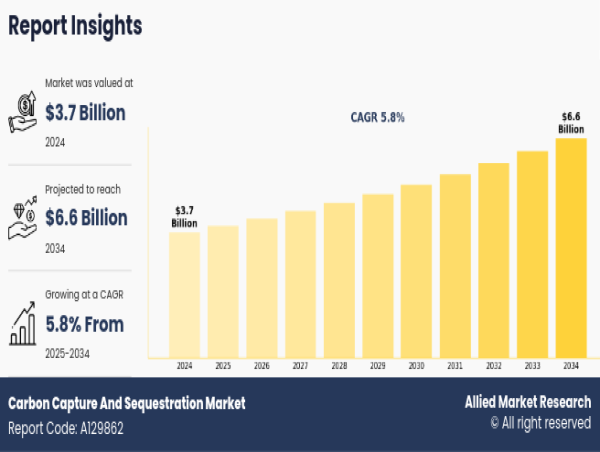

The carbon capture and sequestration market is gaining strong momentum as the world intensifies efforts to mitigate climate change. According to a new report, the market was valued at $3.7 billion in 2024 and is projected to grow to $6.6 billion by 2034, registering a CAGR of 5.8% from 2025 to 2034. This growth is fueled by global clean energy investments, stringent emissions targets, and innovations in carbon removal technologies.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A129862

🌱 What is Carbon Capture and Sequestration?

Carbon capture and sequestration (CCS) is a three-step process that involves capturing carbon dioxide (CO₂) from industrial and power generation sources, transporting it to a storage location, and securely injecting it into underground geological formations. CCS plays a vital role in reducing emissions from hard-to-abate sectors such as cement, steel, and energy production. By preventing CO₂ from reaching the atmosphere, CCS supports global net-zero targets and complements renewable energy solutions.

⚙️ Market Dynamics: Drivers, Challenges & Opportunities

🚀 Market Drivers

One of the major drivers of the carbon capture and sequestration market is the rising investment in clean energy infrastructure. Governments and private sectors worldwide are investing heavily to accelerate CCS adoption. For instance, the U.S. Department of Energy has allocated $1.3 billion to expand CO₂ transport and storage infrastructure.

Corporations like Microsoft are also entering long-term carbon removal agreements, signaling strong private-sector commitment. These initiatives enhance the economic feasibility and scalability of CCS, making it a central pillar in the transition to a low-carbon economy.

🧱 Market Restraints

Despite its benefits, the carbon capture and sequestration market faces hurdles. A key challenge is the limited availability of suitable geological storage sites. For CO₂ to be stored safely, the site must meet specific criteria including sufficient depth, porosity, and impermeability. Identifying and maintaining such sites involves high technical complexity and costs, hindering large-scale deployment.

🌍 Emerging Opportunities

A surge in global climate action is creating unprecedented opportunities in the carbon capture and sequestration market. Nature-based solutions like afforestation and improved land use are being embraced alongside advanced technologies like Bioenergy with Carbon Capture and Storage (BECCS) and hydrogen production with CCS.

The creation of shared carbon capture hubs and industrial clusters, where multiple emitters share centralized infrastructure, is another emerging model. This approach significantly reduces deployment costs and encourages faster scalability, especially in industrial regions with high emissions.

🧪 Market Segmentation Insights

📌 By Type

Ocean Sequestration

Terrestrial Sequestration

Others

The terrestrial sequestration segment is projected to grow at a CAGR of 6.1% through 2034. This growth is driven by the increased use of nature-based carbon removal strategies like reforestation and sustainable land use, which offer cost-effective and scalable alternatives to traditional CCS.

Procure This Report (337 Pages PDF with Insights, Charts, Tables, and Figures): https://bit.ly/4no0cYQ

📌 By Technology

Pre-Combustion Capture

Post-Combustion Capture

Oxyfuel Combustion Capture

Others

Pre-combustion capture is anticipated to expand at the fastest CAGR of 5.9%. This is due to the increasing adoption of Integrated Gasification Combined Cycle (IGCC) power plants, which allow CO₂ to be captured early in the fuel processing phase, delivering higher efficiency and lower energy penalties.

📌 By End-Use Industry

Oil & Gas

Power Generation

Iron & Steel

Cement

Others

The power generation sector is expected to grow at a CAGR of 6.9% over the forecast period. As one of the largest emitters of CO₂, this sector is under immense pressure to decarbonize. With policy support and investment in retrofitting existing plants, CCS adoption in power generation is poised to surge.

🌏 Regional Outlook

Region-wise, the carbon capture and sequestration market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Among these, Asia-Pacific is forecasted to grow at the fastest CAGR of 6.7%.

This growth is driven by:

Rapid industrialization in countries like China and India

Rising energy demands

Strong government support for emissions reduction

Significant investment in clean energy projects

Asia-Pacific is expected to continue leading CCS adoption through large-scale projects and integration into national climate strategies.

🏢 Key Market Players

Prominent companies operating in the carbon capture and sequestration market include:

Siemens A.G.

Fluor Corporation

ExxonMobil Corporation

TotalEnergies

Chevron Corporation

Air Liquide

Linde Plc

Mitsubishi Heavy Industries, Ltd.

Carbon Engineering Ltd.

China National Petroleum Corporation

These companies are investing in R&D, forming strategic partnerships, and scaling up pilot projects to strengthen their market positions and contribute to global climate goals.

Get a Customized Research Report: https://www.alliedmarketresearch.com/request-for-customization/A129862

🔮 Future Outlook

The carbon capture and sequestration market is on track to become a cornerstone of global climate action. As governments implement aggressive decarbonization plans and companies strive for sustainability, CCS technologies will be essential to bridge the gap between current emissions levels and net-zero ambitions.

From developing carbon capture hubs to integrating CCS with hydrogen production and renewable fuels, the market is ripe with innovation and opportunity. Strategic funding, international collaboration, and technological advancement will play pivotal roles in shaping its trajectory through 2034.

✅ Conclusion

The carbon capture and sequestration market represents a transformative solution in the fight against climate change. With increasing investments, favorable policy frameworks, and technological breakthroughs, the CCS industry is set to grow steadily over the next decade. As decarbonization becomes a non-negotiable priority, CCS will remain an indispensable tool for industries, governments, and the global community striving toward a net-zero future.

Trending Reports in Energy and Power Industry:

Carbon Capture and Sequestration Market

https://www.alliedmarketresearch.com/carbon-capture-and-sequestration-market-A129862

Decarbonization Market

https://www.alliedmarketresearch.com/decarbonization-market-A325581

Bioenergy With CCS Market

https://www.alliedmarketresearch.com/bioenergy-with-ccs-market-A325513

Low Carbon Building Market

https://www.alliedmarketresearch.com/low-carbon-building-market-A325511

Carbon Capture and Storage (CCS) in Power Generation Market

https://www.alliedmarketresearch.com/carbon-capture-and-storage-in-power-generation-market-A212152

Carbon Capture, Utilization, and Storage (CCUS) Market

https://www.alliedmarketresearch.com/carbon-capture-and-utilization-market-A12116

Carbon Credit Trading Platform Market

https://www.alliedmarketresearch.com/carbon-credit-trading-platform-market-A145082

Carbon Credits Market

https://www.alliedmarketresearch.com/carbon-credits-market-A107126

Carbon Capture Technology Market

https://www.alliedmarketresearch.com/carbon-capture-technology-market-A191506

Carbon Capture Market

https://www.alliedmarketresearch.com/carbon-capture-market-A175658

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Market Research

+ 1800-792-5285

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()