Highlights:

- Zip and Sezzle have mutually cancelled the proposed merger agreement signed on 28 February 2022.

- The decision has been made considering the current macroeconomic and market conditions.

- Impacted by the announcement, Sezzle's shares have plummeted more than 37% on the ASX (as at 2.50 PM AEST).

Digital retail finance and payments firm Zip Co Limited (ASX: ZIP) and Sezzle Inc (ASX:SZL) have decided to cancel the merger signed on 28 February 2022, according to both companies' ASX filings. The decision has been made considering the current macroeconomic and market conditions and is effective immediately.

Sezzle will get US$11 million from Zip U.S. as part of the mutual termination to cover Sezzle's legal, accounting, and other transaction-related expenses.

Impacted by the news, shares of Zip were spotted trading 6% higher at AU$0.530 per share while, Sezzle's shares have tumbled 37.349% trading at AU$0.260 apiece on the ASX at 3.36 PM AEST.

Image Source: © 2022 Kalkine Media ®

Post cancellation, BNPL giant Zip will also focus on its strategic objective and quicken the process of becoming profitable. With sustained customer and transaction volume growth across key geographies and a robust pipeline of enterprise merchants joining the platform, Zip's core business is still doing well. The U.S. continues to be the company's primary market, region of concentration, and biggest opportunity. Keeping up with the previous forecast, Zip is likely to deliver group profitability during FY24. Zip claims to be well capitalised to carry out its objective.

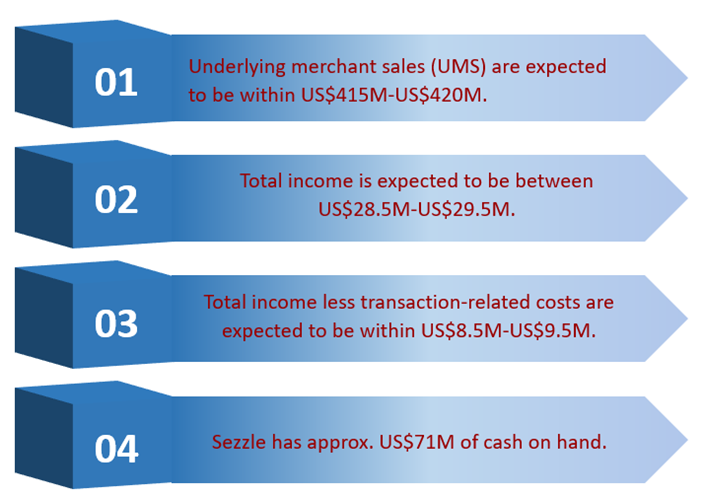

Meanwhile, Sezzle shared its preliminary results for the second quarter ended 30 June 2022.

Key highlights

Image Source: © 2022 Kalkine Media ®

Data Source- Company announcement dated 12 July 2022

What was the deal?

On 28 February 2022, Zip had announced the acquisition of Sezzle in an all-scrip transaction through a statutory merger.

According to the agreement, if the deal would have happened, Sezzle's investors were supposed to get 0.98 Zip's ordinary shares for each Sezzle share they own.

Similarly, Zip shareholders would have owned approximately 78% of the merged group, while Sezzle stockholders would hold about 22%.