Highlights

- Sayona shares closed over 9% higher today despite no company-specific announcement.

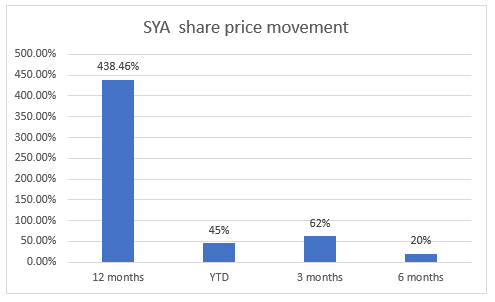

- The stock has gained over 400% in the last 12 months.

- SYA had been recently included in both S&P/ASX 300 Index (ASX:XKO) and All Ords.

Shares of ASX listed lithium producer Sayona Mining Limited (ASX:SYA) ended sharply higher on Friday (25 March 2022), extending the bull run that the stock has been witnessing over the last one year. On Friday, SYA shares ended 9.523% higher at AU$0.230 apiece on the ASX.

Including today’s gains, shares of the Canada and Australia-focused lithium producer has rallied nearly 77% in the last one month.

Which ASX Lithium Stocks gave over 100% yearly returns?

Further, the broader market also traded in the green today with all ordinaries index (ASX:XJO) closing 0.26% higher at 7,406.20 points.

Why are SYA shares gaining today?

While no announcement by SYA can explain today’s share price surge, the stock has been witnessing a bull run reacting to rising price of lithium, a key ingredient used to produce electric vehicle (EV) batteries. For example, lithium carbonate prices have increased five times in China over the last 12 months on increased demand. The ongoing war between Russia and China has led to more demand for lithium globally as traditional fossil fuel prices are surging amid supply concerns.

Related read - Core Lithium (ASX:CXO) shares fall over 4% as managing director steps down

Surging energy prices due to Ukraine and Russian war has strengthened the transition from fossil fuels, indirectly adding to the booming demand for electric vehicles.

The recent surge in lithium price bodes well for lithium producers

SYA share price movement

Image Source © 2022 Kalkine Media ®

Another recent development that can be attributed to the surge in share prices of SYA is the rejig of ASX indices. The company has recently been included in both S&P/ASX 300 (ASX:XKO) and All Ords index. This means passive funds tracking the ASX index must have recently bought the stock to match the underlying portfolio of the index.

Outlook

The company is confident regarding its business strategy and is focused on restarting spodumene concentrate productions at NAL from Q1FY23. SYA is also looking to establish a Northern Quebec lithium hub via building on its acquisition of an interest in the Moblan project.