Highlights

- Reckon Limited has entered into a partnership with Novatti Group Limited to incorporate payment solutions into its products.

- The goal of integration is to generate new revenue streams from current customers.

- Attractive transaction fees for current and new Reckon customers to encourage adoption.

Shares of digital payments service provider firm Novatti Group Limited (ASX:NOV) zoomed up over 2% on the ASX to trade at AU$0.250 ( at 12:00 PM), following the revelation of the partnership with another software firm Reckon Limited (ASX:RKN). At the same time, RKN buzzed into the green zone, rising 1% to trade at AU$0.910.

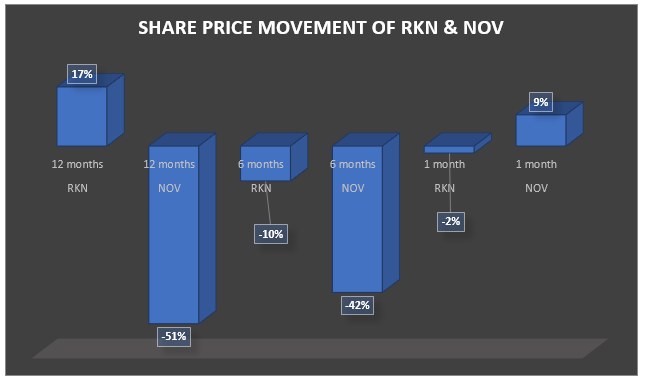

Meanwhile, the information technology sector has been on a downward trend in the past one year, declining 9%. NOV dropped 51% in a year, mirroring the larger IT sector, whereas RKN surged 17%.

Moreover, RKN retreated from its bull run, plunging 10% in six months, while NOV maintained its bearish trend, plummeting 42%. While NOV has recently recovered and grown by 9% in one month, RKN has continued its downward trajectory with a 2% loss.

Image source: © 2022 Kalkine Media®

In addition, S&P ASX All technology [XTX] was trading 0.46% higher at 2,515.30 (at 1PM AEDT). The index plummeted 11% in one year.

Good read: 2 ASX Technology Stocks On Investors’ Radar - NOV, AXE

About the companies

Reckon Limited is a cloud-based software-as-a-service firm that serves several clients, including law firms, accounting firms and SMEs.

Novatti is a fintech firm that allows businesses to pay and get paid, from any device, anyplace. The organisation concentrates on technology-enabled mobility and encompasses the entire payments value chain. Reckon’s largest shareholder, Novatti, owns a 19.9% interest in the firm.

Strategic partnership between Reckon & Novatti

Reckon Limited collaborates with Novatti Group Limited to integrate Novatti’s payments methods into current and new Reckon products.

Source: © Cacaroot | Megapixl.com

According to the terms of the deal, Novatti and Reckon will incorporate payment solutions into Reckon products. Both parties will concentrate on integrating the payments service within the firm’s Reckon One solution and new invoicing app. The business will broaden its service by using its existing client base of around 114,000 cloud users.

Furthermore, Novatti and Reckon will offer attractive transaction costs to current and new Reckon customers to make the new payments solutions more appealing. The revenue generated from the firm’s customer base will be equally shared between the two parties.

Management remark

Sam Allert, CEO of Reckon Group, stated:

Peter Cook, Managing Director of Novatti Group, commented:

Road ahead

In the coming months, Reckon will continue to work seamlessly with Novatti to enhance the integration throughout its whole product suite. Along with Novatti, the firm will look at additional fintech opportunities like digital cards, payment automation, lending and banking and services.

Good read: Visa, Mastercard grant acquiring license to Novatti (ASX:NOV)