Highlights

- Audinate’s revenue guidance has been exceeded by US$30 million based on its performance in May 2022.

- However, the company continues to face a chip supply shortage.

- Audinate shares were highly volatile on the ASX on 6 June, Monday. The stock has opened up in green though on Tuesday.

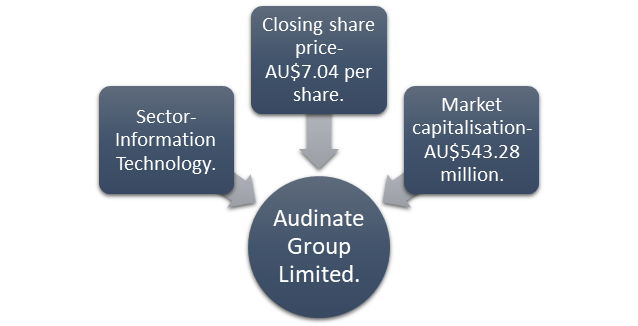

The shares of Audinate Group Limited (ASX:AD8) closed 0.571% higher at AU$7.040 per share on the ASX on 6 June 2022.

The ASX-listed tech company shared its FY22 financial performance updates on the ASX on Monday.

The share price of Audinate has fallen approximately by 8.57% on the ASX over the past 12 months. On the other hand, Audinate’s year-to-date share price also fell over 20% on the ASX. (As of 4 PM AEST, 6 June).

Image Source © 2022 Kalkine Media ®

On Tuesday, the stock gained 2.840%, trading at AU$7.240 apiece at 10:57 AM AEST.

Details of Audinate’s FY22 trading update:

Audinate announced on 6 June, that the company has experienced a good sales record throughout May and is hence expecting its revenue in FY22 to exceed expectations. The board of Audinate stated that the company might experience a similar trading condition as it was in March and April.

Backed by strong trading conditions, Audinate’s FY22 revenue is expected to exceed US$30 million.

Although, the company still fights disruption in the supply chain since January. In its previous trading update, Audinate informed that the company was experiencing a shortage in chip supply in January and February.

The company had to struggle to deliver an unaudited revenue worth US$6.5 million in the first quarter of FY22.

Read more: How Audinate plans to tackle supply chain woes amid chip shortage in 2H22

Why did Audinate shares close in red on 6 June?

The shares of Audinate were extremely volatile throughout the trading session on the ASX on Monday. Although the company came up with a positive update stating strong operating performance and a possibility to earn better revenue, shares closed in red.

One of the primary reasons behind this could be the shortage of chip supply. The fact that Audinate is still battling against the supply chain disruption might have bothered the investors, leading the stock to close bearish.

Nonetheless, Audinate is actively managing all the challenges related to the supply chain. Furthermore, the company has also announced that it will use the upcoming InfoComm tradeshow from 8 June to 10 June in Las Vegas to share details of how the company is managing the shortages of chips.

Meanwhile, the S&P/ASX 200 index (ASX:XJO) is lower today, dropping 0.59% to 7,163.80 on the ASX at around 10:45 AM AEST.