Penny stocks are common shares (generally trading below $1) of the companies with small balance sheet and limited resources. Also, these are small companies or mostly start-ups. Penny stock is called penny stock as it is cheaply priced in the market. The market capitalisation of these stocks is generally smaller than the normal stocks, It may be tough for the investors to earn dividend income from these stocks as they distribute a minimal amount of dividends relative to the price of the stocks; so, to generate dividend income from penny stocks investors should hold these stocks in massive numbers. Penny stocks could prove to be a good pick if chosen wisely and after in-depth research, as they can give a multi-bagging return.

Why Penny Stocks?

There are a couple of reasons why investors prefer penny stocks; letâs have a look at these reasons â

- Penny stocks have a low price per share, which enables investors to start investing with small amount of money; the price mechanism of penny stocks also allows investors, with enough capital to invest a reasonable amount of money and acquire a hefty number of stocks.

- Penny stocks are suitable for investors who manage investments through research and continuous monitoring.

- Due to relatively high volatility, penny stocks can provide investors with a hefty return if chosen wisely & backed by thorough research on fundamental & technical aspects of the business or company.

- The investors need to be very attentive to updates on companies they invest in while investing in Penny Stocks requires qualities like patience, knowledge and maybe expert advice.

Let us have a look at some of the penny stocks on ASX:

DroneShield Ltd (ASX: DRO):

Drone security technology leader, DroneShield Ltd (ASX:DRO) on 6 June 2019, announced that it entered a Memorandum of Understanding to tap the opportunities with the Australian Military and globally. It is reported that the MoU is in collaboration with Collins Aerospace Systems â a subsidiary of NYSE listed United Technologies. The collaboration would combine DROâs counter-drone capabilities with broader surveillance systems produced by Collins Aerospace for its existing customer base.

DroneShield Overview (Source: Companyâs 2019 AGM Presentation)

As per the companyâs announcement, Collins currently holds several contracts within the Australian Defence Force, and DRO offers counter-drone technologies, which can protect the base and forward the deployed groups against enemy drone threats. These capabilities of DRO are powered by its platform technologies: DroneSentinelâ¢, DroneGun TacticalTM, DroneSentry⢠and RfPatrolTM.

Reportedly, the company developed drone securities that protect people, places and critical infrastructure from the intrusion of drones. Also, the company is based in three countries, Australia, the UK and the USA.

The stock of the company is currently trading at A$0.140 (as on 7 June 2019, 3:00 PM AEST). The performance of the stock in the last one-year period is negative 26.32%, and its year-to-date return is negative 14.71%. However, the performance of DRO in the period of six months, three months and one month is positive 3.57%, 34.88% and 11.54%, respectively.

Immutep Limited (ASX: IMM):

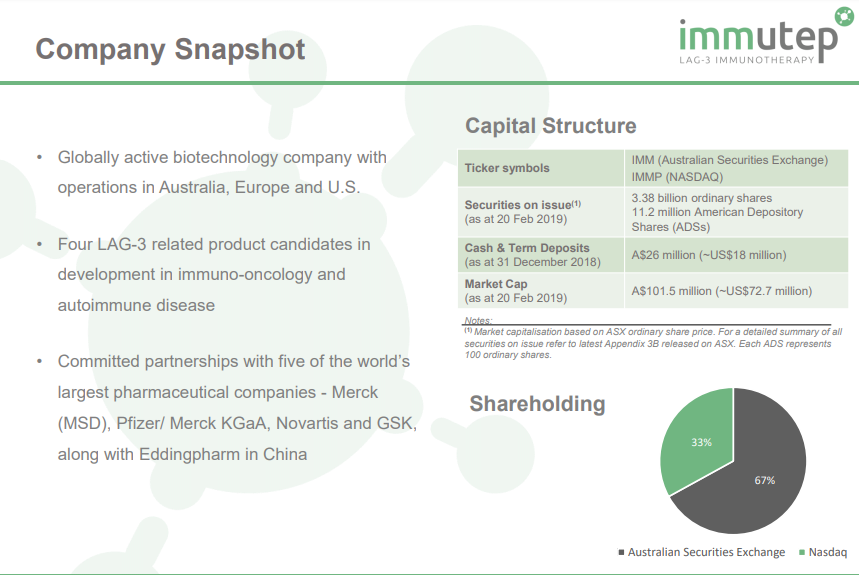

Immunotherapeutic products developer, Immutep Limited (ASX: IMM) develops products for treating cancer and autoimmune disease. IMM has is listed on ASX (IMM) and NASDAQ (IMMP) both, and the company has several product candidates in the pipeline.

Company Overview (Source: Immutep Presentation, Feb 2019)

Company Overview (Source: Immutep Presentation, Feb 2019)

On 06 June 2019, IMM announced that the INSIGHT-004 Phase I clinical trial, which is being conducted in Merck KGaA, Darmstadt, Germany with Pfizer Inc, has enrolled its first patient and the patient has received the first dose of treatment.

It is reported that through the trial, the patient would receive 800Mg avelumab intravenously and either 6mg or 30mg of IMP321 by subcutaneous injections and the frequency would be once in every two weeks for 12 cycles.

Reportedly, the strategic alliance of Merck KGaA & Pfizer Inc. has been co-developing and co-commercialising an anti-PD-L1 therapy â Avelumab. Prof. Dr Salah-Eddin Al-Batran is the lead investigator for the clinical trial, under the protocol of the ongoing INSIGHT clinical study. Also, the sponsor of the trial is The Institute of Clinical Cancer Research, in Frankfurt, Germany.

The stock of the company is currently trading at A$0.026 (as on 7 June 2019, 3:20 PM AEST), down by 3.704%. The performance of IMM in the periods of six months, three months and one month is -18.18%, -22.86% and -22.86%.

Impression Healthcare Limited (ASX: IHL):

Impression Healthcare Limited (ASX:IHL) offers customised oral devices to customers and B2B network of dentists.

On 6 June 2019, the company announced that a binding agreement had been signed with Force Impact Technologies, Inc to supply FiTGuard technology suite, which has three products FiTGuard, FiTApp and FiTCloud.

FiTGuard Suite (Source: Companyâs Announcement)

FiTGuard Suite (Source: Companyâs Announcement)

It is reported that IHL would engage with B2C channels or B2B Preferred Practitioner of Dentists to provide customised fitting with the mouthguards for distribution to customers across Australia, New Zealand and Hong Kong.

As per the companyâs release, post the testing of the FitGuard at its laboratory in Melbourne; the results imply that the FiT module could be involved in the Gameday production process. Also, in order to demonstrate the efficacy of the products in the Australian market, 50 FitGuard module units would be used for discrete product trial by Force.

IHL asserted that the FiT products helps to monitor the impacts on athletes during play or training and provides a rapid decision in sports wherein head impact, concussion and the second-impact syndrome is a continual possibility.

Mr Joel Latham, CEO of Impression Healthcare, notably stated about the upcoming clinical trial with CBD oil aimed to reduce brain injuries following the concussion; the trial is expected to commence in the third quarter of this year. Also, he reiterated that THC-free (synthetic) CBD is now legal in Australia for the consumption by sportspeople to reduce inflammation, and this had been confirmed recently by the World Anti-Doping Authority (WADA) and the Australian Sports Anti-Doping Authority (ASADA).

The stock of the company is currently trading at A$0.023 (as on 7 June 2019, 3: 30 PM AEST), up by 9.524%.

The performance of IHL stock in the periods of six months, three months and one month are +10.53%, +10.53 and -4.55%. The year-to-date performance of the stock is +31.25% along with +21.31% in the past one-year period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.