Certain decisions and amendments could have adverse impact on the performance of stocks on trade exchanges. Sustaining dynamic environment is a challenge that every business and its constituents are constantly exposed to, and this is perhaps what keeps the investing momentum on, for the good or bad.

In this article, we have freshly cherry-picked three stocks for you, which were noticed to have taken a back seat while trading on ASX on 14 August 2019. Letâs understand the reasons that might have caused the respective stocks to not rise up on ASX:

Pact Group Holdings Limited

Company Profile: Best known as the largest manufacturer of rigid plastic packaging products in Australasia, Pact Group Holdings Limited (ASX: PGH) has a growing presence in Asia as well. The company operates in over a hundred market segments across 22 thousand products variants. It has a diversified consumer and industrial packaging range, contract manufacturing businesses, materials handling solutions and sustainability products and services. PGH had appointed a new CEO, Mr Sanjay Dayal, who commenced his term from April 2019.

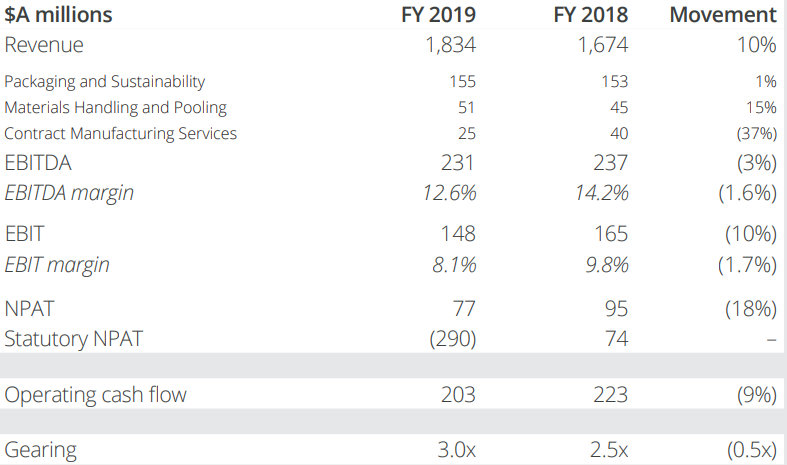

FY19 Results: On 14 August 2019, PGH released FY19 results for the period ending 30 June 2019, notifying that the revenue was up by 10% to $1,834 million. On the flip side, the statutory NPAT stood at $290 million, though the company had posted a statutory NPAT of $74 million in pcp. EBITDA was down by 3% to $231 million. The lopsided results were driven by lags in recovering higher raw material and energy costs in 1H19, while lower volumes were incurred in few sectors amid weak demands. Drought impacted agriculture which had a direct effect on Packaging volumes. Materials Handling volumes fell prey to fewer available infrastructure projects. The jolt had hit shareholders when it was declared by the Board that there would be no final dividend, even though the dividend was paid in pcp (11.5 CPS).

PGH Financial Summary (Source: PGHâs Report)

On the brighter side, the company has extended debt of $380 million to January 2022, and established a $50 million subordinated term loan facility. Another highlight of the result were acquisitions made in the year- Asia acquisition and TIC Retail Accessories. The company bagged a long-term contract with a major retailer in the USA for the supply of reuse services.

On the outlook front, PGH expects EBITDA in 2020 to undergo slight improvements, subject to global conditions.

Stock Performance and Returns: Given the net loss and hefty asset write-downs, PGHâs stock resonated with the FY19 results on 14 August 2019 on the ASX. By the end of the trading session, on 14 August 2019, the stock of the company had slumped down by 16.906% and was quoted at a price of A$2.31. With a market capitalisation of A$956.3 million and ~344 million outstanding shares, the PGH stock has delivered a negative YTD return of 17.26%.

ECS Botanics Holdings Limited

Company Profile: Listed on ASX in 1986 and headquartered in Perth, ECS Botanics Holdings Limited (ASX: ECS) is an industrial hemp seed grower which has an innovative food brand with a Tasmanian heritage. Tasmania is renowned for clean air, fertile soil and fine foods, making ECS a leading player in the Australian hemp market. The company was founded by Mr Alex Keach, who is the present MD of ECS.

The company recently accomplished its maiden hemp harvest from the Tasmanian operations. The company has licence applications with the Office of Drug Control and holds licences to grow, produce and deliver industrial hemp in Tasmania for non-therapeutic commercial purposes and another license for research purpose.

New Agreements and Investments: On 13 August 2019, ECS notified on a strategic investment in TapAgrico or Tasmanian Agricultural Producers Pty Ltd, which is a grain handling, marketing, storage and export packing facility in Tasmania.

The investment (initially of $750,000) in TapAgrico would fund the purchase of key infrastructure at a time when the company is growing and grant it a 28.4% stake in TapAgrico. The company has also signed an agreement with Eden Foods, which related to retail food distribution, where the companyâs products would be offered.

TapAgricoâs facility (Source: ECSâs Profile)

Stock Performance and Returns:

ECS was formerly known as Axxis Technology Group Limited. It was previously notified in February 2019, and later set out in the AGM, that the company had procured 100 percent of the issued capital of ECS Botanics Pty ltd.

As updated to the market, the company renamed as ECS Botanics Holding Limited began trading on ASX from 22 July 2019. It witnessed an oversubscribed $6.5 million worth recompliance capital raising at 4 cents per share. The event is believed to have occurred at a crucial time of growth, positioning the company well in the competitive hemp food and industrial sector. The capital raising would be followed by hiring of new sales and marketing staff and development of new products.

However, the ECS stock is yet to pick up the momentum in the exchange. The stock of the company closed flat at A$0.071, by the end of the trading session. With a market cap of A$36.04 million and ~507 million outstanding shares, the stock has delivered a YTD return of 9.23%.

Clover Corporation Limited

Company Profile: Clover Corporation Limited (ASX: CLV) has evolved from being a production, marketing and research and development company to a tech-savvy, new product development and commercialisation player. It had been listed and trading on the ASX since 1999. The company provides innovative products in areas of infant nutrition- Novel fatty acids, Microencapsulation technologies and Preterm infant and medical nutrition. CLVâs product range consists of DHA oils, DHA powders and Microencapsulation. The companyâs headquarters are in Altona North.

FY19 interim dividend: On 30 April 2019, the company notified that the payment of its FY19 fully franked interim dividend of 0.625 cps had been made.

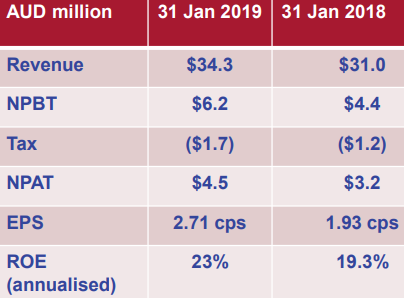

1H19 Result and Investor Presentation: On 20 March 2019, the company released its 1H19 results, posting a Net Profit of $4.5 million, which was up by 40% on pcp. The Operating Revenue of $34.3 million was up by 10.4% on pcp and Operating expenses worth $4.6 million were up by 24%, driven by the increase in business development. The cash balance recorded at the end of the period was $6.2 million.

CLVâs 1H19 Results (Source: CLVâs Report)

The company was focussing on the infant formula market, and the New products delivering alternative applications in the US include milk, health bars and sports nutrition. The Vegan encapsulated product has paved a new growing segment.

On the outlook front, the company would Focus on new product applications across nutrition segments and continue to enhance efficiency and reduce costs. It would aim at tapping opportunities in the EU where the infant formula players are bound to meet with the new 20mg/100kcal DHA legislated requirements in 2020. The company would also Develop Chinese infant formula relationships to prepare for the proposed new manufacturing standard requiring 15mg/kcal DHA.

Stock Performance and Returns: Of late the company had not been active on the media and news forum. This could be a reason for the stock to have taken a back seat as the stock performance of CLV, which was disappointing on the ASX.

The companyâs stock, by the closure of the trading session, slipped by 1.351% and was quoted at A$2.190. With ~165 million outstanding shares, the market capitalisation of the company stood at A$366.7 million. It has depicted a YTD return of 65.67%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_06_13_2025_06_30_45_136544.jpg)