Highlights:

- TELUS Corporation's adjusted EBITDA in Q3 2022 was C$ 1,724 million.

- BCE Inc. posted operating revenue of C$ 6,024 million in Q3 2022.

- TELUS Corporation has a dividend yield of 5.373 per cent.

Telecom stocks are considered stable, being an essential sector. When some smaller companies come into the fray, they deliver sub-standard services, much to the annoyance of consumers and investors. However, they are soon taken over by large companies, and services get up to the mark for customers. This can lead to growth for these companies with improved services and products. However, in 2022, every sector suffered due to volatility in the stock market. So, how did the telecom stocks perform in the broader market?

Here, we look at two TSX telecom stocks and their performances in recent quarters:

TELUS Corporation (TSX:T)

Telus Corporation is among the three biggest wireless service provider companies in Canada. The company with nine million mobile subscribers, Telus, has a dividend yield of 5.373 per cent. It paid a quarterly dividend of C$ 0.351 per share.

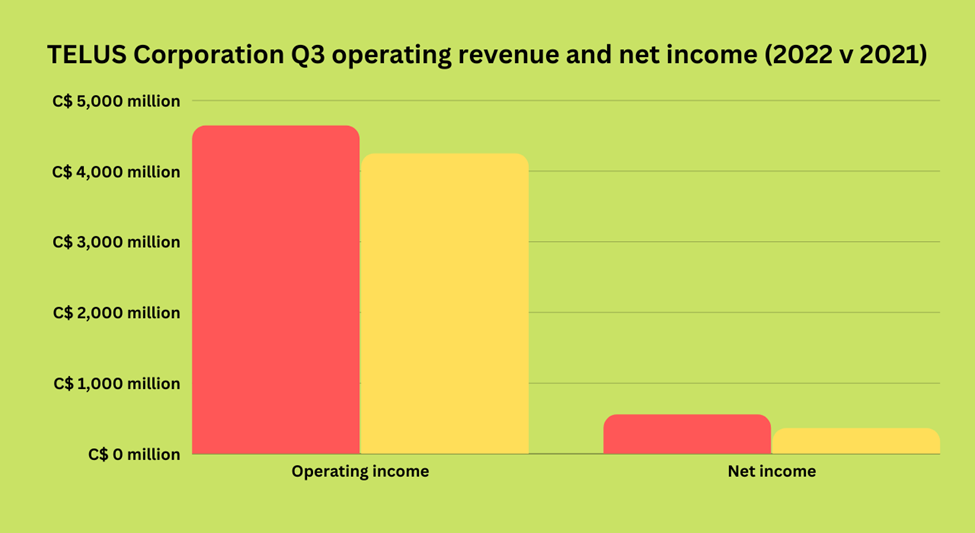

In its Q3 2022 financial results, Telus registered total mobile and fixed customer growth of 347,000, which was up 27,000 from last year. The company posted operating revenue of C$ 4,640 million in the third quarter of fiscal 2022 compared to C$ 4,246 million in the year-ago quarter.

Its net income also surged to C$ 551 million against a net income of C$ 358 million in the same comparative period a year earlier. The adjusted basic EPS in the current reported quarter was C$ 0.34 versus C$ 0.29 in Q3 2021. The adjusted EBITDA in Q3 2022 was C$ 1,724 million, whereas it was C$ 1,559 million in the same quarter in 2021.

Source: ©Kalkine Media®; © Canva via Canva.com

BCE Inc. (TSX:BCE)

BCE Inc. captures almost 30 per cent of the wireless and internet service market in Canada and is one of the three biggest companies in the country. The company with close 10 million customers, BCE, paid a quarterly dividend of C$ 0.92 apiece. It has a three-year dividend growth of 4.38.

BCE Inc.'s operating revenues in Q3 2022 saw a jump of 3.2 per cent compared to the year-ago quarter. It posted operating revenue of C$ 6,024 million in the third quarter of this fiscal compared to C$ 5,836 million in the third quarter of 2021. Its net earnings in the reported quarter were C$ 771 million versus C$ 813 million (down 5.2 per cent) in the corresponding quarter a year ago. The adjusted net earnings of BCE in Q3 2022 were C$ 801 million against net earnings of C$ 748 million in Q3 2021.

Bottom line

This year's equity market has been volatile, and there were massive selloffs. Investors are wary of putting their bets on stocks in a bearish market. So, as an investor, do your analysis well before making a decision. Go for a long-term strategy and diversify your portfolio to mitigate any risk associated with investing in a volatile market. This will ensure that your investments remain safe until the market corrects itself and return to normal.

_12_29_2022_12_53_03_828953.jpg)