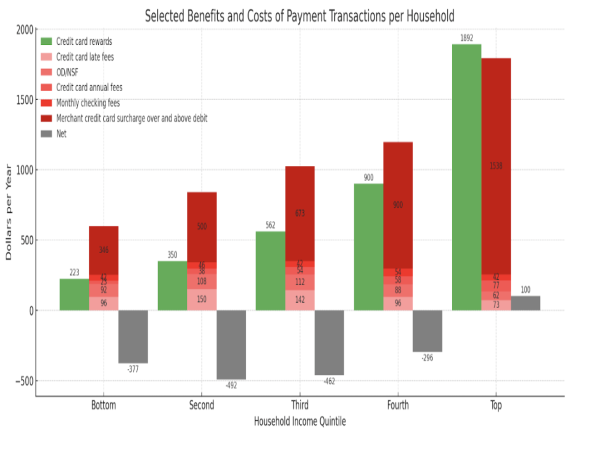

Top earners net about $100 annually in credit card rewards after fees, while the bottom 80% pay $300 to $500 more in fees than they receive in rewards.

“The current banking and credit card system redistributes wealth upward, with the middle- and working-class subsidizing credit card rewards for the wealthy,” said economist Alexei Alexandrov, author of the report.

This net loss is especially burdensome for middle-income families, who also face the highest rates of direct bank fees such as overdraft and maintenance charges, the report finds.

Read the full report here.

In addition to direct banking fees, the report incorporates credit card processing fees—costs that retailers build into the prices of nearly all goods and services no matter how a consumer pays. According to the report, households paid an average of about $1,000 in these fees in 2024. Higher-income households are more likely to use credit cards, earning rewards that offset these costs. In contrast, lower- and middle-income households are more likely to use debit or cash, forgoing rewards while still paying these transaction fees.

“The bulk of payment-related fees are hidden in the cost of everyday items through credit card fees built into retail prices,” Alexandrov said. “Consumers who pay with cash or debit are subsidizing wealthier households that collect credit card rewards on those same purchases.”

These fees take a meaningful toll on household budgets, particularly for lower-income families. The report found that more than one-third of households have less than $1,000 in emergency savings, with 14% reporting less than $100.

“For lower-income families, banking and transaction fees can be the difference between financial stability and hardship,” Alexandrov said. “If even a portion of these fees could be saved instead, it could push a household into the high-saver category within a few years—helping them escape the cycle of living paycheck to paycheck.”

Alexandrov said the study underscores the urgent need for reforms to reduce the burden of banking and transaction fees on middle- and low-income families.

Key Policy Solutions to Address Fee Inequity:

- Encourage competition from fintech firms and alternative banking models that offer lower-cost checking and savings accounts by reducing reliance on brick-and-mortar branches.

- Promote lower-interest installment lending (e.g., buy-now-pay-later) as an alternative to high-interest revolving credit card debt.

- Increase competition among credit card networks and encourage merchant discounts for debit or cash payments. Promote adoption of pay-by-bank systems to allow direct payments from consumer bank accounts.

- Integrate consumer financial education into high school curricula to address misinformation about fees, credit, and savings.

“These reforms are designed to foster competition, transparency, and fairness,” Alexandrov said. “Practical steps can make the financial system less regressive, helping households build savings and stability instead of eroding them.”

About the Report’s Methodology

The findings are based on a nationally representative phone survey of 1,000 households conducted in February 2025, combined with data from the U.S. Census Bureau, Federal Reserve, CFPB, and other leading sources. The report updates previous research with the latest data and provides a comprehensive analysis of how banking fees and payment systems affect American households.

About the Author

Alexei Alexandrov conducts research and advises nonprofits and government agencies on financial and consumer policy. He has served as chief economist of the U.S. Federal Housing Finance Agency, led economics and machine learning research at Amazon and Wayfair, and worked as a senior economist and AI fellow at the Consumer Financial Protection Bureau. Alexandrov holds a Ph.D. from Northwestern University, has taught at the University of Rochester, and has published academic work on antitrust and consumer finance.

Carlton Carroll

Lamont Street

+1 850-445-0988

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()