Highlights

- European entrepreneurs Castiglioni and Milone to acquire 50% stake in Vmoto’s Italian distribution company VSI.

- VMT’s financial result for FY21 calmingly reflect its strong status in the electric motorcycles markets.

- Vmoto shares trade bullish on ASX after the announcement.

Electric vehicle company Vmoto Limited (ASX:VMT) has inked a strategic advisory and investment agreement with renowned European motorcycle industry entrepreneurs Giovanni Castiglioni (Castiglioni) and Graziano Milone (Milone).

Vmoto has also appointed Milone as the company's chief marketing officer / president of strategy and business development. He is already a partner of Vmoto's Italian distribution company, Vmoto Soco Italy srl (VSI).

Furthermore, Castiglioni is also to make an investment in VSI making both the owners of a combined 50% stake in VSI.

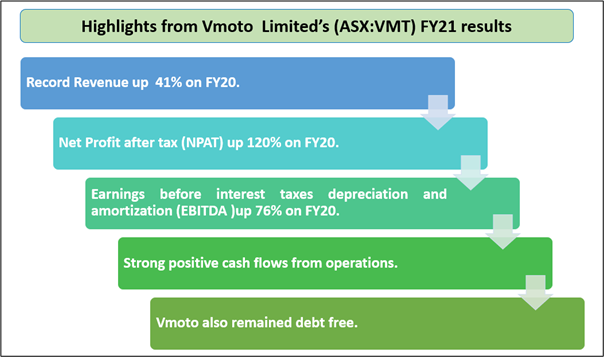

Vmoto had recently reported a record preliminary financial result for FY21, which it believes its reflective of its position in the electric motorcycles/mopeds markets.

The Australian market seems to be taking the announcement positively as VMT share on the ASX trades about 1.25% higher today at AU$0.405 a share as at 10:27 AM AEDT.

Vmoto’s European strategic partnerships and investments

- Vmoto Limited has strategic advisory and investment agreement with Giovanni Castiglioni, part of the motorcycle industry’s renowned Castiglioni family known for its MV Augusta bikes.

- The electric vehicle company has also inked a partnership and investment agreement with Graziano Milone. Vmoto has appointed Milone as chief marketing officer / president of strategy and business development.

- The company, has, via its Italian distribution company VSI, also entered into an investment agreement with Milone.

- The strategic agreement with Castiglioni also consists of a direct investment in Vmoto and his appointment as an advisor to Vmoto's board of directors for developing new sales opportunities and marketing strategies in Europe and across the globe.

- Alongside direct investment in Vmoto, Castiglioni is to also make an investment in VSI. Both Castiglioni and Milone shall thus become owners of a 25% stake each in VSI giving them a combined 50% ownership, while Vmoto retains the remaining 50%.

- VSI is an important international distribution arm of Vmoto for the Italian market facilitating access to opportunities worldwide.

A look Vmoto’s recent financial performance

In its latest financial results for the period ending on 31 December 2021, Vmoto Limited reported a record financial performance.

Image source-©2022 Kalkine Media ®

Data Source- Vmoto Limited’s annual report for FY21

Before entering into the current strategic partnership and investment agreements in Europe, Vmoto had expanded its electric vehicle business via its partnership with Helbiz (NASDAQ:HLBZ), an intra-urban transportation company for supplying electric mopeds for deployment in the Italian market.

Bottom line

Vmoto Limited seems to be pursuing the strategic partnership and investments with Castiglioni and Milone, for developing its European design and product development centre in Italy. For this the company has agreed to dilute ownership stake in its Italian distribution joint venture. However, the markets seem to have reacted positively to the announcement.

Interesting read- What challenges await automakers transitioning to electric vehicles?