Highlights

- Bubs has posted a gross revenue of AU$17.6 million in FY22 third quarter.

- The company has marked a positive pcp growth momentum in all important business pillars: global, domestic and China.

- With 42.1% of the overall domestic goat market, Bubs is now the No.1 goat infant formula brand.

Shares of beverage firm, Bubs Australia Limited (ASX:BUB), traded 6.122% lower at AU$0.460 per share at 10:30 AM AEST on the ASX. Despite announcing a strong Q3 FY22 quarterly report and strong PCP growth with the third consecutive quarter, the company’s stock has dropped today.

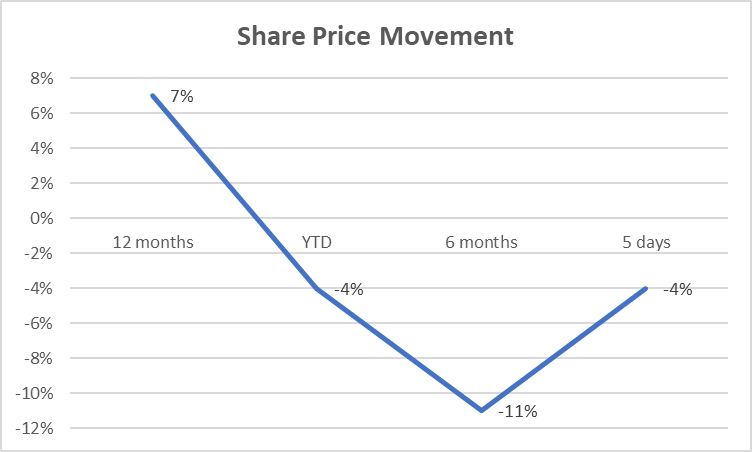

In a year, the company’s stock has climbed 7%. BUB has fallen 4% on YTD and 11% in the last six months. Recently, the stock’s performance has not improved significantly, declining 4% in five days.

Image source: © 2022 Kalkine Media®

Good read: Why Bubs (ASX:BUB) share price could be on watch today

Bubs performance in Q3

Bubs Australia has filed its quarterly activities report and appendix 4C cashflow statement for the third quarter ended 31 March 2022.

Key highlights of Q3 FY22 quarterly activities report

- Gross revenue of AU$17.6 million in Q3 was up 49% pcp, marking the third quarter of growth over the previous year.

- Positive pcp(previous corresponding period) growth momentum in all important business pillars: global, domestic and China.

- Domestic retail infant formula sales increased by 108% on pcp.

- Bubs achieves a market share of 4.2% of the entire infant formula category, with a 40% increase in scan sales.

- With 42.1% of the overall domestic goat market, Bubs is now the No.1 goat infant formula brand.

- Bubs organic increased market share by 61.4% over the previous year.

- Total China sales were up 8% on pcp.

- International gross income increased 153% pcp, with Bubs products’ global sales up 63% pcp.

- With 254 Smart & Final stores in the USA, the firm’s retail reach has grown significantly.

- Willis Trading; the primary Daigou distributor, has entered into a strategic equity-linked alliance; the agreement is conditional on product purchase milestones of at least AU$50 million in FY22 and AU$80M to AU$120M in FY23.

- Bubs Supreme® A2 beta-casein protein infant formula was launched in May with a ‘super premium’ formulation, with nationwide coles distribution beginning in May and a purchase order from Willis Trading valued at AU$32.9 million.

Management remark

Kristy Carr, Bubs CEO and Founder commented:

Outlook

In accordance with previous guidance, the firm forecasts modest sales growth in the second half of FY22, with increased revenue expected from the launch of Bubs Supreme® A2 beta-casein protein infant formula in Q4.

Meantime, Bubs recognises that persistent macroeconomic uncertainty and COVID-19 related supply chain interruption may result in transitory variability.

Good read: Bubs’ (ASX:BUB) sales nearly double in Q1; here’s why