Highlights:

- Benchmark S&P/ ASX 200 closed 2.02% lower at 6,845.60 points on 1 September 2022.

- Consumer Staples sector was the only one out of all major ones that managed to close on stronger note.

- Consumer Staples (INDEXASX:XSJ) has gained 2.94% in last six months.

S&P/ASX 200 buzzed in the red territory throughout the trading session today (1 September 2022). It closed 2.02% down at 6,845.60 and set a new 20-day low. Over the past five trading sessions, the index fell by 2.87% and down by 9.05% on a year-to-date basis.

Ten out of eleven significant sectors ended in the red today. Consumer Staples was the only sector that ended in green zone and recorded a rise of 1.031%.

The Consumer Staples sector features 79 companies and has been divided into three categories - food, beverage & tobacco; household & personal; and food & staples retailing industries. In this story, we at Kalkine Media®, will discuss top food, beverages & tobacco companies. The companies discussed here are Treasury Wine Estates Limited, The A2 Milk Company Limited, Elders Limited, Costa Group Holdings Limited and Bega Cheese Limited.

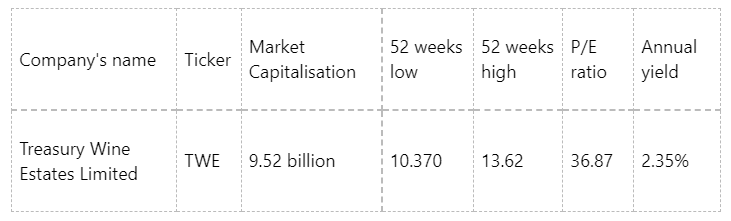

Treasury Wine Estates Limited (ASX:TWE)

Premium wine company, Treasury Wine Estates claims to be the world’s largest wine organisation which is listed on ASX. TWE is a vertically integrated business which focuses on brand-led marketing, winemaking and grape growing and sourcing.

In the financial year 2022 (FY22), the company reported a growth of 3% in its EBITS, driven by the development of its distribution network, portfolio premiumisation and availability of priority brands. EBITS margin also improved to 21.1% by 1.3 percentage points. Reportedly, net profit after tax (NPAT) improved by 4.2%, and EPS (earnings per share) grew by 4.1%.

The company declared a final dividend of 16 cents during FY22, 23% higher than the previous year’s final dividend. The tentative payment date is 30 September 2022.

Today, Treasury Wine share price closed 0.38% up at AU$13.24 per share.

The A2 Milk Company Limited (ASX:A2M)

Nutritional dairy company, A2 Milk produces dairy products that contain the A2 beta-casein protein type. This AU$4.12 billion market cap organisation reported a significant growth in implementing its growth strategy and improving its performance in FY22.

A2 Milk’s revenue in 12 months improved by 19.8%, and EBITDA grew by a whopping 59%. EPS enhanced by 51.8%, and NPAT attributable to the company’s owner surged by 52%. Reportedly, the USA, China and other Asia were the best performing segments in FY22.

The company has not announced any dividend yet.

A2 Milk shares closed 2.70% up at AU$5.70 per share today.

Elders Limited (ASX:ELD)

Australian agribusiness, Elders works with the Australian primary producer to access specialist technical advice, products and marketing services across financial, agency and retail product categories. Elders’ businesses have been categorised into four major categories: home loans, insurance, rural estate and rural services.

In the first half of FY22, Elders delivered an 80% growth in EBIT, a 36% surge in underlying EPS and a 38% growth in sales revenue. The substantial growth in FY22 was driven by the sales of rural products (up 48% on first half of FY21) and wholesale products (up by 27% on first half of FY21).

Worth mentioning here is that the company increased its full-year underlying EBIT guidance to 30 to 40% above the previous financial year. The company boosted its guidance as it expects to reap benefits from a positive winter cropping outlook.

The company had declared an interim dividend of 28 cents per share, a hike of 40% on the prior period.

Elders shares registered a surge of 0.69% to close the trade at AU$11.66 per share today.

Costa Group Holdings Limited (ASX:CGC)

Fresh produce marketer, Costa Group operates in over 30 regional and rural communities across Australia. Headquartered in Victoria, the company began with a local vegetables and fruits shop in downtown Geelong and now is an international company that farms, packs and markets fresh produce.

On 26 August, the company released its financial results for the six months ended 3 July 2022. The key highlight of the half yearly performance was 10.8% growth in underlying NPAT over the previous period. The operating performance was in line with the guidance as the EBITDA-S grew by 12.6%. In the half, the revenue increased by 15.7%.

The company announced a 4 cents per share distribution during its first half, which is expected to be paid on 56 October 2022. In terms of dividend distribution, the company has been following its trend to pay 4cps of interim dividend every year (being followed since 2022).

Costa Group’s share closed 1.115% down at AU$2.66 per share.

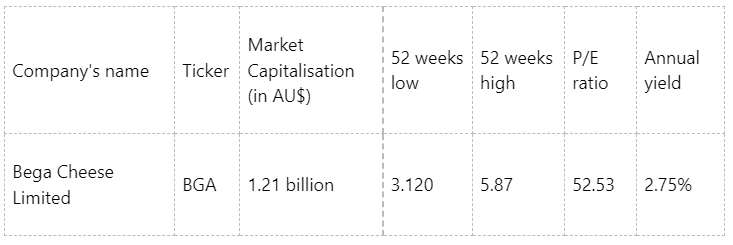

Bega Cheese Limited (ASX:BGA)

Began as a dairy company, now Bega Cheese claims to be a dominant brand in Australia for more than 40 years in natural and processed cheddar cheese products. Almost five years back, the company expanded its portfolio to Bega Peanut Butter, ZoOSH and Vegemite. As per the company’s website, it operates manufacturing sites across New South Wales and Victoria, producing some iconic food products and brands.

Since the company witnessed supply chain disruptions, transportation challenges due to flooding and the impact of Ukraine and Russia war, it reported a 19% fall in EBITDA and a 58% decline in EBIT (compared to previous year). The company ended the year with AU$265 million of net debt, AU$60 million less than the previous year.

The group declared a final dividend of 5.5 cents per share, bringing the full-year dividend to 11.0 cents per share. The tentative payment date is 23 September 2022.

On Thursday, Bega Cheese share price fell by 0.25% to AU$3.99 per share.