Summary

- The Canadian insurance industry is overwhelmed with rising claims and volumes amid the pandemic

- Business continuity, liquidity and insolvency have emerged as key threats to the sector

- Relaxing regulatory requirements, deferring tax collection and federal support is the need of the hour

The Canadian insurance sector was broadly well-positioned at the end of 2019, some forecasting a CAGR 4.1 percent growth between 2020 and 2024. And then the world turned upside down.

The entire insurance sector plunged into the COVID-19 morass and the strict containment measures enforced to curb its spread. GlobalData’s revised projections slashed the industry’s growth to CAGR of 1.7 percent, down from 4.1 percent before the pandemic.

How do you deal with a public health emergency of such magnitude, insiders in insurance industry asked each other as the impacts of the pandemic slowly began to unfold by mid-March.

Challenges Faced by Insurance Sector in COVID-19

Thrust abruptly in the stark coronavirus pandemic, the Canadian insurance sector faces three-edged challenge in the form of rising claims, business continuity, and eroding capital reserves.

- Rising Claims & Policy Support

As anticipated, life and health insurance claims have shot up with the pandemic. Canadians seem to have suddenly woken up to the need of life and health policy, some even buying expensive and high-premium insurance to safeguard their families.

To support life and health policyholders on claims and coverage during COVID-19, many insurers have granted grace periods on premiums and extended eligibility and coverage period. Some are also relaxing their underwriting requirements, reports Deloitte Canada, to expedite and encourage new policy issuance.

However, the impact on non-life insurance segments have somewhat been unpredictable.

Canada may boast of top-notch universal healthcare system, but it is mostly private non-life insurers who pay for prescription drugs, ambulance services and other costs not covered by the public system.

Then there are insurance segments for business interruption, liability and travel that are facing the brunt of the financial and operational strain due to increased claims. Though most have standard exclusion for pandemics and related risks, companies are gearing up to pay.

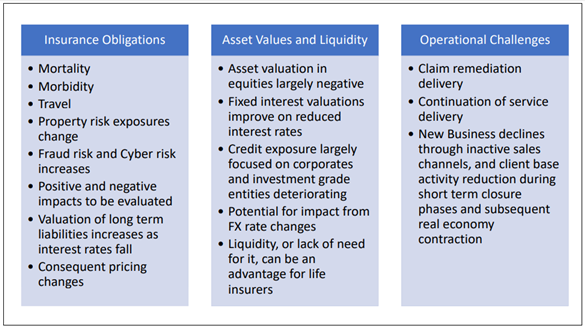

Meeting claims are becoming a costly affair, given the scale of economic disruption says the World Bank in its COVID-19 Notes Financial Series. And as a result, insurers face short- and medium-term impacts, it adds.

COVID Impact on Insurance Sector

(Source: COVID-19 Outbreak: Insurance Implications and Response report, World Bank)

In Canada, insurance firms are regulated at federal and provincial governments. Despite the economic implications, no industry-specific stimulus or measures have been doled out by the governments.

Meanwhile, several media reports indicate that Canadian business policyholders have begun slapping class action lawsuits on insurers for their refusal to pay pandemic-related income claims.

- Business Continuity

As employees shifted en masse to remote working processes, insurance organizations rushed to enable their staff with digital tool kits, learning and management system (LMS), cybersecurity to maintain business continuity.

Several life and health insurance firms reported significant challenges from “operational and back-office perspective”, expressing inability to fully transition “employees and critical functions to a virtual work environment,” says a Deloitte Canada report. There’s also been a significant rise in call center volumes leading to challenges in customer service expectations, adds the report.

Moreover, insurers must have robust systems to navigate the rapidly changing regulatory landscape amid the pandemic.

In these testing times, insurance sector’s business continuity is stressed out. Lack of accurate risk disclosures, dropping share prices for publicly traded firms, scrutiny of underwriters and third party services providers (TPAs) can lead to Directors and officers (D&O) claims. However, as mentioned above, several insurance providers are relaxing time-bound policies and payment of claims and assisting Canadians during these distressing times of COVID.

Merger and acquisition (M&A) in the insurance industry are also under spotlight in pandemic times. An Ernst & Young post claims that M&A and consolidation activity will be constrained in short to medium term but will “accelerate underlying” trends in the long run.

Sector consolidation will be based on rise of new insurance ecosystems and disposing of legacy businesses while profoundly changing the nature of M&A transactions in the future, adds EnY.

- Liquidity and Insolvency

The coronavirus pandemic has thrown an immediate capital and liquidity problem for the Canadian insurance industry. Insurers are experiencing several “asset, liability, and investment pressures,” says KPMG study.

On asset side, brokers struggling to bring onboard new business proposals as clients slash spending. While on the liability side, payouts have shot up over claims (and litigation), increasing outflows. Finally, on the investment side, “ultra-low interest rate environment” is diminishing investment returns in an already volatile financial market, says KPMG.

Canada’s Office of the Superintendent of Financial Institutions has eased some regulatory policies to reduce this operational burden.

Changing Circumstances

Turbulent times also mean accelerated measures. In the last four to five months, the insurance firms have beefed up their digital capabilities and relaunching or reprioritizing their planned initiatives such as automation of claims, robo-advisers, virtual assistance/call centres, and self-serve capabilities.

Product offerings have also evolved under these changed circumstances and more free virtual health services are on offer.

However, the industry is on the brink of being overwhelmed and federal and regulatory support is essential. Government should consider relaxing timelines and standards for regulatory requirements and deferring tax collection based on premiums paid.