Summary

- QuickFee shares have provided a positive return of 392.85% between 23 March-8 July, and the Company has achieved record lending in both the US and Australian markets in Q4 FY20.

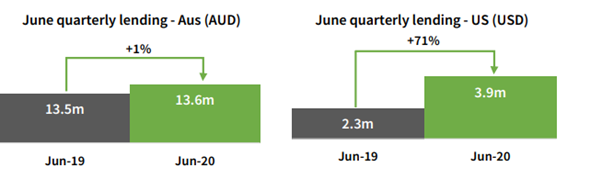

- A sum of US$ 3.9 million was given out in lending in June quarter, while a 1% boost in lending was recorded by the firm at A$13.6 million in Australia, during the same period.

- QuickFee announced increases to its existing debt facilities in the US to US$ 10 million and to A$25 million in Australia.

- QFE had completed $7.5 million placement in May to finance its ongoing technology projects and loan book development.

Closure of offices and emergence of remote working amid COVID-19 has driven professional firms to shift from cheques to online payments have lately, given a boost to fintech firms . QuickFee is one such firm that has gained from coronavirus induced behavioural shift in borrowers while making any payments.

QuickFee Limited (ASX:QFE) shares zoomed to day’s high of A$0.93 on 6 July, and closed 33.333% higher at $0.86. Its shares have provided a return of whopping 392.85% between hitting a low price of A$0.14 on 23 March to ending at A$0.69 on 8 July. Also, on 9 July 2020, QFE was trading at A$0.715, moving up by 3.623% (at AEST 2:00 PM).

Australian domiciled entity, QuickFee Limited is an online payment solutions, which enables clients of companies using QFE platform to take on financing for bills produced by an organisation, along with payment of bills through credit card or EFT. QFE was established in March 2009 and created a unique payment method letting businesses to receive payment plans on monthly basis to make credit easily accessible to clients online and making the invoice payments to professional services companies much smoother.

Performance Highlights

QuickFee has achieved record lending in both the US and Australia since coronavirus outbreak. The payment solutions firm reported robust quarterly and YOY growth in the US market.

As per the Q4FY20 business update dated 8 July, lending in the US market increased by 71% on pcp in Q4 to US$ 3.9 million and rose 63% to US$ 13 million in FY20. Some of the highlights from the Q4 period are as follows:

- The US transaction volume rose 154% in June quarter to stand at US$ 136.9 million.

- For FY20 period, lending in Australia grew 17% to be noted at A$49.3 million, while for Q4 it was recorded at A$13.6 million, with a rise of 1% on pcp.

- The annualised payment portal transaction processing run rate stands at USD 554 million compared to USD 174 million in June 2019.

- 88 new firms were inked in the US over the quarter period.

Source: ASX

Lending in Australia was up by 1% on pcp in Q4 FY20 reflecting weaker lending in late April and May as companies lowered invoicing amid COVID-19 lockdown phase. However, lending in June broke all monthly records, reaching A$5.4 million. Transaction volumes, as well as values, persisted in speeding up steeply through the US payment platform.

Extension of lending facilities in the US and Australia

Recently in June, QuickFee notified on growth in its current debt facilities in the US and Australian markets to comply with the growing demand for its payment plans. Global Credit Investments, the current lender of QFE, implemented deals to double the present US$ 5 million debt facility and grow the borrowing base ratio from 80% to 85%. The facility was also improved by permitting loans to law firm clients to include up to 20% of the utilised balance of the facility.

The rise in the debt facility to US$ 10 million, combined with placement capital raising gives the firm the needed headroom to capitalise on the mounting demand for its payment plans in the US. QuickFee’s Australian debt facility provided by LC (Lease Collateral Pty Ltd) also received a boost of A$5 million to stand at A$25 million, demonstrating the prolongation of a long-time association with LC. Also, it allows QFE to finance the expected additional expansion on loan book front in the market of Australia.

Rise in the number of new firms signing up in the US

QFE persists to gain traction in the US market with 88 new firms inked by QuickFee in Q4FY20, increasing by 300% compared to 22 new firm sign-ups in pcp. This included signing in June of QFE’s first “Top 10” US accounting firm with revenue surpassing US$ 1 billion to the PayLater solution. About 26 “Top 100” US accounting firms who have signed up and the total number of firms signed up with QFE US, as on 30 June 2020 were 412.

The Company plans to ascertain the size of expanded general provision for potentially unrecoverable receivables and would consist the amount in the FY20 financial statements amid COVID-19 challenges. Overall, the lending book of QFE continues to perform well.

Bruce Coombes, CEO, QFE stated that QuickFee kept on being encouraged by the traction the firm was getting in the US market.

The record consecutive lending in the third quarter shows a very strong acceptance of QFE products by the US accounting and law firms, and with persistent growth in new firms signing up, the lending momentum is expected to step up.

QuickFee benefitted from COVID-19, moving many firms and clients to switch to online payments with transactional volumes reaching to new highs in the US market. The rise in the trend online payments is expected to continue in the US where online payments have not been used widely for accounting firms.

Capital raising to fund growth

In May, the payment solutions firm concluded $7.5 million share placement, raising capital to fund the ongoing technology projects and loan book expansion. The capital raising came after record lending in the US, up by 61% at USD 3.6 million in the March quarter and 19% to A$11.6 million in Australia.

The share placement got strong support from new and existing investors, as well as directors. The placement consists of an offer of 35,714,286 fully paid ordinary shares at an issue price of 21 cents/share.

The record year in Australia for lending and an extraordinary growth for the same in the US market has shown that QuickFee will head towards FY21, with a strong momentum. Huge number of new firms signing up, new activations, increase in the funding capacity and growing acceptance for its products have put the Company in good position to cater to massive demand from the US market.