Highlights

- Empire Resources considers the results to date across various prospects at its Yuinmery Project to be highly encouraging.

- ERL remains optimistic about the potential of the Nanadie Project as there has been no historical drilling undertaken in the area.

- ERL has planned further exploration programs across the project portfolio to enhance its understanding of geology.

Gold and copper-focussed explorer and developer Empire Resources Limited (ASX:ERL) holds a portfolio of highly prospective projects. These projects comprise several exploration targets with excellent potential.

ERL has been continuing exploration activities across its projects, especially its 100% owned Yuinmery Copper-Gold Project, which is located 470km northeast of Perth in the Youanmi Greenstone Belt.

RELATED ARTICLE: Empire Resources (ASX:ERL) boasts a strong stance with solid work across portfolio

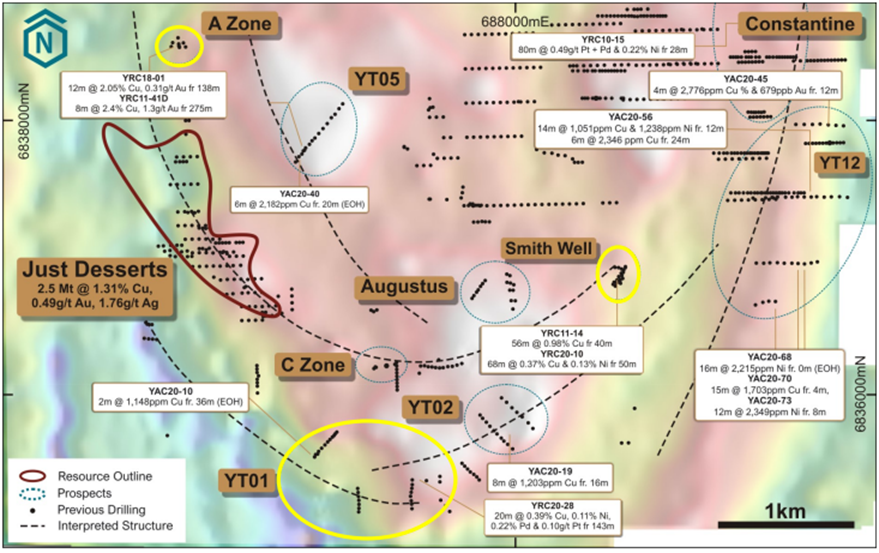

Yuinmery Project status

ERL has successfully unearthed significant exploration results across its projects with an accelerated rate of progress. ERL received encouraging results from its Yuinmery Project as the Company concluded a diamond drilling program in the first quarter of the current calendar year.

Recently, the YT-01 prospect has undergone diamond drilling, and another diamond drilling across the Smiths Well prospect was concluded in May 2022. Results for both these drilling programs are due in third quarter of 2022.

Source: ERL Presentation 14/06/22

ALSO READ: How has Empire Resources (ASX:ERL) managed to deliver consistent exploration success?

A technical assessment is currently underway at the Smiths Well prospect, and the Company plans to undertake DHEM surveys in June 2022.

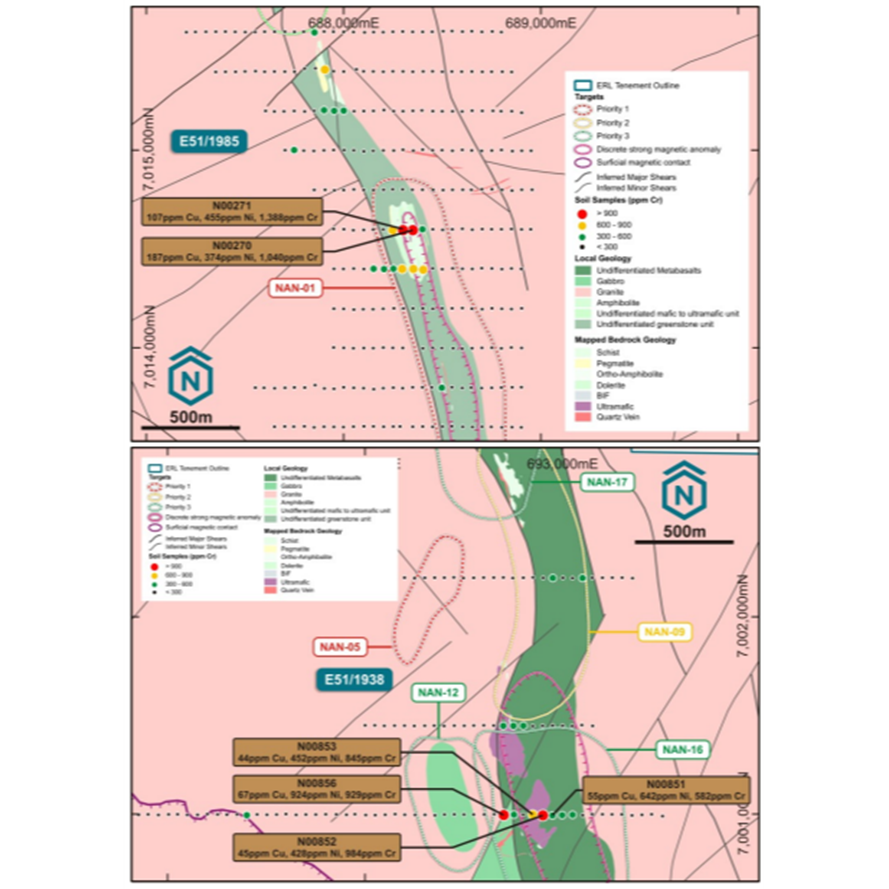

Groundwork at the Nanadie Project

ERL has also been progressing work at the Nanadie Project, an excellent little package which indicates notable potential.

ERL had set the boots on the ground at the Nanadie Project, and the Company has been undertaking work to understand the potential of the target. The Company executed a 1500-point soil orientation survey, and the Company’s geological team has been actively engaged in undertaking mapping.

Source: ERL Presentation 14/06/22

RELATED ARTICLE: Empire Resources (ASX:ERL) reports further massive sulphides at Smiths Well, shares zoom up 25%

The area has not witnessed drilling historically, and this indicates an opportunity for ERL.

Drilling planned at Penny’s Find Gold Mine

At the Penny’s Find Gold Mine, HRZ has been ramping up work to advance the mine towards production. In July 2021, a resource update was concluded for the mine, and an additional infill and extensional drilling are planned.

Source: © Adwo | Megapixl.com

REALTED READ: Empire Resources (ASX:ERL) continues to impress with Yuinmery drilling results, shares skyrocket 22%

The drilling is completely permitted, and a toll milling agreement has been implemented for the second half of 2022.

Moving forward, the Company has plans to actively pursue exploration work across its project portfolio and has a strong, debt-free balance sheet.

ALSO READ: Empire Resources (ASX:ERL) reports another busy quarter of fieldwork