Highlights:

- On Wednesday, Althea Group Holdings Limited (ASX:AGH) released its March quarter results.

- In the reported period, cash receipts stood at AU$9.24 million, reflecting a rise of 68% from pcp.

- In the final quarter of FY23, AGH anticipates reporting a significantly better cash flow position and operating profit.

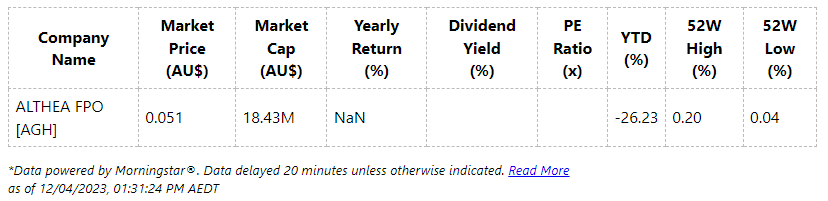

The Australian benchmark index S&P/ASX200 was increasing by 0.56% and trading at 7,350.70 points on Wednesday, 12 April 2023, at around 12:17 pm AEST. At the same time, outperforming the benchmark index was the international leader in manufacturing and sales of cannabis-based medicines, Althea Group Holdings Limited (ASX: AGH), which was up 11.111% and was trading at AU$0.050 after it released its quarterly results ended 31 March this year.

Let’s get apprised of AGH’s latest quarterly results now.

On Wednesday, Althea Group released its operational update for the March quarter, wherein cash receipts stood at AU$9.24 million, reflecting a rise of 68% from pcp. However, net cash outflows fell by 24% during the reported quarter period to AU$1.63 million versus AU$2.15 million in pcp. Net cash outflows comprised AU$1.96 million in buying products, which would be utilised for upcoming medical sales since its suppliers need around six-month lead time.

In the final quarter of FY23, AGH anticipates reporting a significantly better cash flow position and recording a quarterly operating profit.

Further, receipts from customers grew 39% to AU$2.60 million from the December quarter. As a result of cost-cutting programs, operating expenditures continued to decline.

On the segment front, the company’s 100% owned subsidiary, Peak Processing Solutions, attained a record AU$5.15 million in receipts from customers during the March quarter. Whereas the Group’s cannabis-based medicine business – Althea, attained AU$3.75 million in receipts from customers in the reported period.

As notified by the company in January this year, it has been awarded a CAD$2 million loan facility from lenders in Canada. Apart from that, in February this year, AGH announced an additional AU$2.2 million of convertible debt funding. It has been provided by a US-based institutional investor.

Althea Group’s March quarter’s operation performance

On the operational front, Peak Processing, which is into manufacturing and sales of legal recreational cannabis products in Canada longest standing beverage consumer- Electric Brands, had a broadly successful last year when it sold 700K units of their Sweet Justice branded infused-cannabis beverages. Electric Brands is predicting to sell over 1.3 million units this year.

The pharmaceutical cannabis business Althea’s first soft gel capsule sales, known as Althea CBD25, persist in increasing as an elevated number of doctors are educated about Althea’s new preparation. Althea anticipates to introducing two more soft gel capsule SKUs in the June quarter, conditional on obtaining the required regulatory consents.