Highlights

- The ASX 200 benchmark index closed in the green today (November 24), gaining 10.00 points or 0.14% to end at 7,241.80 points.

- Over the last five days, the index has gained 1.49%, but is down 2.72% for the last year to date.

- IT was the biggest gainer, advancing 1.49%, followed by materials, which ended 1.12% up, while energy fell 1.57%.

The ASX 200 benchmark index closed in the green today (November 24), gaining 10.00 points or 0.14% to end at 7,241.80 points.

Key pointers from the ASX closing today

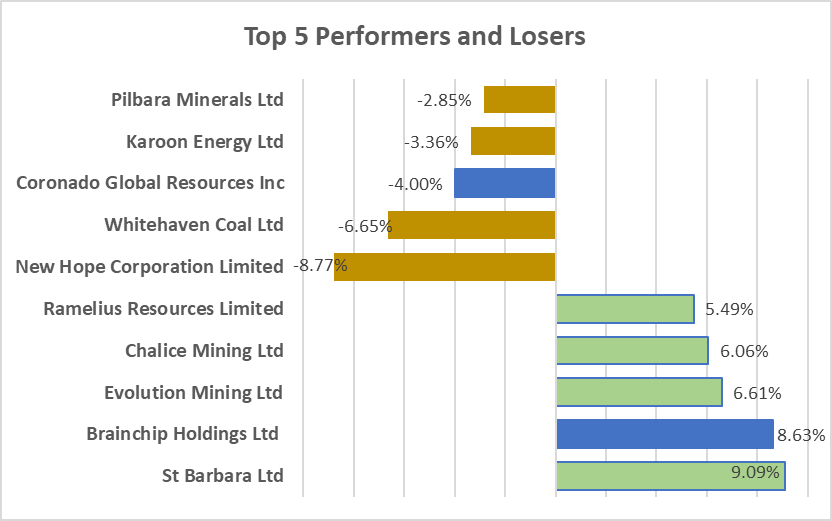

- St Barbara Ltd (ASX:SBM) and Brainchip Holdings Ltd (ASX:BRN) gained the most on the index, moving ahead 9.09% and 8.63%, respectively.

- New Hope Corporation Limited (ASX:NHC) and Whitehaven Coal Ltd (ASX:WHC) fell 8.77% and 6.65% respectively.

- Over the last five days, the index has gained 1.49%, but is down 2.72% for the last year to date.

- Seven out of 11 sectors closed in green today.

- IT was the biggest gainer, advancing 1.49%, followed by materials, which ended 1.12% up, while energy fell 1.57%.

- The All-Ordinaries Index gained 0.13%.

Newsmakers

Calima Energy (ASX:CE1): The drilling activities for this year at Calima Energy's (CE1) Brooks asset in Alberta, Canada, are almost finished.

As part of its drilling schedule for quarter four, the firm today informed investors that three of its Sunburst wells, Gemini 10, 11 and 12, and one glauconitic well, Pisces 6, had already been completed. Pisces 7 was the remaining well in the drilling programme.

MetalsTech (ASX:MTC): As part of a phase four diamond drilling programme, MetalsTech has discovered high-grade gold at the Drill Chamber IV location within its Sturec gold mine in Slovakia.

The purpose of the drilling was to give the corporation more assurance regarding the southernmost limits of the mineral resource already held by Sturec. It also sought to increase down-dip and down-plunge mineralization in the south.

Image source: © 2022 Kalkine Media®

Data source- ASX website dated 24 November 2022

Bond yields

Australia’s 10-year Bond Yield stands at 3.56% as of 4.12 PM AEDT.

Global markets

Following the release of the minutes, market pricing suggested that traders anticipate the Fed to raise rates by half a percentage point at each of its upcoming two meetings, ending a string of four consecutive quarter-point rises. Following multiple rises of half a percentage point, the Bank of Korea increased its benchmark rate by a quarter of a percentage point this morning, mirroring the RBA.

The S&P 500 gained 0.59% to 4,027.26. The Dow Jones was 0.28% up to 34,194.06. The NASDAQ Composite increased by 0.99% to 11,285.32, and the small-cap Russell 2000 was up by 0.17% to 1,863.52.

In Asia, the Asia Dow was 0.78% up, Nikkei in Japan gained 1.09%, the Hang Seng in Hong Kong was 0.30% up while Shanghai Composite in China decreased by 0.21% at 4.17 PM AEDT.

Commodities markets

Crude Oil WTI was spotted trading at US$77.58/bbl, while brent was at US$84.93/bbl at 4.18 PM AEDT.

Gold was at US$1754.68 an ounce, copper was at US$3.65/Lbs, and iron ore was at US$98.00/T at 4.18 PM AEDT.