Highlights:

- King River Resources is focused on exploring the Speewah Specialty Metals Project.

- The project holds one of the largest deposits of vanadium globally.

- Vanadium has made to the list of critical metals in several countries, including Australia.

- Vanadium, which has numerous industrial applications, is considered to be one of the foundation elements of the green industrial revolution.

King River Resources Limited (ASX:KRR) is making serious strides to mark its presence in the green metals space. The robust project portfolio of the Australian mineral explorer holds the potential to position the Company among global leaders in the supply of green metals, including vanadium and high purity alumina.

The Company is currently engaged in conducting metallurgical testwork to determine the most efficient and cost-effective way to produce vanadium, titanium, and metallic iron from its Speewah Specialty Metals Project. This is a significant development as vanadium is gaining prominence as a green metal.

Related read: King River Resources’ (ASX:KRR) ‘green’ process flowsheet to focus on speciality metals at Speewah

Vanadium – A critical green metal

The global push for green economy can bring results only through green metals, including lithium, vanadium, copper, cobalt and rare earth metals. These metals are leading the charge against climate change fight. The capital market has long underappreciated the fact that green metals will be the foundation of green economy as metals would create products that will help in reshaping the world.

Lithium and cobalt are used in batteries for electric vehicles while rare earth metals are used in sophisticated and advanced technology products. As we know, anything electrical will have copper in it.

Gaining popularity as a green metal, vanadium has been added to the list of critical metals by Geoscience Australia. It is believed that vanadium will accelerate the green industrial revolution due to its wide-ranging applications in several industrial sectors.

Related read: King River Resources (ASX:KRR) repeats high-purity Type 1 precursor results, shares jump

Global vanadium demand and supply

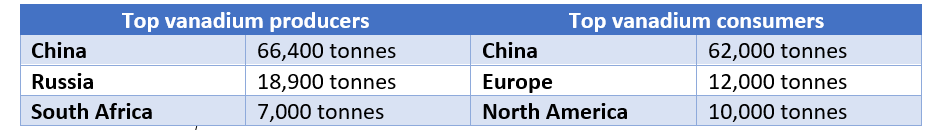

At present, nearly 70% of vanadium is produced as a co-product of steel slag. Vanadium mining accounts for just 18% of the total vanadium production, while the rest 12% is contributed by the recycling industry.

China is a global leader in steel production, as it is the world’s largest producer of vanadium. Vanadium, in small quantities, is used as an alloy to increase the strength of steel.

Data source: Outlook for Selected Critical Minerals in Australia 2021 report

The cost analysis has shown that vanadium produced through mining activities costs less than the one that is produced in steel mills. Despite this, only three major companies are involved in vanadium mining. These are Campbell Pit by Largo Resources, Vametco by Bushveld and Rhovan Mines by Glencore.

Related read: King River Resources’ (ASX:KRR) first half marked by major strides at HPA and gold projects

Almost 90% of the current vanadium demand comes from the steel and alloy industries. Steel, rebar, and other building materials use vanadium for increasing strength and preventing corrosion.

Another major application is in titanium-aluminium-vanadium alloy production. Vanadium is used as a bonding agent for titanium and steel, and the alloy is used extensively in the aerospace industry. There is no substitute for vanadium in the aircraft industry; hence, its demand is slated to remain high for this industry.

Automakers have started to use more vanadium in the production of auto body parts, including chassis. The metal helps in keeping the weight lower without compromising the strength.

The battery storage industry is another sector where vanadium can play a pivotal role. Vanadium redox flow batteries are gaining popularity and are expected to contribute 15-25% of the total capacity of 600GW (battery storage industry expected growth) by 2025.

Related read: Inside King River Resources’ (ASX:KRR) quest to supercharge gold exploration

How is King River positioned in buoyant vanadium market?

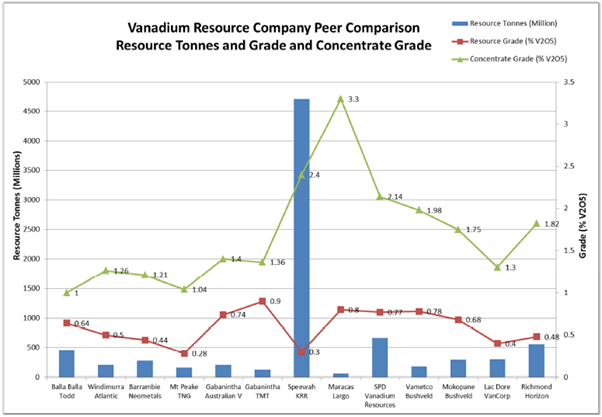

King River operates the Speewah Specialty Metals Project in the Kimberley region of Western Australia. The project is based on the Company’s 100%-owned vanadium deposit, which has a mineral resource of 4,712Mt @ 0.3% vanadium pentoxide, 3.3% titanium dioxide and 14.7% iron. The Company holds one of the largest vanadium resources globally.

Resource size, grade and concentrate grade of Speewah deposit (Image source: Company update, 5 April 2022)

Also read: King River Resources (ASX:KRR) receives R&D Tax Rebate of $450K

Currently, King River Resources is engaged in developing its new green process flowsheet, which focuses on producing speciality metals at Speewah. Amid the transition to renewable energy, the Company is committed to exploring and developing new economy critical minerals.

KRR shares traded at AU$0.027 on 9 May 2022.

_05_16_2025_06_30_06_131533.jpg)