Highlights:

- St Barbara released its Q1 FY23 report on ASX today.

- The report said that the company’s gold production in the given period was lower than expected.

- St Barbara’s shares were trading 20.895% lower at 1:12 PM AEDT.

Gold explorer and producer St Barbara Limited (ASX:SBM) on Tuesday released its Q1 FY23 report for the period ending 30 September 2022. Followed by this update, the shares of St Barbara were trading 20.895% lower on ASX at AU$0.530 apiece at 1:12 PM AEDT.

St Barbara’s Q1 FY23 report

In its Q1 FY23 report, St Barbara mentioned that it had produced 63,7000 ounces of gold in the given period at an AISC of AU$2,490. Although Simberi and Atlantic performed as per the company’s expectation, the group gold production was lower than expected due to a slowdown in underground mine equipment availability and utilisation affecting gold production at Leonora.

St Barbara also added that the Leonora Province Plan Feasibility studies had progressed well during the given period.

In the same quarter strategic review of Simberi, supported by mining reviews, identified oxide ore in the region. This additional material can extend the mining of oxide ore through FY25, said St Barbara.

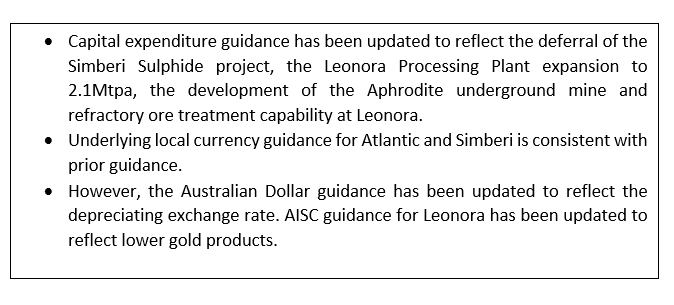

St Barbara’s guidance update

Initially, St Barbara had determined to deliver 1.1Mt of Gwalia ore to the processing plant in FY23 Leonora. It was driven by the company’s steady rate of improvement in equipment availability and utilisation over the last year.

However, the company also informed that there was intense competition for highly skilled fitters and maintainers in Q1 FY23. However, St Barbara and McMahon could only manage to fill most required positions by the end of September 2022.

Hence, it is confirmed that the company wont be able to deliver the full-year target of 1.1Mt in FY23, said St Barbara.

Therefore, a new target of around 950kt has been set based on the most recent expected equipment availability and utilisation rate projections at Leonara, representing a 14% reduction rate in production.

_10_18_2022_04_54_40_501331.jpg)