AMP Limited

When it comes to investing in the financial sector, AMP is a well-known name in Australian Security Market. The company was listed on the Australian Stock Exchange in 1998. On 13 September 2019, by the end of the trading session, AMPâs market price was at A$1.852 per share, and the annual dividend yield of the company stood at 7.59%.

AMP Limited (ASX: AMP) is a wealth management entity. It is a provider of life insurance, superannuation related services among many others. The market capitalisation of the company stood at A$6.19 billion as on 13th September 2019.

Change in Directorsâ Interest

On 13 September 2019, AMP made a series of announcements pertaining to change of the companyâs directorsâ interest as mentioned below:

- Accordingly, Francesco Alexander DE FERRARI has made a change to his interest in the company by acquiring 6,367,402 performance rights without a cash payment by him on 12 September 2019.

- Also, Michael John Wilkins has made a change to his holdings in the company by acquiring 9,375 ordinary shares at a consideration of AUD 1.60 per share, as the issue price per share under AMPâs Share Purchase Plan on 13 September 2019. The total securities held with the director post-change stood at 108,525 ordinary shares.

- One of the directors, Peter Joseph Noozhumurry Varghese on 13 September 2019 acquired 9,375 ordinary shares at the consideration of AUD 1.60 per share, under the issue price per share under AMPâs Share Purchase Plan. The total securities held with the Peter Joseph Noozhumurry Varghese post-change stood at 80,075 ordinary shares.

- Besides, on 13 September 2019, Andrea Elizabeth Slattery acquired 9,375 ordinary shares at the consideration of AUD 1.60 per share, under the issue price per share under AMPâs Share Purchase Plan. The total securities held with the Andrea Elizabeth Slattery post-change stood at 58,475 ordinary shares.

- John Kevin OâSULLIVAN, too on 13 September 2019 acquired 9,375 ordinary shares at the consideration of AUD 1.60 per share, under the issue price per share under AMPâs Share Purchase Plan. The total securities held with the John Kevin OâSULLIVAN post-change stood at 2,000 ordinary shares registered in the name of the Director. While 52,086 ordinary shares, were registered in the name of Angrim Pty Ltd as trustee for the Boomwallah Trust A/C.

- On 13 September 2019, Andrew HARMOS acquired 9,375 ordinary shares at the consideration of AUD 1.60 per share, under the issue price per share under AMPâs Share Purchase Plan.

- Simultaneously, on 13 September 2019, John Arthur FRASER, too, acquired 9,375 ordinary shares at a consideration of AUD 1.60 per share, under the issue price per share under AMPâs Share Purchase Plan.

- Further, David Victor MURRAY acquired 9,375 ordinary shares at a consideration of AUD 1.60 per share, under the issue price per share under AMPâs Share Purchase Plan on 13 September 2019.

Share Purchase Plan

As per the release dated 10th September 2019, the company announced that it has successfully wrapped up its Share Purchase Plan on 5th September 2019. It added that the completion of the share purchase plan wraps up the roll-out of its capital raising, which was announced on 8th August 2019. The capital raising of the company include an underwritten institutional placement amounting to A$650 million and the non-underwritten Share purchase plan.

The company further added that a total of around A$134.1 million was raised under the share purchase plan. The company will issue 83.8 million new shares to eligible applicants on 13 September 2019, having an issue price of A$1.60 per New Share. It was also mentioned in the release that the same price has been received from institutional investors under underwritten institutional placement. The share purchase plan in combination with underwritten institutional placement will lead to the raising of around A$784 million under its capital raising program.

In another update, on 3 September 2019, the company announced a change in the relevant interests of the substantial holder Charter Hall Long Wale REIT on 30 August 2019. Charter Hall Long Wale REIT now has a voting power of 7.37% in comparison to the previous voting power of 6.25%.

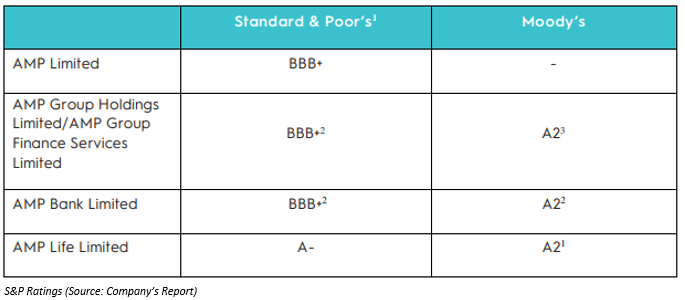

Ratings Downgraded by S&P

As per the release dated 27th August 2019, the company announced that S&P has lowered its rating by one notch in AMP Limited and its subsidiaries. The rating has been lowered due to pending divestment of AMP Life. The companyâs rating has moved to BBB+ from A-. However, the company possesses a strong balance sheet and capital position.

A look at Operational and Financial Performance

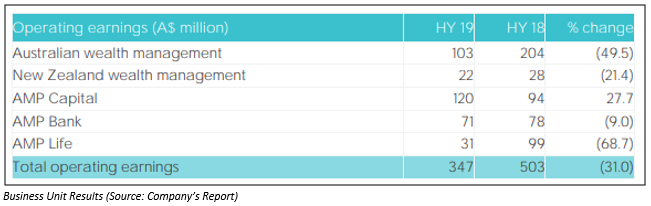

On 8th August 2019, the company has announced its results for 1H FY19 closed 30 June this year, wherein, it provided an update to the market about its operational and financial performance as well its strategy:

- The company reported underlying profit amounting to A$309 million for the period, which resulted through earnings growth in AMP Capital and resilient AMP Bank performance.

- It posted Impairments (post-tax) amounting to A$2.35 billion.

- The company delivered net cash outflows totaling to A$3.1 billion in 1H FY19, which includes A$1.2 billion in pension payments in order to underpin clients in their retirement, were consistent with 2H FY18; mainly because of lower inflows as well as elevated outflows. It added that the continuing reputational impacts and adviser focus on client retention although signs of improvement emerged towards the end of the half.

- The total corporate superannuation asset under management amounted to A$31.9 billion in 1H FY19, which reflects a rise of 7% in comparison to FY 18. This was primarily led by stronger investment markets. The company further stated that the net outflows were higher, but it retained most large corporate super mandates, in spite of a rise in the number of employer review.

A look at Strategy

The company has recently announced a three-year strategic plan for transforming the business into a simpler, client focused business i.e higher growth and higher return.

A few of the pointers of strategy plan are as follows:

- The company will be divesting its majority ownership in AMP Life in order to release capital and localise New Zealand wealth management for exploring options to divest.

- It will grow contemporary solutions in the Australian wealth management, which includes shifting focus to direct-to-client channels and digital solutions.

Share Performance

When it comes to the past performance of AMPâs stock, it last traded at a price of A$1.860 per share on 13th September 2019. It witnessed a fall of 19.78% in the time span of six months. On Year-To-Date basis, the stock has given a negative return of 24.39 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.