Highlights

- Sezzle’s group income increased by 6.2% during the first quarter that ended on 31 March 2022.

- Sezzle stands at US$60.6 million cash at the end of this given quarter.

- Sezzle is progressing with the cash-cost saving.

Shares of Sezzle Inc. (ASX:SZL) jumped 9.20% on Friday after the company shared its quarterly report through the ASX-announcement. The payment platform operator delivered a robust set of numbers during the first quarter for the period ending 31 March 2021.

At 3:42 PM AEST, shares of Sezzle were spotted trading at AU$0.89 apiece, 9.20% higher than the previous day's close. Sezzle shares have outperformed its benchmark index, ASX 200 Info Tech (XIJ), today (29 April 2022), as it was trading around 1.80% to 1,640.20 (at 4:05 PM AEST).

Suggested reading: HCD, CSE & ICE - Three ASX penny stocks ending the week on a strong note

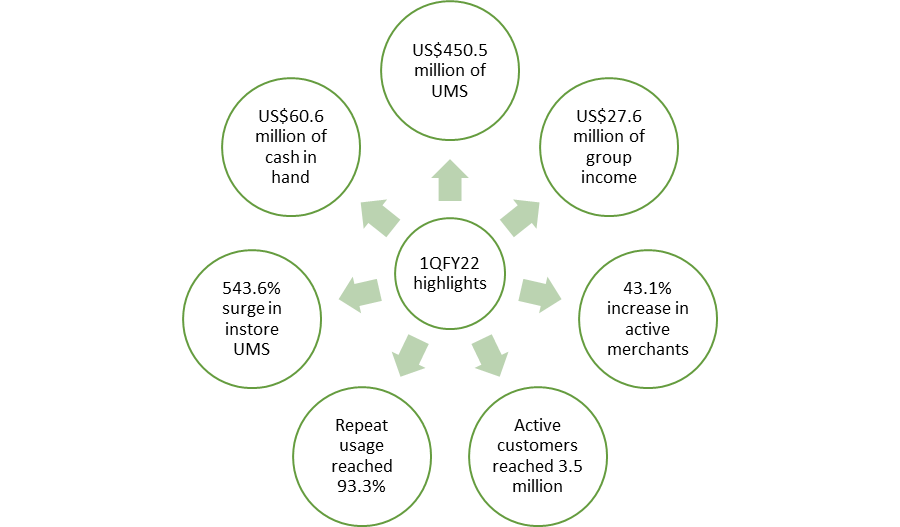

Key highlights of the Sezzle's quarterly activities

Image source: © 2022 Kalkine Media®

Image source: © 2022 Kalkine Media®

In the first quarter, Sezzle reported underlying merchant sales (UMS) of US$450.5 million, up by 20.1% within a year. The total income reached US$27.6 million, 6.2% higher than the previous year. The group income comprises merchant fees and UMS.

ASX-listed software and service company recorded a 43.1% year-over-year rise in the active merchants. At the end of the first quarter, the number of active consumers reached 3.5 million. Sezzle mentioned that it experienced a continuous surge in consumer engagement, and it resulted in an improvement in repeat usage to 93.3% for the 39th consecutive month.

Image source: © Ipopba | Megapixl.com

Image source: © Ipopba | Megapixl.com

Sezzle delivered some eye-popping numbers as well. Instore UMS skyrocketed by 543.6% in the first quarter on the prior corresponding period (pcp). As of 31 March 2022, the Sezzle application was downloaded by more than 4.1 million consumers.

Sezzle Canada also came out as a strong performer during the quarter as it marked an 87.9% increase in the UMS on pcp, and within a year, active merchants increased by 87.7% and active consumers by 92.1%.

Sezzle had US$60.6 million cash in hand at the end of the quarter. The cash declined by US$18.3 million because of US$26.2 million in financing activities. The cash outflow was partially offset by the operating activities inflow of US$7.8 million. CEO and executive chairman of Sezzle commented on the cash flow that the company is well funded for growth opportunities and current operations.

The cash flow from operating activities was driven by the strong holiday season during the fourth quarter of 2021. In the first quarter, the receipts from customers were up by 30.3%. As a result, the payment from customers was higher than payments made to merchants.

How is Sezzle planning to cash-cost save around US$17 million?

Sezzle reportedly said that it is in the process of improving its free cash flow. To achieve the path of profitability, Sezzle is planning to reduce the workforce, change payment processing in India, scale back in Europe, and spin-off the Brazilian operations.

Must read: Bulls dominate ASX 200 at open on strong Wall Street cues