Highlights:

- Best & Less Group Holdings Limited (ASX:BST) notified receiving a cash off-market takeover offer of all its securities for AU$1.89 a security by Ray Itaoui and BBRC.

- The takeover offer is contingent on a minimum acceptance condition of 55% (inclusive of the 16.45% relevant stake in BBRC already holds), etc.

- The company has formed an Independent Board Committee to evaluate and respond to the takeover offer.

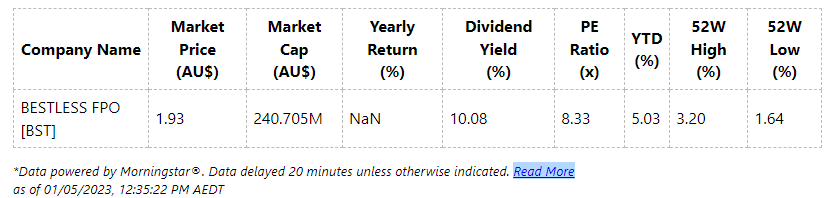

A leading value apparel speciality retailer with an omnichannel sales network, Best & Less Group Holdings Limited (ASX:BST) notified receiving a cash off-market takeover offer by Ray Itaoui and BBRC International Pty Ltd. Post this news, BST share price decreased by 3.274% and was trading at AU$1.920 on Monday, 1 May 2023, at 11: 42 am AEST.

Let’s get apprised of the takeover offer by BBRC and Ray Itaoui for BST in detail.

On Monday, the ASX consumer stock notified receiving a cash off-market takeover offer of all its securities for AU$1.89 a security by Ray Itaoui and BBRC International Pty Ltd as trustee for the BBRC, which has a relevant interest in nearly 16.45% of the BST securities on issue. BBRC is associated with Mr Brett Blundy, a non-executive director of BST and a renowned investor in retail businesses.

Further, both Ray Itaoui and BBRC (the bidder) have mentioned that the cash offer of AU$1.89 a BST security would be lessened by any dividend or other distribution right that might be paid after the announcement of this offer.

BST plans to work cooperatively with the bidder to despatch the bidder’s statement from the bidder and BST’s target statement to stakeholders combined in the upcoming weeks. BST stakeholders are not required to take any action associated with the takeover offer before their receipt of offers from the bidder.

The cash offer of AU$1.89 a BST security compares to a closing price of AU$1.985 a BST security on 28 April, along with VWAP of AU$1.934 a security in the three-month period ended 28 April 2023.

The takeover offer is contingent on a minimum acceptance condition of 55% (inclusive of the 16.45% relevant stake in BBRC already holds), no material adverse change and no legal or regulatory constraints, and no prescribed events.

The company’s board discussed the terms and conditional of the takeover offer with its main stakeholders- Allegro (32.43% holding of the BST securities on issue) and Bignor (8.27% holding of the BST securities on issue), given their joint ability to fulfil the minimum acceptance threshold should they be supportive of the offer. They both have notified they would intend to accept the offer if there is no superior proposal.

The company has formed an Independent Board Committee to evaluate and respond to the takeover offer. BST has hired E&P Corporate Advisory as financial advisor and Ashurst as legal adviser pertaining to the offer.