Highlights

- Zip’s share price fall was in-line with the broader ASX 200 Index, which fell 0.16% to close at 7,304.70.

- This might be because of the company’s announceme that a considerable number of shares will be gradually freed from voluntary escrow.

- Zip’s shares have recorded a negative growth of over 75% YTD.

Shares of financial technology company Zip Co Limited (ASX:ZIP) closed 10.83% lower today (4 May 2022) at AU$1.03 per share on ASX. This was in line with the broader ASX 200 Index, which fell 0.16% at 7,304.70.

Why did Zip's shares plunge today?

The reason for falling of the Zip's share price could be the ASX announcement made by the company today. The buy now, pay later (BNPL) company informed that a considerable number of shares will be gradually freed from voluntary escrow and all of this will happen in the next month or so.

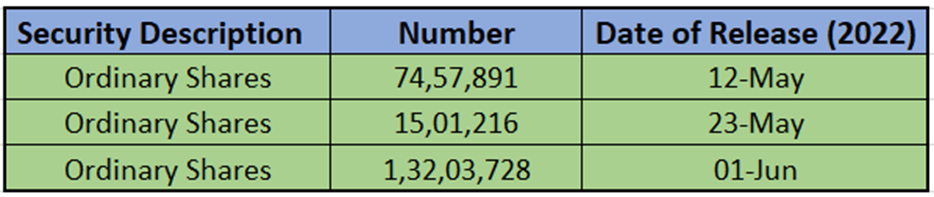

Following is the number of shares to be released date wise:

Image Source: © 2022 Kalkine Media ®

Image Source: © 2022 Kalkine Media ®

Data Source- Company announcement dated 04 May 2022

The abovementioned ordinary shares are currently quoted on ASX and were issued to the company's purchase of Twisto Payments, Spotii Holdings, and QuadPay Inc, respectively.

Update on Sezzle's deal

On 22 April 2022, Sezzle Inc (ASX:SZL) announced that the waiting period for the Federal Trade Commission's review of the previously announced proposed acquisition of the company by Zip Co Limited pursuant to the merger agreement, dated 28 February 2022 by and between the company, parent, and Miyagi Merger Sub (Merger Sub), Inc has expired.

Source: © Josepalbert13 | Megapixl.com

Source: © Josepalbert13 | Megapixl.com

Merger Sub will combine with and into the company at the closure of the transaction, pursuant to the merger agreement and its terms and circumstances. The company will survive the merger as an indirect wholly owned subsidiary of the parent.

On 21 April 2022, Zip had shared its third-quarter results for the financial year 2022.

Key highlights of 3QFY22

Image Source: © 2022 Kalkine Media ®

Image Source: © 2022 Kalkine Media ®

Data Source- Company announcement dated 21 April 2022

Stock performance: Zip's shares have been performing down since starting of 2022. They have recorded negative growth of over 75% YTD.

Bottomline

Investors are probably concerned that the issuance of such a huge number of shares may result in continuous selling pressure on the Zip stock price. After all, Zip has dropped by such a significant percentage thus far in 2022. As a result, many investors who own these shares may choose to cash them out after they are released from escrow.

Also Read: HUM, ZIP, SZL, DOU: Look at the performance of these BNPL stocks