Highlights

- Ark Mines Ltd (ASX:AHK) has recently released a summary of key activities conducted during the March 2022 quarter at its high-grade projects.

- The Company primarily progressed with the development of its Gunnawarra Nickel-Cobalt Project and Mt Jesse Copper-Iron Project during the quarter.

- The mineral exploration company closed the March 2022 quarter with a decent cash balance of about A$3.56 million.

Australian mining entity Ark Mines Ltd (ASX:AHK) has recently released its quarterly activities and cash flow report for the period ended 31 March 2022. The report incorporates the key developments announced by the Company during the March quarter with respect to its high-quality projects.

Ark is developing its 100% owned projects situated in the prolific Mt Garnet and Greenvale mineral fields of Northern Queensland. These projects comprise Mt Jesse Copper-Iron Project, Gunnawarra Nickel-Cobalt Project, and Pluton Porphyry Gold Project. The Company’s project portfolio is prospective for elements that are crucial to the manufacturing of rechargeable Lithium-ion batteries and the viability of EVs (electric vehicles).

Following the release of the March quarter report, Ark shares rallied by over 4.5% to A$0.455 as of 11:34 AM AEST.

Now, let us discuss the key activities undertaken at Ark’s projects during the March quarter:

Gunnawarra Nickel-Cobalt Project

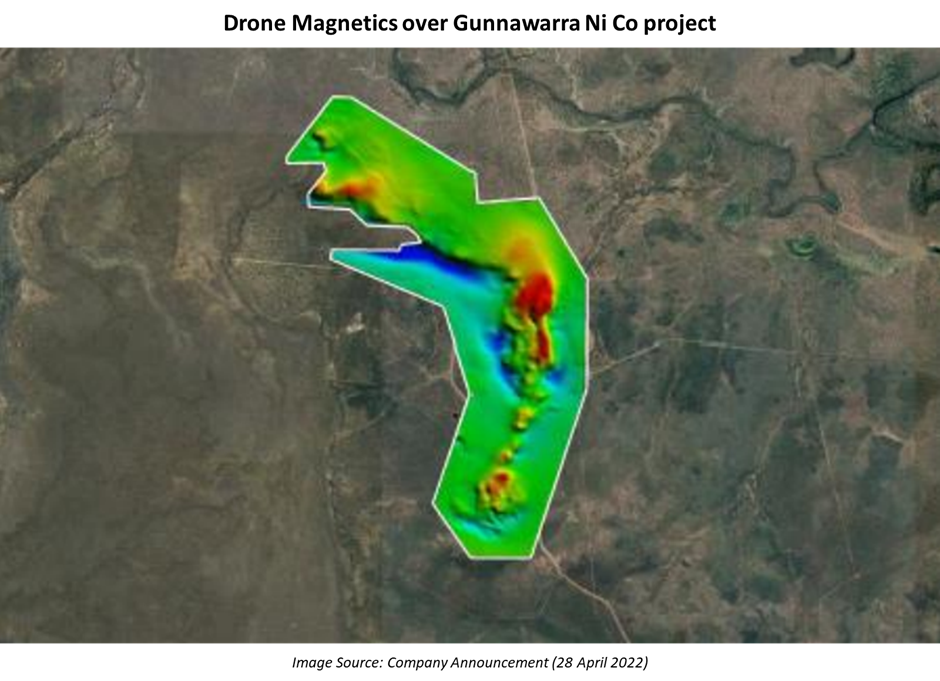

In February 2022, Ark conducted a high spatial resolution drone magnetic survey across Gunnawarra’s 36km2 tenure. The Company engaged Ultramag Geophysics to undertake this detailed drone magnetic survey. Unmanned aerial vehicles were used for the survey, which provided Ark with comparable resolution at 10x the speed and a quarter of the cost of traditional methods.

The survey results were of excellent quality, with high-resolution data providing the Company with a clear and detailed aeromagnetic image of the project. Substantial magnetic highs and lows were shown to coincide exceedingly well with the Nickel-Cobalt laterite deposits at surface and in the underlying ultramafic geology. Moreover, several high priority drill targets were identified from the survey.

In late March 2022, Ark undertook a 1500m RC (Reverse Circulation) drilling program at the highly prospective Gunnawarra Nickel-Cobalt project located in the Mount Garnet NQ area. The drill program targeted known mineralisation in shallow laterites and other potential mineralisation in some step out locations.

Related Article: Ark Mines (ASX:AHK) kicks off RC drilling at Gunnawarra nickel-cobalt project

At the completion of the first stage of drilling, Nickel and Cobalt mineralisation has been intersected up to 60m in depth in the targeted laterites. Given the extent of intersections, the RC drill program was extended by at least another 400m to the west.

Mineralisation was identified using handheld XRF. However, accurate grades will be ascertained by assaying at NAL in Pine Creek, with results anticipated in mid to later May.

Read More at Ark Mines (ASX:AHK) reports encouraging results from drill program at Gunnawarra

Mt Jesse Copper-Iron Project

In February, Ark signed a Memorandum of Understanding (MOU) with R3D Resources Limited (ASX:R3D) aimed at enabling the Company to fast-track commercialisation of its copper oxide mineralisation at its Mt Jesse project by potentially selling ore to R3D at a price based on the prevailing copper price and other material factors.

MOU provides for Ark to sell oxide copper ore to R3D for treatment in R3D’s heap leach – solvent extraction – crystallisation plant situated at its Tartana mine site near Chillagoe. This plant has been kept on care and maintenance since 2014, after a decade of operation producing copper sulphate for sales into the mining and stockfeed industries. R3D expects the first production to start in the September 2022 quarter following a six-month refurbishment period.

MOU further provides for Ark and R3D to work together, enabling the Company to initiate resource drilling as soon as possible.

Ark closed the March 2022 quarter with a decent cash balance of about A$3.56 million. This cash balance is estimated to be sufficient to fund its operating activities for the coming 8.7 quarters.