Summary

- In the “Buy Now Pay Later” business model, the entire risk lies with BNPL players as the customer receives the merchandise or service real time, with the merchants receiving the entire payment within a stipulated time.

- Australian Stock Exchange houses many BNPL companies such as Zip, Sezzle, and investors’ darling Afterpay that have received triple digit growth in last three months.

- Most of the BNPL business updates focus on growth in underlying sales and revenues earned through merchant fees or acquisition of customers, However, the strength of a company can be identified from operating cash flows and components that make up the net cash and cash equivalent.

Consumers who choose BNPL services enjoy making heavy purchase or costly item at no-interest payment, spread over a certain period of time. The BNPL service provides easy payment without the hassle of paying any interest associated with the likes of debit or credit card.

Merchants also prefer BNPL offerings, as the sales volume goes up in a given period of time despite higher merchant fees paid to BNPL players over credit and debit card service providers.

In a BNPL business model, the entire risk lies with BNPL players as the customer receives the merchandise or service real time with the merchants receiving the entire payment within a stipulated time.

However, as the ticket size is small, risk of default goes down significantly, as no customer would like to go off-platform from a service that provides such high benefits of enjoying costlier items made available through interest free repayments.

Australian Stock Exchange houses many BNPL companies such as Zip, Sezzle, and investors’ darling Afterpay. Most of their business updates focus a lot on their colossal underlying sales and revenues earned through merchant fees or acquisition of customers reaching millions within a short span of time.

However, to understand how fundamentally strong a company is, a look at their operating cash flows is a must. Let us decode numbers for ASX listed BNPL players – SZL, APT, and Z1P.

Also Read: Are Most Dividend Yields Flawed Now: 2 Areas Investors Should Look at; Balance Sheet and Cash Flows

Sezzle Inc. (ASX:SZL)

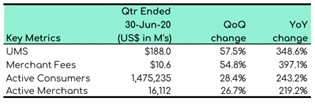

Sezzle recently registered 1.48 million active customers by the end of Q2 FY20 ended 30 June 2020 and onboarded more than 16 thousand merchants.

The second quarter of FY20 witnessed Sezzle to record $188 million in underlying merchant sales, the best ever since its inception. Merchant fees also recorded significant growth on annual and quarterly basis.

Source: Company ASX Update

A look at their cashflows

The Company reported positive net Operating Cash flows of US$4.3 million in Q2 FY20 and US$2.5 million in H1 FY20, with receipts from customers recorded at US$169.35 million in Q2 FY20 and US$280.06 million in H1 FY20. Cash Payment to Merchants was US$154.26 million in Q2 FY20, an increase of 49.2% QoQ and US$257.67 million in H1 FY20, demonstrating a lesser outflow of money.

The Company also highlighted a net cash and cash equivalents of US$55.7 million split into US$52.8 million in bank balance and US$2.9 million in restricted cash. The increase in cash balances was backed by a $4.3 million positive operating cash flow and US$37.0 million additional borrowings drawn on the Company’s US$100.0 million line of credit as of 30 June 2020.

On 28 July, SZL teamed up with Plaid, which will allow SZL to utilise Plaid’s data network to enable SZL’s consumers to link their bank account to Sezzle. The Plaid network would enable Sezzle to facilitate consumer payments via the Automated Clearing House system (ACH).

On 30 July, SZL was trading at A$7.060 (at AEST 1:21 PM), up by 0.713%. In the last one month and three months, the Company gave a share price return of 87.94% and 340.88%, respectively.

Afterpay Limited (ASX:APT)

Afterpay currently serves close to 10 million active customers and has 55,400 merchants globally.

Recently, the Company reported trading update pertaining to FY2020 and Q4 FY20 period ended 30 June 2020 wherein it mentioned the underlying sales reaching A$11.1 billion in FY20, up by 112% from FY19.

Source: Company ASX Update

A look at their latest cash flow data available

As per the half-yearly report published by the end of February, APT reported a negative net cash flow in H1 FY20, with receipts from customers substantially less than payments made to merchants and suppliers.

While cash receipts stood at A$4.1 billion, payment made to merchants and suppliers was A$4.4 billion. Net cash and cash equivalents at end of H1 FY20 ending 31 December 2019 stood at A$402.5 million backed by strong financing.

As on 31 May 2020, the Company recorded a Pro forma cash balance of A$1,194.9 million that included A$650.0 million as Placement proceeds, which APT raised on 8 July 2020.

Afterpay followed a Share Purchase Plan (SPP), post raising the capital and had notified its shareholders over the availability of the SPP announced on 7 July 2020 that allows eligible stakeholders to avail a minimum of A$1k and a maximum of A$20k worth of shares at a pre-decided issue price based on criteria.

On 30 July, APT was trading at A$69.39, up by 2.39% (at AEST 1:41 PM). In the last one month and three months, APT gave a share price return of 19.10% and 140.75%, respectively.

Zip Co Limited (ASX:Z1P)

Zip currently serves 2.1 million customers, as on FY20 ended June 2020, up annually by 63%, with merchants on the platform increased to 24.5 thousand, up by 51%.

The company recorded a 91% year-on-year increase in FY20 revenue to A$161.2 million with record quarterly revenue of A$46.4 million, which experienced a 72% increase over previous corresponding period (pcp).

A look at their latest cash flow data available

Source: Company ASX Update

Source: Company ASX Update

As per the half- yearly report published earlier, by the end of February, Zip reported a net cash flow from operating activities of A$6.7 million. Portfolio income from customers was A$69.3 million, while the company paid A$46.02 million to suppliers and employees. Net cash and cash equivalents at the end of H1 FY20 ending 31 December 2019 stood at A$39.1 million.

On 20 July, Respiri Limited (ASX:RSH), an eHealth SaaS entity inked a deal with Zip Money Payments Pty Ltd (100% owned subsidiary company of Z1P). RSH’s CEO, Mr Marjan Mikel stated that the agreement with Zip Money would provide asthmatic patients looking for an access to their platform with financial flexibility, while making significant healthcare decisions associated with improvements in handling their ailment.

On 30 July, Z1P was trading at A$6.1, up by 1.498% (at AEST 1:58 PM). In the last one month and three months, Z1P gave a share price return of 18.07% and 174.43%, respectively.

Also Read: BNPL strong run on ASX & changing stance on stimulus: Are stocks done with the run-up?