Highlights:

- The consumer sector faced various ‘ups and downs’ in 2022.

- Today (9 January 2023) on ASX, many consumer stocks were trading in green zone.

- Read further to know how WOW, COL and other consumer stocks are performing on ASX today.

The consumer sector experienced a roller coaster ride in 2022 due to COVID-19 lockdowns and fear of inflation. In the last one year, the consumer staples sector has fallen by 5.85% on ASX. However, on a YTD basis, the sector gained almost 1% on ASX as of 1:21 PM AEDT on Monday, 9 January 2023.

Here in this article, we have primarily featured four ASX-listed consumer stocks: Woolworths Group Limited (ASX:WOW), Coles Group Limited (ASX:COL), Endeavour Group Limited (ASX:EDV), and GrainCorp Limited (ASX:GNC).

Woolworths Group Limited (ASX:WOW)

Image source: © Tktktk | Megapixl.com

Woolworths Group Limited (ASX:WOW) shares were noted in the positive territory on Monday (9 January 2023). The company’s share price stood at AU$33.550 per share, up by 0.993% on ASX at 12:39 PM AEDT today.

In the last 12 months, Woolworths’ share price has decreased by almost 10% on ASX. Furthermore, Woolworths’ share price has come down by 2.57% on ASX in the last one month. However, on a YTD basis, the company’s share price jumped marginally by 1.44% (as of 12:39 PM AEDT today).

Last month, the food and staples retailer updated about an agreement for the acquisition of a 55% equity interest in Petspiration Group. The cash consideration of this acquisition is AU$586 million. Woolworths expects this investment to deliver strong returns to shareholders.

Coles Group Limited (ASX:COL)

Shares of Australian supermarket Coles Group Limited (ASX:COL) were spotted trading on a positive note during the afternoon trading session on ASX today. The company’s share price stood at AU$16.575 per share, up by 0.698% as of 12:42 PM AEDT on ASX.

Coles’ share price has gone down by almost 3% in the last one-year period and nearly 9% in the last six months. Moreover, Coles’ share price has dropped by almost 2% on ASX in the last one month (as of 12:42 PM AEDT on 9 January 2023).

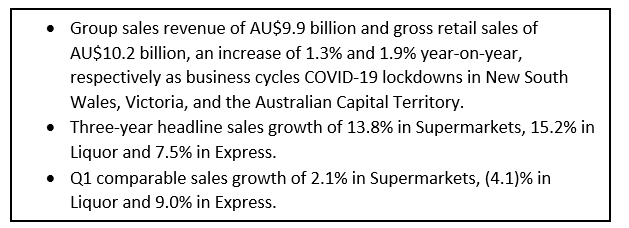

Financial performance of Coles during the first quarter of FY23 (Q1FY23):

Data source: company update

Endeavour Group Limited (ASX:EDV)

Shares of drinks retailer Endeavour Group Limited (ASX:EDV) were spotted trading in the green zone on ASX on Monday afternoon. The company’s share price increased marginally by 0.08% on ASX today, to AU$6.235 per share, as of 12:48 PM AEDT today.

Over the last 12 months, Endeavour’s share price has fallen by almost 6% on ASX. On a YTD basis, the company’s share price dropped by 1.03% on ASX. Furthermore, in a month’s time, Endeavour’s share price reduced almost by almost 11% on ASX (as of 12:48 PM AEDT today).

In the last company update, Endeavour said that the Australian Competition and Consumer Commission (ACCC) wouldn’t raise any objection to the proposed acquisitions of the Beach Hotel and Tower Hotel. The decision was backed by a court-enforceable undertaking offered by the company to sell the BWS Seaford bottle shop.

As per the revised proposal, the company has withdrawn its proposal to acquire the Whitehorse Inn in Bolivar and the Crown Inn in Old Reynella, two hotels based in South Australia.

Endeavour also mentioned in its update that it has revised the acquisition proposal and agreed to divest the BWS Seaford bottle shop during ACCC’s review process.

GrainCorp Limited (ASX:GNC)

Image source: © Jirsak | Megapixl.com

Shares of global agriculture business GrainCorp Limited (ASX:GNC) were buzzing in the green territory on ASX during the afternoon trading session on Monday. The company’s share price went up slightly by 0.821% on ASX to AU$7.36 per share as of 12:48 PM AEDT today.

Over a period of one year, GrainCorp’s share price has fallen almost by 11% on ASX. In the last one month, the company’s share price dropped by almost 9%, while on a year-to-date basis, the share price has jumped by almost 2%.

GrainCorp Limited is an Australian agriculture business organisation offering grain storage, handling, and freight services on the east coast of Australia. The company caters to more than 350 customers in over 50 countries, as per the November company update. After delivering an outstanding operational and financial performance in FY22, the company anticipates continued decent demand for oilseeds and grains from Australia in the financial year 2023. GNC plans to provide guidance in February 2023.

Meanwhile, the S&P/ASX 200 Consumer Staples sector (INDEXASX:XSJ) was trading 0.66% lower at 12440.1 points at 1:19 PM AEDT today (9 January 2023).

The S&P/ASX 200 Consumer Discretionary sector (INDEXASX:XDJ) was trading 0.628% higher at 2836.2 points at 1:19 PM AEDT today.