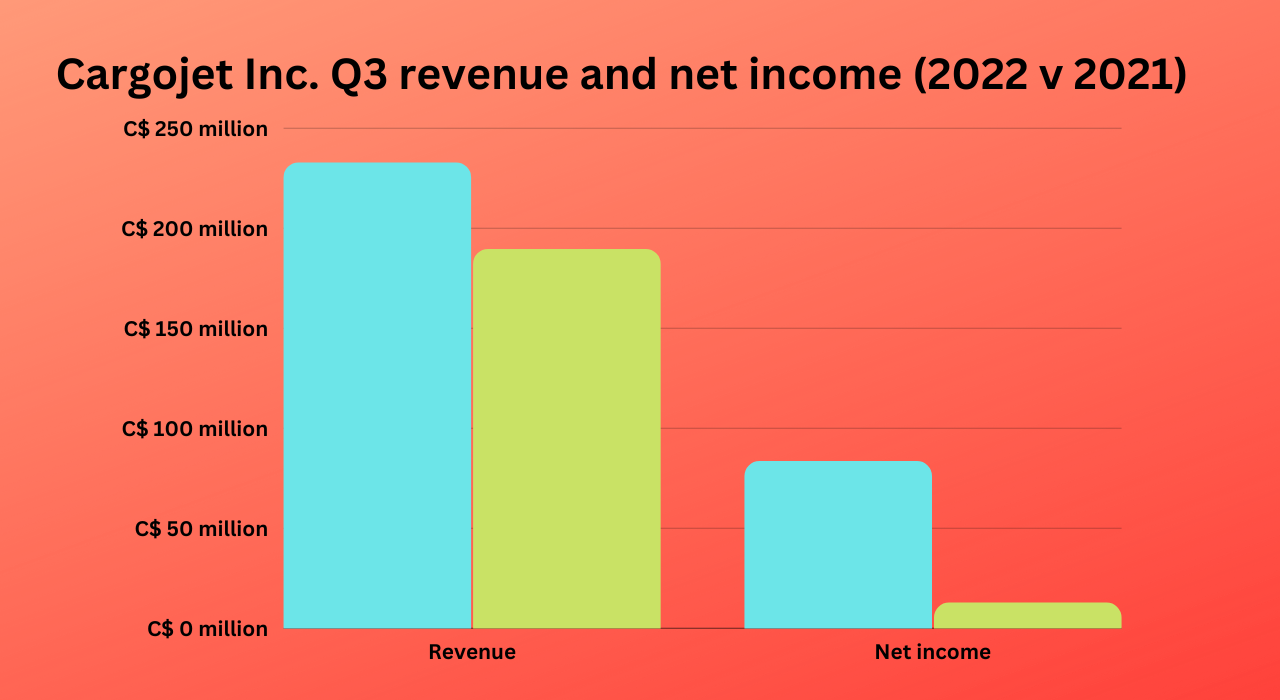

The total revenues of Cargojet in the third quarter of 2022 were C$ 232.7 million compared to C$ 189.5 million in the same period a year ago.

Cargojet’s gross margin in Q3 2022 was C$ 57.6 million versus C$ 54 million in the year-ago quarter. Its adjusted EBITDA for the reported quarter of 2022 was C$ 82.1 million, relative to C$ 70.9 million in the same quarter a year ago.

Meanwhile, the net income was C$ 83.4 million compared to C$ 12.9 million in 2021.

For the three months that ended September 30, 2022, the adjusted free cash flow was posted at C$ 47.9 million compared to C$ 51.1 million for the same period a year earlier.

The CJT stock gained over six per cent in the last five days.

Source: ©Kalkine Media®; © Canva via Canva.com

Bottom line

Investing during a bearish phase is challenging for investors. Do a thorough analysis of the companies before putting your bets. You might take the long-term route. Diversification is another way to protect your portfolio.