Drilling intersection includes 3.4 g/t gold over 50 metres, including 78.1 g/t gold over 1 metre

Toronto, Ontario--(Newsfile Corp. - June 18, 2025) - Lavras Gold Corp. (TSXV: LGC) (OTCQX: LGCFF) ("Lavras Gold" or the "Company") is pleased to release the results from seven new drill holes totaling 1,825 metres, testing the Butiá Gold Deposit ("Butiá" or "Butiá Gold Deposit"), located at the western edge of the LDS Project in southern Brazil. Gold mineralization was intersected in all seven holes reported in this news release at Butiá, which hosts a Mineral Resource Estimate of 377,000 ounces of gold in the Measured and Indicated categories and 115,000 ounces of gold in the Inferred category. Several of these new holes returned long intervals of continuous gold mineralization characterized by higher-grade subintervals with striking similarities to previously disclosed results. These holes were designed to increase the confidence in the Butiá gold resource (converting the Inferred Resource into the Measured & Indicated categories) and to potentially increase the gold endowment and footprint of known mineralization of the Butiá Gold Deposit.

Lavras Gold recently renewed a 25,000-metre drilling contract, seamlessly continuing the ongoing drilling program. The Butiá metallurgical test program continues to advance using the SGS Laboratory in Belo Horizonte, Brazil. Also, three 150-kilogram composite samples from the Fazenda do Posto gold target have been sent to the lab for investigation following up on a comprehensive metallurgical test program for Butiá mineralization.

These new drill results and initiatives continue to move Lavras Gold toward its short-term corporate goal of defining an economically feasible gold resource on the LDS Project, focused on the Butiá Gold Deposit and the adjacent Fazenda do Posto gold target.

HIGHLIGHTS

Drilling

Hole 25BT047 returned:

- 371.0 metres grading 1.0 g/t gold from surface, and including:

- 23.0 metres grading 1.3 g/t gold from 92.0 metres,

- 19.0 metres grading 2.0 g/t gold from 222.0 metres, and including

- 1.0 metres grading 25.8 g/t gold from 222.0 metres.

- 50.0 metres grading 3.4 g/t gold from 317.0 metres and including:

- 1.0 metres grading 15.5 g/t gold from 317.0 metres

- 1.0 metres grading 78.1 g/t gold from 318.0 metres

- 1.0 metres grading 7.4 g/t gold from 319.0 metres

- 1.0 metres grading 5.5 g/t gold from 321.0 metres

- 1.0 metres grading 5.7 g/t gold from 325.0 metres

- 1.0 metres grading 3.7 g/t gold from 343.0 metres

- 1.0 metres grading 10.2 g/t gold from 346.0 metres

- 1.0 metres grading 15.8 g/t gold from 347.0 metres.

Hole 25BT045 intersected multiple intervals of gold mineralization. Highlights include:

- 50.0 metres grading 0.5 g/t gold from 167.0 metres and including:

- 15.0 metres grading 1.2 g/t gold from 167.0 metres and including:

- 1.0 metre grading 2.1 g/t gold from 168.0 metres, and

- 2.0 metre grading 1.6 g/t gold from 170.0 metres, and

- 2.0 metres grading 2.2 g/t gold from 174.0 metres, and

- 1.0 metre grading 1.1 g/t gold from 180.0 metres

- 10.0 metres grading 3.7 g/t gold from 245.0 metres including:

- 1.0 metre grading 34.8 g/t gold from 247.0 metres.

"We are pleased with the drilling progress we are making at Butiá and are achieving our goal of increasing the confidence of the gold resource estimate by converting inferred gold resources into measured and indicated gold resources and expanding the footprint of gold mineralization," commented CEO Michael Durose. "Drill hole 25BT047 is noteworthy for its length of 371.0 metres grading 1.0 g/t gold. The lower portion of this hole shows a 50.0 metre interval grading 3.4 g/t gold from 317.0 metres to approximately 367.0 metres. This not only extends the previously known zone of mineralization, but it also demonstrates that this extension has a significantly higher grade than the mineralization above it. Adjusted for the angle of the drillhole, this 50-metre extension of gold mineralization begins at a vertical depth of approximately 275.0 and extends to 318.0 metres. The mineralized footprint has also increased in size to the south of Butiá as defined by drillhole 25BT045, and to the southeast via drillhole 24BT042."

Drillholes 25BT044 and 25BT046 were drilled approximately 500 metres southeast of Butiá along an interpreted northeast-southwest structural zone (see Figure 2). Both holes encountered hydrothermally altered rocks, very similar to those seen at Butiá and Fazenda do Posto. Narrow 1.0 metre low-grade intervals of gold were encountered in each hole. The current interpretation is that these holes were collared too far southeast. Nevertheless, the significance here is the continuation of the alteration footprint to the south of Butiá for at least 500 metres thereby generating the potential for defining new exploration drill targets which the exploration team are following up on.

To date, 198 drill holes totalling nearly 53,000 metres have been completed at Butiá and the adjacent Fazenda do Posto target claim block. This compares with 78 drill holes and 20,000 metres of historical drilling by our predecessor company at the Butiá target prior to our current drilling program that started in early 2023. We will disclose results from our ongoing drilling program for these areas and our recently discovered Olaria area when final assay results are received, and the geological interpretation is completed.

Click here for additional comments from CEO Michael Durose.

[* Footnote: Butiá hosts an Estimated Mineral Resource of 377,000 ounces of gold in the Measured and Indicated categories and 115,000 ounces of gold in the Inferred category as detailed in the NI 43-101 Technical Report Mineral Resource for Butiá Gold Prospect dated and effective January 25, 2022 and updated in November 2024. The report was prepared by VMG Consultoria e Soluções Ltda. for Lavras Gold Corp. and is available on the Company's website and www.sedarplus.com under Lavras Gold's issuer profile.]

Discussion of Drill Results - Butiá Deposit

Butiá is the most advanced gold deposit on the LDS Project consisting of the mineral resource as stated in the footnote above (*), located immediately east of the Fazenda do Posto gold discovery. The purpose of the current drilling program at Butiá is to increase the geological confidence of the existing gold resource by converting a significant portion of inferred geological resources into the measured and indicated categories and to increase the gold endowment of the existing gold resource. Recent drilling results from Butiá were disclosed in the news release dated March 03, 2025. To date, results from 41 Lavras Gold drill holes totaling 11,171 metres of drilling have been disclosed based on the 2023, 2024 and 2025 drilling program. This total includes the seven holes disclosed in this news release (24BT042 to 24BT049). More than 31,000 metres of drilling have been completed at Butiá to date, including historical drilling prior to 2023.

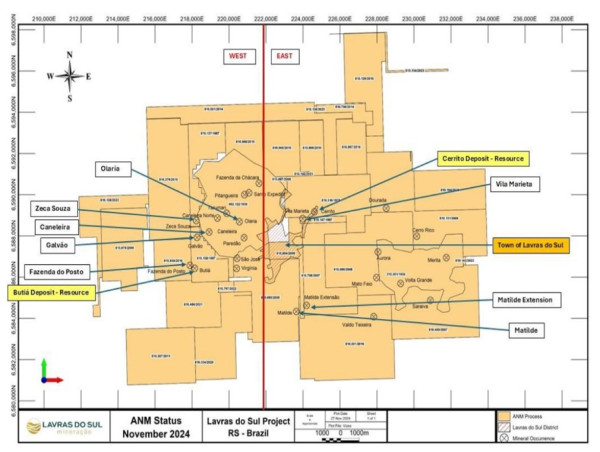

Figure 1 is a general location map for the LDS Project deposits and targets. Figure 2 shows the location of the Casa Velha target area about 500 metres southeast of Butiá. Details of the locations of the new drill holes can be found in the plan view in Figure 3. A long section looking northeast is shown in Figure 4. Figure 5 shows a cross section looking northeast of drill hole 25BT047 highlighting the high-grade depth extension. Figure 6 shows hydrothermal alteration features of the Casa Velha target area. Figure 7 illustrates an example of high-grade gold mineralization found at depth in drill hole 25BT047. Table 1 details newly disclosed assay results in this press release. Table 2 tabulates drill hole information including collar coordinates, drill hole azimuth and drill hole depths. For all previous drilling results, visit the News section of the Lavras Gold website.

A primary purpose of the recent drilling was to continue testing the lateral continuity of gold mineralization at Butiá across a postulated northeast trending structural corridor and fill in gaps interpreted from northwest-southeast cross-sections of previous drilling. All of the holes were drilled with an azimuth oriented 110 degrees and/or 290 degrees. As shown in Figure 3 and summarized in Table 1, these holes include 24BT042, 25BT045, 25BT047, 25BT048 and 25BT049. These holes confirm continuous gold mineralization across a northeast trending structure. Continuous, moderate grade gold was extended in the south and southeast in areas of Butiá typically associated with mineralized perthitic granite. Significantly, higher grade gold mineralization was found at depth below the central portion of Butiá associated with mineralized episyenite materially increasing the mineralized footprint as defined by drill hole 25BT047 (see Figure 5).

Two holes, 25BT044 and 25BT046, were collared about 500 metres southwest of Butiá testing a drilling target called Casa Velha (see Figure 2). Both holes encountered rocks that had intervals of hydrothermally altered rocks including perthitic granite and episyenite with some local clusters of disseminated pyrite. While these drill holes encountered only minor gold mineralization of narrow widths, the drilling proves that the hydrothermal alteration footprint extends to the southwest at least 500 metres from Butiá/Fazenda do Posto (See Figure 5). The geology team is currently interpreting these results with the goal of defining further targets for drill-testing.

Detailed gold assay results by drill hole are summarized in Table 1. The seven new holes disclosed in this press release are from 24BT042 to 24BT049 (and excludes 24BT043 that tested the Fazenda do Posto Target and disclosed in the April 2, 2025 press release).

Highlights of the recent drilling results from the Butiá area are as follows:

Drill hole 24BT042 was collared southeast of 24BT038 in the southeast portion of Butiá and designed to test the southeast continuity of gold mineralization. The hole confirms the lateral extension and continuity of gold mineralization in the southeast portion of Butiá and extends mineralization east of mineralization found in drill hole 24BT038. Highlights include:

- 15.0 metres grading 0.3 g/t gold from 41.0 metres,

- 4.0 metres grading 1.8 g/t gold from 62.0 metres,

- 25.0 metres grading 0.9 g/t gold from 92.0 metres including:

- 3.0 metres grading 4.6 g/t gold from 114.0

Drill hole 25BT045 was collared in the southeast portion of Butiá and drilled on an azimuth 290 degrees. The hole successfully encountered multiple long intervals of gold mineralization successfully extending gold mineralization to the south. Highlights include:

- 31.0 metres grading 0.2 g/t gold from 41.0 metres,

- 23.0 metres grading 0.3 g/t gold from 84.0 metres and including

- 1.0 metres grading 1.4 g/t gold from 104.0 metres

- 50.0 metres grading 0.5 g/t gold including,

- 15.0 metres grading 1.2 g/t gold from 167.0 metres

- 10.0 metres grading 3.7 g/t gold from 245.0 metres including,

- 1.0 metres grading 34.8 g/t gold from 247.0 metres

Drill hole 25BT047 was collared along the east-central portion of Butiá on an azimuth of 290 degrees at an inclined angle of 60 degrees and designed to infill a gap in the Butiá resource, and test for the down-dip extension of gold mineralization. The hole was successful on both fronts returning continuous gold grade from surface to 371 metres.

- 371.0 metres grading 1.0 g/t gold from surface metres, and including:

- 23.0 metres grading 1.3 g/t gold from 92.0 metres,

- 19.0 metres grading 2.0 g/t gold from 222.0 metres, and including

- 1.0 metres grading 25.8 g/t gold from 222.0 metres.

- 50.0 metres grading 3.4 g/t gold from 317.0 metres and including:

- 1.0 metres grading 15.5 g/t gold from 317.0 metres

- 1.0 metres grading 78.1 g/t gold from 318.0 metres

- 1.0 metres grading 7.4 g/t gold from 319.0 metres

- 1.0 metres grading 5.5 g/t gold from 321.0 metres

- 1.0 metres grading 5.7 g/t gold from 325.0 metres

- 1.0 metres grading 3.7 g/t gold from 343.0 metres

- 1.0 metres grading 10.2 g/t gold from 346.0 metres

- 1.0 metres grading 15.8 g/t gold from 347.0 metres

The bottom high-grade intercept extends previously known gold mineralization from a vertical depth of 275 metres to 318 metres (see Figure 5). The higher-grade interval is characterized by disseminated pyrite in strongly hydrothermally altered dark green episyenite (see Figure 7).

Drill hole 25BT049 was collared along the south-central portion of Butiá and drilled on an azimuth 290 degrees at an inclined angle of 60 degrees. The hole was designed to infill a gap in the existing gold resource model of Butiá and to test the down-dip extension of mineralization. Highlights of drilling include:

- 25.0 metres grading 0.4 g/t gold from 83.0 metres including:

- 5.0 metres grading 1.1 g/t gold from 83.0 metres and including:

- 2.0 metres grading 2.4 g/t gold from 84.0 metres

- 56.0 metres grading 0.3 g/t gold from 115.0 metres and including:

- 1.0 metre grading 1.1 g/t gold from 165.0 metres

- 55.0 metres grading 1.0 g/t gold from 171.0 metres and including:

- 24.0 metres grading 1.2 g/t gold from 171.0 metres, and

- 8.0 metres grading 1.0 g/t gold from 218.0 metres.

Please refer to Table 1 for a complete list of all drill holes and detailed assay results.

Figure 1 - LDS Project Deposit and Target Locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10429/255950_07527bc0e47d8a82_002full.jpg

Table 1. Summary of Drill Hole Composites from the Butiá Gold Deposit

| Drill Hole | From (metres) | To metres) | Interval (metres) | Gold grade (grams/tonne) | Comment | |

| 24BT042 | 41.00 | 56.00 | 15.00 | 0.259 | Perthitic Granite | |

| 62.00 | 66.00 | 4.00 | 1.817 | Perthitic Granite | ||

| including | 65.00 | 66.00 | 1.00 | 6.457 | Perthitic Granite | |

| 73.00 | 76.00 | 3.00 | 0.278 | Perthitic Granite | ||

| 92.00 | 117.00 | 25.00 | 0.931 | Episyenite | ||

| including | 96.00 | 97.00 | 1.00 | 1.127 | Episyenite | |

| including | 106.00 | 107.00 | 1.00 | 1.389 | Episyenite | |

| including | 114.00 | 117.00 | 3.00 | 4.583 | Episyenite | |

| and including | 114.00 | 115.00 | 1.00 | 10.520 | Episyenite | |

| 25BT044 | 166.00 | 167.00 | 1.00 | 0.114 | Perthitic Granite/Episyenite | |

| 24BT045 | 1.00 | 3.00 | 2.00 | 0.259 | Saprolite | |

| 41.00 | 72.00 | 31.00 | 0.241 | Episyenite/Perthitic Granite | ||

| 84.00 | 107.00 | 23.00 | 0.298 | Perthitic Granite/Episyenite | ||

| including | 104.00 | 105.00 | 1.00 | 1.405 | Perthitic Granite | |

| 118.00 | 133.00 | 15.00 | 0.217 | Episyenite | ||

| 137.00 | 147.00 | 10.00 | 0.259 | Episyenite | ||

| 167.00 | 217.00 | 50.00 | 0.537 | Episyenite/Perthitic Granite | ||

| including | 167.00 | 182.00 | 15.00 | 1.232 | Episyenite/Perthitic Granite | |

| and including | 168.00 | 169.00 | 1.00 | 2.147 | Episyenite | |

| and including | 170.00 | 172.00 | 2.00 | 1.595 | Episyenite | |

| and including | 174.00 | 176.00 | 2.00 | 2.214 | Episyenite | |

| and including | 180.00 | 181.00 | 1.00 | 1.135 | Episyenite | |

| 238.00 | 239.00 | 1.00 | 0.445 | Perthitic Granite | ||

| 245.00 | 255.00 | 10.00 | 3.680 | Perthitic Granite/Episyenite | ||

| including | 247.00 | 248.00 | 1.00 | 34.814 | Perthitic Granite | |

| 25BT046 | 50.00 | 51.00 | 1.00 | 0.244 | Perthitic Granite/Episyenite | |

| 25BT047 | 0.00 | 371.00 | 371.00 | 0.946 | Perthitic Granite/Episyenite | |

| Including | 2.00 | 5.00 | 3.00 | 1.445 | Perthitic Granite | |

| Including | 11.00 | 12.00 | 1.00 | 2.010 | Perthitic Granite | |

| Including | 27.00 | 28.00 | 1.00 | 1.723 | Perthitic Granite | |

| Including | 56.00 | 59.00 | 3.00 | 1.911 | Episyenite | |

| Including | 68.00 | 69.00 | 1.00 | 1.542 | Episyenite | |

| Including | 74.00 | 78.00 | 4.00 | 1.200 | Episyenite | |

| Including | 82.00 | 85.00 | 3.00 | 1.063 | Episyenite | |

| Including | 92.00 | 115.00 | 23.00 | 1.330 | Episyenite | |

| Including | 125.00 | 128.00 | 3.00 | 1.061 | Episyenite | |

| Including | 137.00 | 138.00 | 1.00 | 1.019 | Episyenite | |

| Including | 147.00 | 149.00 | 2.00 | 1.155 | Episyenite | |

| Including | 178.00 | 190.00 | 12.00 | 1.452 | Episyenite | |

| Including | 201.00 | 203.00 | 2.00 | 0.949 | Episyenite | |

| including | 222.00 | 241.00 | 19.00 | 2.016 | Episyenite/Perthitic Granite | |

| and including | 222.00 | 223.00 | 1.00 | 25.833 | Episyenite | |

| including | 317.00 | 367.00 | 50.00 | 3.372 | Episyenite/Perthitic Granite | |

| and including | 317.00 | 318.00 | 1.00 | 15.467 | Episyenite/Perthitic Granite | |

| and including | 318.00 | 319.00 | 1.00 | 78.100 | Episyenite/Perthitic Granite | |

| and including | 319.00 | 320.00 | 1.00 | 7.397 | Episyenite/Perthitic Granite | |

| and including | 320.00 | 321.00 | 1.00 | 1.919 | Episyenite/Perthitic Granite | |

| and including | 321.00 | 322.00 | 1.00 | 5.457 | Episyenite | |

| and including | 324.00 | 325.00 | 1.00 | 1.112 | Episyenite | |

| and including | 325.00 | 326.00 | 1.00 | 5.657 | Episyenite | |

| and including | 335.00 | 336.00 | 1.00 | 1.665 | Perthitic Granite | |

| and including | 342.00 | 343.00 | 1.00 | 1.038 | Episyenite | |

| and including | 343.00 | 344.00 | 1.00 | 3.683 | Episyenite | |

| and including | 346.00 | 347.00 | 1.00 | 10.183 | Episyenite | |

| and including | 347.00 | 348.00 | 1.00 | 15.767 | Episyenite | |

| and including | 348.00 | 349.00 | 1.00 | 1.880 | Episyenite | |

| and including | 349.00 | 350.00 | 1.00 | 0.993 | Episyenite | |

| and including | 351.00 | 352.00 | 1.00 | 1.190 | Episyenite | |

| and including | 355.00 | 356.00 | 1.00 | 1.073 | Episyenite | |

| and including | 357.00 | 358.00 | 1.00 | 1.097 | Episyenite | |

| and including | 358.00 | 359.00 | 1.00 | 1.488 | Episyenite | |

| and including | 359.00 | 360.00 | 1.00 | 1.483 | Episyenite | |

| and including | 360.00 | 361.00 | 1.00 | 1.245 | Episyenite | |

| and including | 366.00 | 367.00 | 1.00 | 1.073 | Episyenite | |

| 25BT048 | 152.00 | 154.00 | 2.00 | 0.356 | Perthitic Granite/Episyenite | |

| 25BT049 | 83.00 | 108.00 | 25.00 | 0.365 | Episyenite/Perthitic Granite | |

| including | 83.00 | 88.00 | 5.00 | 1.090 | Episyenite/Perthitic Granite | |

| and including | 84.00 | 86.00 | 2.00 | 2.445 | Episyenite/Perthitic Granite | |

| including | 106.00 | 107.00 | 1.00 | 1.062 | Episyenite/Perthitic Granite | |

| 115.00 | 171.00 | 56.00 | 0.256 | Perthitic Granite/Episyenite | ||

| including | 165.00 | 166.00 | 1.00 | 1.097 | Episyenite | |

| 171.00 | 226.00 | 55.00 | 0.982 | Episyenite | ||

| Including | 171.00 | 195.00 | 24.00 | 1.236 | Episyenite | |

| including | 218.00 | 226.00 | 8.00 | 1.019 | Episyenite | |

| 226.00 | 241.00 | 15.00 | 0.386 | Episyenite | ||

| 248.00 | 249.00 | 1.00 | 0.540 | Episyenite | ||

| 260.00 | 261.00 | 1.00 | 0.242 | Episyenite | ||

| 263.00 | 264.00 | 1.00 | 0.254 | Episyenite | ||

| 282.00 | 283.00 | 1.00 | 0.236 | Episyenite | ||

| 286.00 | 287.00 | 1.00 | 0.194 | Episyenite | ||

| 291.00 | 292.00 | 1.00 | 0.476 | Episyenite | ||

| 300.00 | 303.00 | 3.00 | 0.418 | Perthitic Granite | ||

| 316.00 | 320.00 | 4.00 | 0.208 | Perthitic Granite |

- Assumes 0.20 g/t gold cut-off grade, no top cut.

- The Company has been targeting larger intersections of greater than 0.20 g/t gold. Intersections lower than this threshold may provide exploration insight and may therefore be disclosed.

- Intervals represent drill core interval; true widths have not been determined at this time.

Table 2. Butiá Drill Hole Coordinates

| Drill Hole | Easting | Northing | Elevation Azimuth (m) | (Degrees) | Dip (degrees) | Start Depth (metres) | Final Depth (metres) |

| 24BT042 | 218244 | 6586275 | 391 | 110 | -60 | 0 | 151.00 |

| 25BT044 | 218000 | 6585775 | 401 | 110 | -60 | 0 | 222.82 |

| 25BT045 | 218155 | 6586260 | 397 | 290 | -60 | 0 | 295.11 |

| 25BT046 | 218042 | 6585767 | 406 | 290 | -60 | 0 | 231.88 |

| 25BT047 | 218201 | 6586395 | 403 | 290 | -60 | 0 | 412.17 |

| 25BT048 | 218148 | 6586288 | 393 | 290 | -60 | 0 | 171.96 |

| 25BT049 | 218186 | 6586356 | 382 | 290 | -60 | 0 | 340.31 |

Figure 2. Plan View Showing Butiá Gold Deposit Relative to Casa Velha Target and North 020 Lineament

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10429/255950_07527bc0e47d8a82_003full.jpg

Figure 3. Plan View of 2023, 2024 and 2025 Butiá Drill Holes and Gold Assay Grades

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10429/255950_07527bc0e47d8a82_004full.jpg

Figure 4. Long-Section Looking Northeast of 2023, 2024 and 2025 Butiá Drill Holes and Gold Assay Grades

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10429/255950_07527bc0e47d8a82_005full.jpg

Figure 5. Cross Section Looking Northeast of Drill Hole 25BT047 Highlighting Length of Mineralization and Higher Grade Interval of 50.0 metres grading 3.4 g/t Gold near the Bottom of the Hole.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10429/255950_07527bc0e47d8a82_006full.jpg

Figure 6. Drill core from Casa Velha Target area showing Hydrothermal Alteration of original granites. The photo on the left shows Phengite (green) and Potassic (Pink) alteration and Milky Quartz forming worm-like features infilling Vugs in Perthitic Granite. The Photo on the Right shows Fe-Rich Chlorite Replacing Milky Quartz. These are alteration features seen at the Butiá and Fazenda do Posto areas about 500 metres north of Casa Velha.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10429/255950_lavras%20figure%206.jpg

Figure 7. Drill core from Butiá Gold Deposit drill hole 25BT047. This sample of dark green episyenite with disseminated pyrite, chlorite and phengite mica averaged 15.8 g/t gold from 348.0 to 349.0 metres.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10429/255950_07527bc0e47d8a82_009full.jpg

About the LDS Project

The LDS Project is centred on the town of Lavras do Sul in Rio Grande do Sul, Brazil. It is approximately 320 kilometres, or a 4.5-hour drive, from the state capital of Porto Alegre. The Company, through its subsidiary, holds directly or indirectly, contractual interests over 34 mineral rights covering approximately 23,000 hectares.

The LDS intrusive complex is a multiphase intrusive centre that is surrounded by coeval volcanic rocks to the east. Geologically, LDS is in the far south of the Neoproterozoic Mantiqueira Province, a 2,700-kilometre-long belt of tectonically and magmatically accreted terrains that stretch as far south as the coastline of central Uruguay and north into southern Bahia State in Brazil. The most advanced targets are the Butiá and Cerrito gold deposits - Butiá with 377,000 ounces of gold in the Measured and Indicated categories and 115,000 ounces of gold in the Inferred category, and Cerrito with 188,000 ounces of gold in the Indicated category and 293,000 ounces of gold in the Inferred category.

About Lavras Gold Corp.

Lavras Gold Corp. (TSXV: LGC) (OTCQX: LGCFF) is a Canadian exploration company focused on realizing the potential of a highly prospective gold district in southern Brazil. Its Lavras do Sul Project is located in Rio Grande do Sul State and is primarily an intrusive hosted gold system of possible alkaline affinity. More than 24 gold prospects centred on historic gold workings have been identified on the property, which spans approximately 23,000 hectares. Follow Lavras Gold on www.lavrasgold.com, as well as on LinkedIn, Twitter, and YouTube.

Michael Durose, President & CEO of Lavras Gold Corp., is the qualified person ("QP") as defined by Canadian National Instrument 43-101, and has reviewed and approved the technical information contained in this release.

On Behalf of Lavras Gold Corp.

"Michael Durose"

President & CEO

For further information, please visit the Lavras Gold Corp. website at www.lavrasgold.com, or contact:

Michael Durose, President & CEO

or

Naomi Nemeth, VP Investor Relations

Phone: +1-289-624-1343 or +1-289-624-1377

Email: [email protected]

Website: www.lavrasgold.com

X (Twitter): @LavrasGold

LinkedIn: Lavras Gold Corp.

YouTube

Additional Technical Notes:

Quality Assurance & Quality Control: For the Butiá Gold Deposit, sample handling, preparation, and analysis are monitored through the implementation of formal chain-of-custody procedures and quality assurance/quality control programs designed to follow industry best practices.

All drill hole samples in this drilling program consist of split NQ diamond drill core. Drill core is logged and sampled in a secure facility located in Lavras do Sul, Rio Grande do Sul State, Brazil. Drill core samples for gold assay are cut in half using a diamond saw and submitted to ALS Laboratories Inc. in Goiania, Goiás State, Brazil for preparation by crushing to 85% passing 1.0 mm, riffle splitting to obtain 500 g aliquots, and pulverizing to 85% passing 75 microns.

Pulps are shipped to ALS Laboratories Inc. in Lima, Peru and analyzed by a 50g fire assay and AAS finish. Three 50g aliquots are taken for samples in the mineralized zone and one aliquot is taken in fresh rocks. The average grade of the three aliquots is used to determine the final grade of the mineralized sample.

Certified standards, non-certified blanks and field duplicates are inserted into the sample stream at regular intervals, so that QA/QC accounted for about 10% of the total samples. Results are routinely evaluated for accuracy, precision, and contamination.

Lavras Gold has been targeting larger intersections of greater than 0.25 g/t gold. Intersections that are lower than this threshold may provide exploration insight and may therefore be disclosed. The Company maintains a robust QAQC program that includes the collection and analysis of duplicate samples and the insertion of blanks and standards (certified reference material).

Disclaimer: Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements: This news release includes certain "forward-looking information" within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively "forward-looking statements"). Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "forecast", "expect", "potential", "project", "target", "schedule", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company's further 2025 drill plans and future results at the LDS Project are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company's expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/255950