So, for the third day in a row, the TSX Composite Index gained Tuesday, May 17, after it closed 1.41 per cent up. After sinking to a correction, Canada’s benchmark index has recovered four per cent and at market close stood at 20,491.01, up 284.60 points.

All sectors saw gains and base metals rose about five per cent after China reportedly eased restrictions and the healthcare sector gained over three per cent driven by the stocks of top marijuana players.

Meanwhile, the badly hit tech sector was up 2.15 per cent. One stock in particular, Dye & Durham Ltd’s DND has risen a whopping 67.3 in four trading sessions.

One-year price chart (May 17). Analysis by © 2022 Kalkine Media®

Volume actives

Manulife Financial Corporation saw 25 million shares traded, making it the most active stock. It was followed by Enbridge Inc that saw over 20 million shares switch hands, and Suncor Energy Inc saw eight million shares traded.

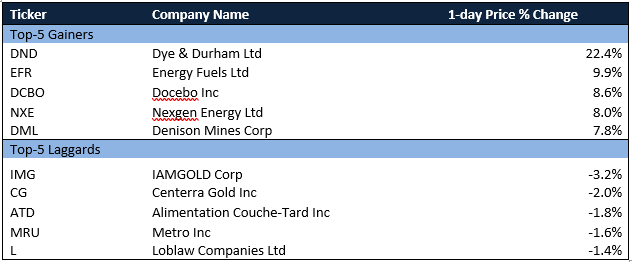

Movers and laggards

Wall Street updates

Similarly, on Wall Street, the tech-heavy Nasdaq composite spiked 2.76 per cent, 321.73 points, to 11,984.52. The S&P 500 grew 2.02 per cent, 80.84 points, to 4,088.85 and the Dow increased 1.34 per cent, 431.17 points, to 32,654.59

Commodities gain

Gold was up 0.27 per cent to US$ 1,818.90. The price of Brent oil lost 2.02 per cent and was at US$ 111.93/bbl and that of crude oil was down 1.58 per cent to US$ 112.40/bbl.

Currency news

The loonie gained 0.26 per cent compared to the US dollar while USD/CAD ended at 1.2809. The US Dollar Index was at 103.31 against the basket of major currencies, down 0.84 per cent.

Money market

The US 10-year bond yield was up 3.79 per cent to 2.995 and the Canada 10-year bond yield was up 3.45 per cent to 3.026.

.jpg)